Oil

- OPEC maintains its optimistic demand forecasts for 2024 and increases demand projections for 2023

- OPEC+ is set to continue production cuts at the level of 1.6 million barrels per day until the middle of next year, and some countries have expressed their intention to extend these cuts until the end of 2024

- Saudi Arabia and Russia aim to maintain additional supply cuts until the end of this year (Saudi Arabia intends to maintain an additional 1 million barrels per day cut, while Russia plans to keep export cuts at 0.3 million barrels per day)

- Saudi Arabia has experienced its largest production decline in 15 years, and its economy is expected to contract by 0.5% this year. However, the decline in oil revenue is expected to be offset to some extent by a significant dividend payout from Saudi Aramco and the issuance of new shares by the end of this year

- Saudi Arabia needs to keep prices above $80 until the end of the year due to the share issuance and the budget breakeven price above $80 per barrel

- OPEC has simultaneously blamed speculators for the recent drop in oil prices while expecting an increase in demand next year. Saudi Arabia points out that uncertainty regarding demand necessitates the maintenance of additional production cuts

- There are also speculations that Iraq might cut production and exports due to the situation in the Gaza Strip. Arab countries have announced the possibility of limiting the supply of petroleum products to Israel

- At the same time, the impact of the Middle East conflict on oil is already diminishing

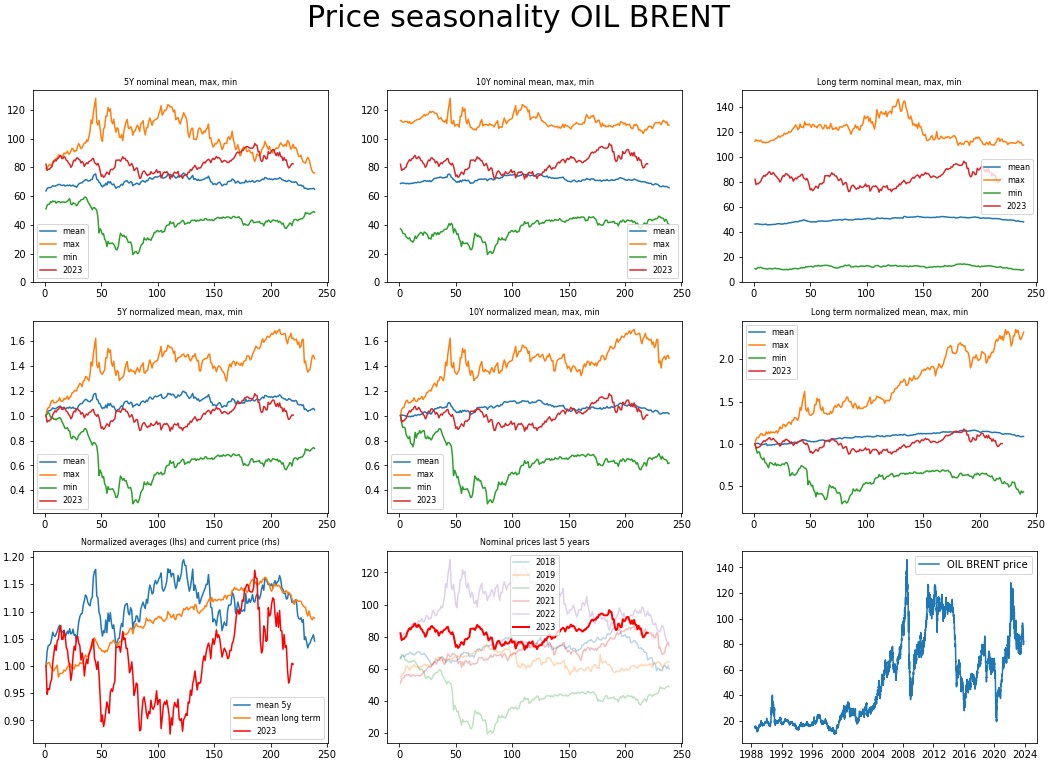

- Seasonal patterns indicate potential further price drops at the end of this year

