- Precious metals lose momentum today after Donald Trump Remarks

- Gold loses 2% and silver is down more than 4%

- Precious metals lose momentum today after Donald Trump Remarks

- Gold loses 2% and silver is down more than 4%

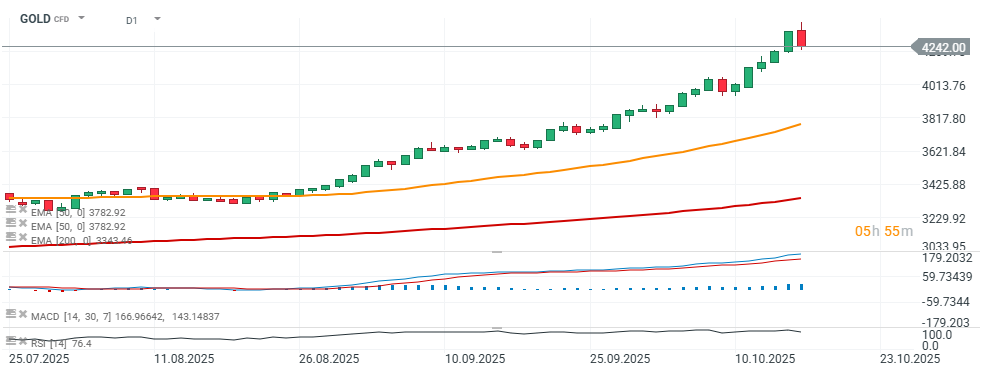

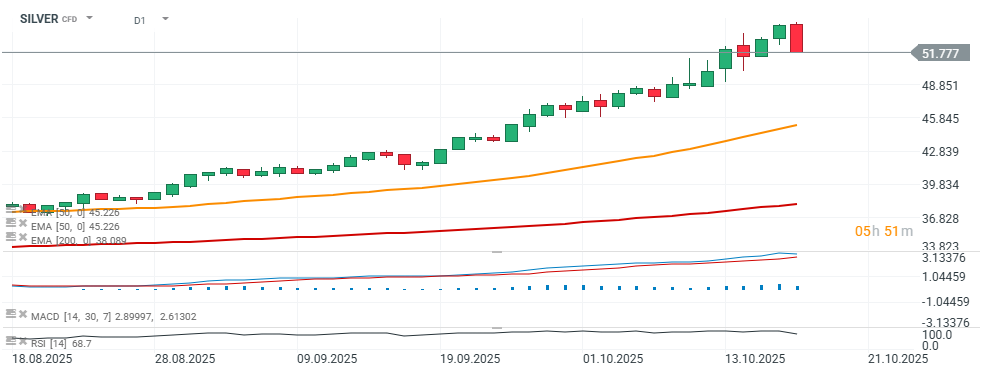

Precious metals fell as the U.S. dollar strengthened, following President Donald Trump’s remark that a “full-scale” tariff on China would be unsustainable in the long term. For a moment, gold appeared ready to extend its biggest rally since the 2008 collapse of Lehman Brothers, but prices later retreated as Trump adopted a calmer tone on trade policy. The announcement of a meeting between the U.S. president and Chinese leader Xi helped ease market sentiment and reduce demand for safe-haven assets.

Source: xStation5

Even so, the metal has gained more than 60% this year, driven by geopolitical tensions, central bank purchases, and expectations of U.S. interest rate cuts. Standard Chartered forecasts an average gold price of $4,488 in 2026, while HSBC sees $5,000 as a realistic target. Physical demand in Asia remains strong, with Indian spot gold premiums reaching decade highs.

Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!