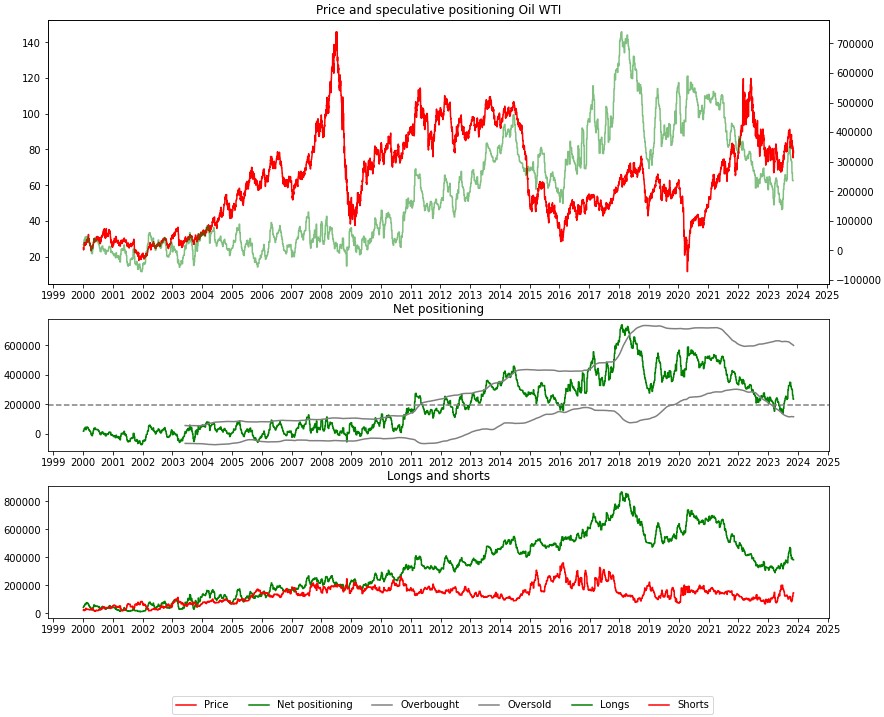

Number of open long positions on WTI is being reduced significantly, while number of open short positions increased slightly. While oil found a support recently, further drop in net speculative positioning may exert additional pressure on prices by the end of this year. Source: Bloomberg Finance LP, XTB

Prices is declining in-line with seasonal patterns, but slightly less than 5- and long-term seasonalities suggest. At the same time, seasonal data shows that beginning of a new year tends to be positive for crude prices. Source: Bloomberg Finance LP, XTB Research

Natural Gas (NATGAS)

- Seasonality still indicates the possibility of further price increases on natural gas market, although seasonal peak is usually reached in the second half of November

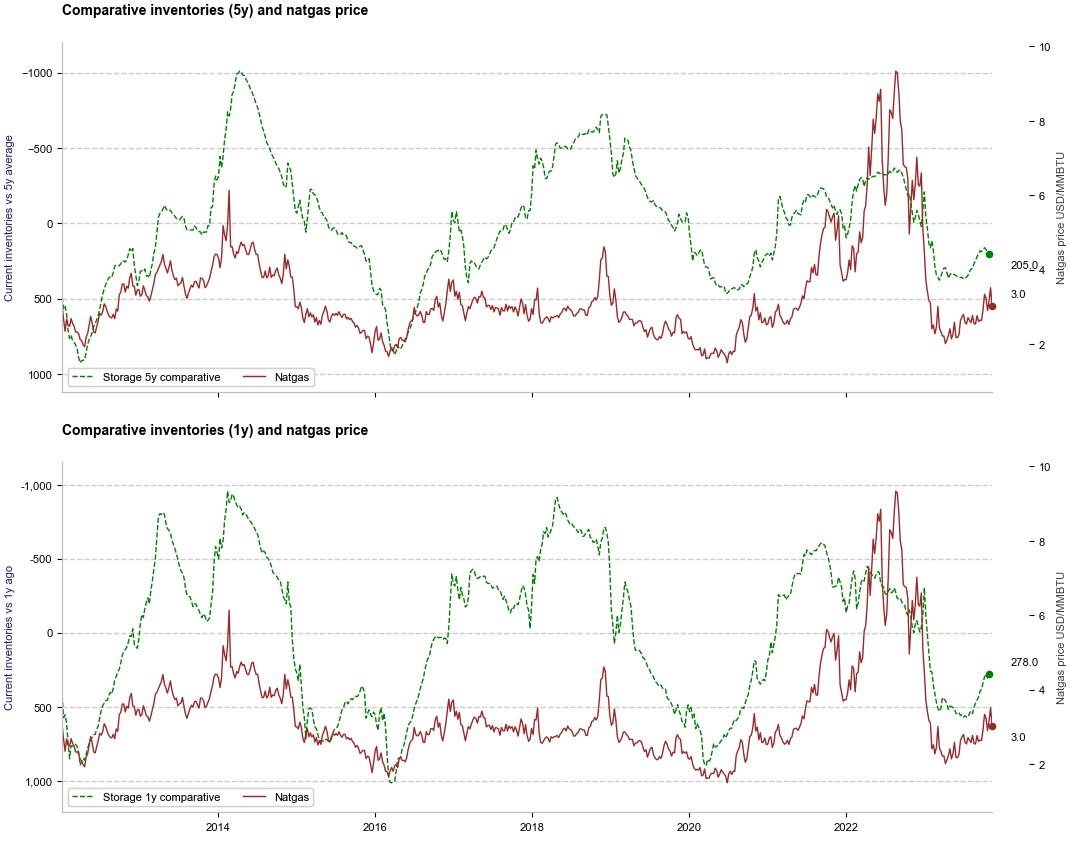

- Due to reporting delays at EIA, we haven't received the inventory report for the beginning of November. The latest available data shows that comparative inventories are still decreasing compared to the previous year but have rebounded compared to the 5-year average. This may suggest limited potential for price growth

- The futures curve shows a potential weakening of short-term demand, although, of course, changes in weather conditions could lead to price fluctuations in the coming months

Seasonality patterns for NATGAS suggest that local peak may be reached soon. Source: xStation5

Comparative inventories, compared to 5-year average, do not show much room for further price gains. Source: Bloomberg Finance LP, XTB Research

Futures curve suggests that short-term demand is weakening. Source: Bloomberg Finance LP

Gold

- In the past 5 years, Gold gained in the final month of the year in the previous 5 years. The average increase has been just over 4%. Average growth in the past 10 years is 1.87%

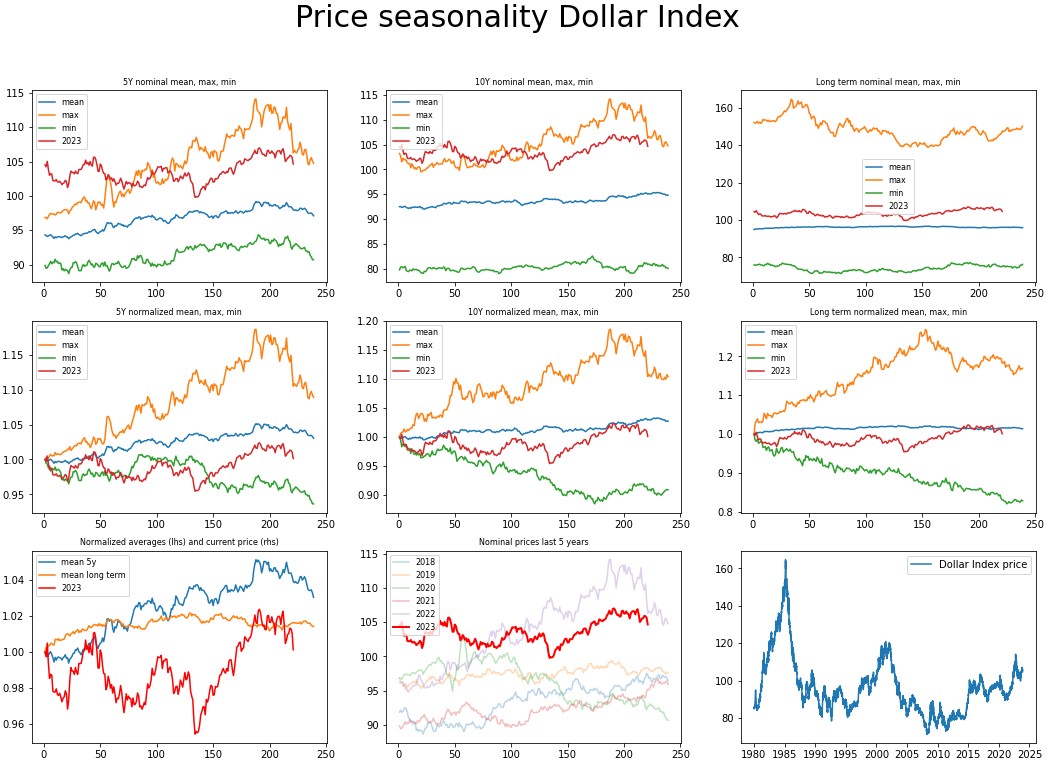

- Seasonality also indicates that the dollar tends to lose value towards the end of the year, which should be a supportive factor for precious metal prices

- The Federal Reserve is unlikely to raise interest rates further, and there may be a shift in expectations toward the first rate cut

- So far, gold has never closed the month above $2000. In October, there was a slight pullback from this level

Seasonal trends support a potential rebound in gold price by the end of the year. Source: Bloomberg Finance LP

Seasonal trends support a potential rebound in gold price by the end of the year. Source: Bloomberg Finance LP

Seasonal patterns for USD suggest a potential for weakening by the end of the year, what may support precious metals prices. Source: Bloomberg Finance LP, XTB

Seasonal patterns for USD suggest a potential for weakening by the end of the year, what may support precious metals prices. Source: Bloomberg Finance LP, XTB

Gold has never closed a month above $2,000 per ounce. However, there is still a chance for such monthly close in November and potentially in December as well. Source: xStation5

Gold has never closed a month above $2,000 per ounce. However, there is still a chance for such monthly close in November and potentially in December as well. Source: xStation5

Coffee

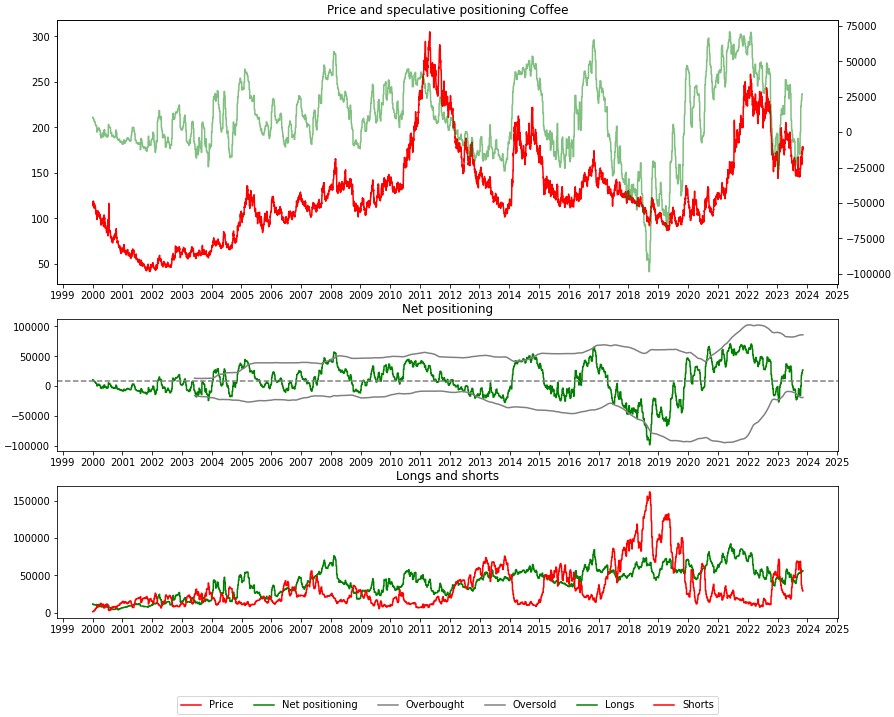

- The net positioning in coffee has clearly rebounded and is above 0, as well as above the long-term average

- Increase in net speculative positioning is primarily the result of reducing short positions, similar to what occurred at the beginning of 2023 when prices rose above 200 cents per pound

- Long positions are increasing, although they are at a relatively high level compared to the past 2 years, but still distant from historical peaks

- Any further rebound in coffee prices at the end of this year may be motivated by the potential weakening of the U.S. dollar, in-line with seasonality and fundamentals resulting from Fed decisions

- Seasonality also indicates the potential for further price rebounds at the end of the year

- Fundamentally, concerns about future harvests can be expected due to the occurrence of the El Nino phenomenon

- The rebound in coffee prices is also a result of a significant rebound in the Brazilian real, which is at its highest level since the second half of September

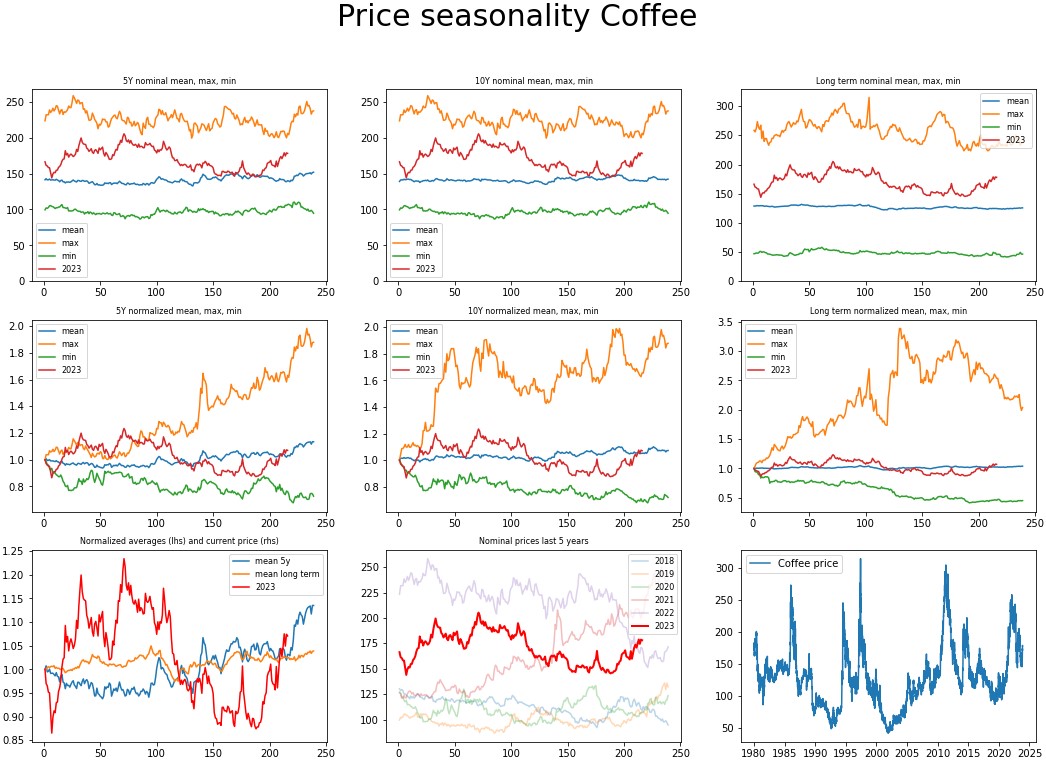

Seasonal patterns suggest that coffee prices may rebound by the end of this year Early-year peaks near 200 cents per pound could be the target. Source: Bloomberg Finance LP, XTB

Speculative positioning supports further price recovery, just as it was the case at the beginning of this year

Speculative positioning supports further price recovery, just as it was the case at the beginning of this year

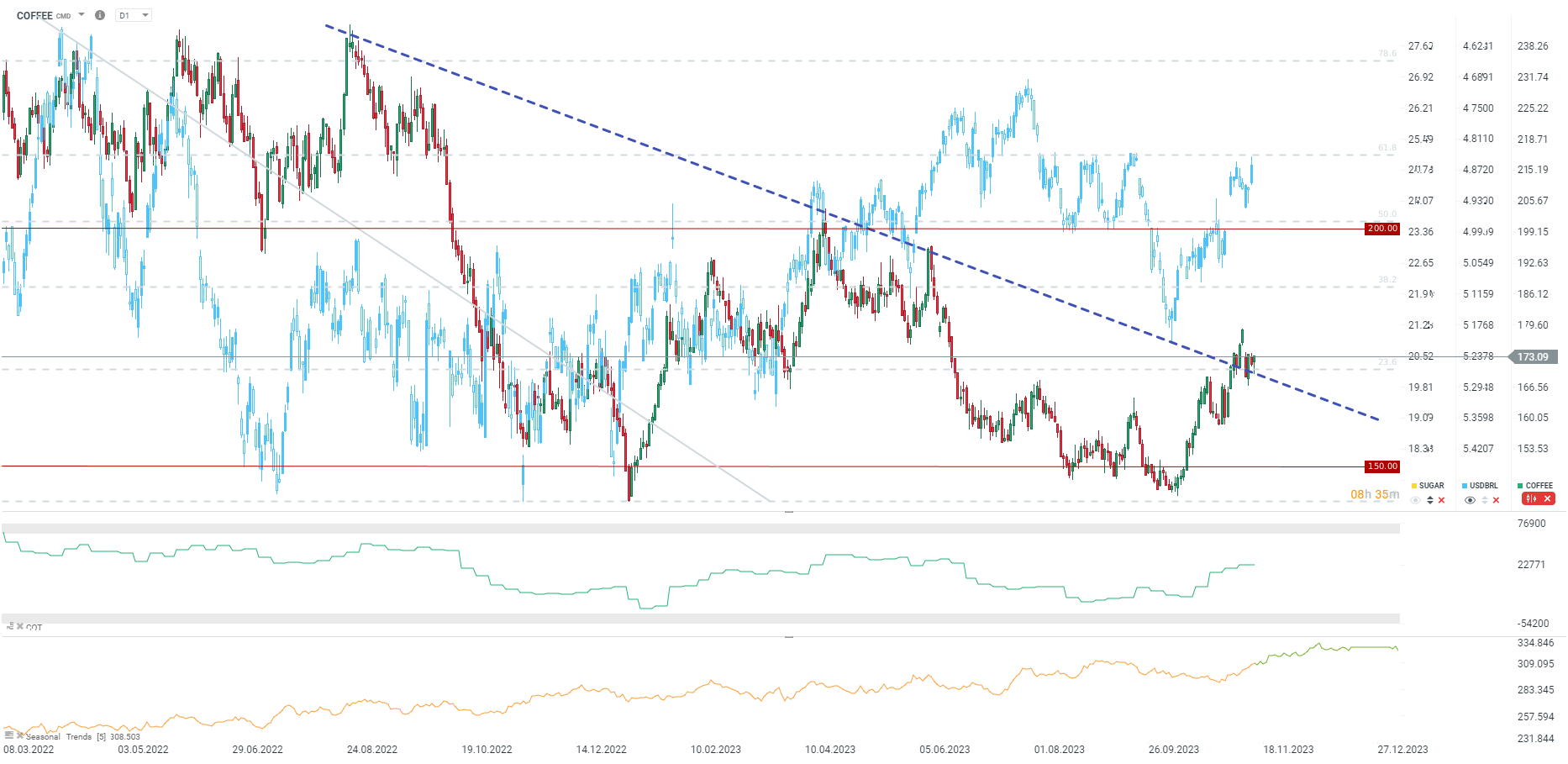

COFFEE broke above the downward trendline but has stabilized later on amid negative impact of contract rollover. If USD continues to weaken, especially against BRL, it may provide fuel for resumption of gains. Source: xStation5

COFFEE broke above the downward trendline but has stabilized later on amid negative impact of contract rollover. If USD continues to weaken, especially against BRL, it may provide fuel for resumption of gains. Source: xStation5

3 markets to watch next week (24.10.2024)

Chart of the day: GOLD (24.10.2025)

NATGAS loses after the EIA inventories report

BREAKING: OIL gain extends to 3.5% 📈Chinese state companies stop Russian oil purchases