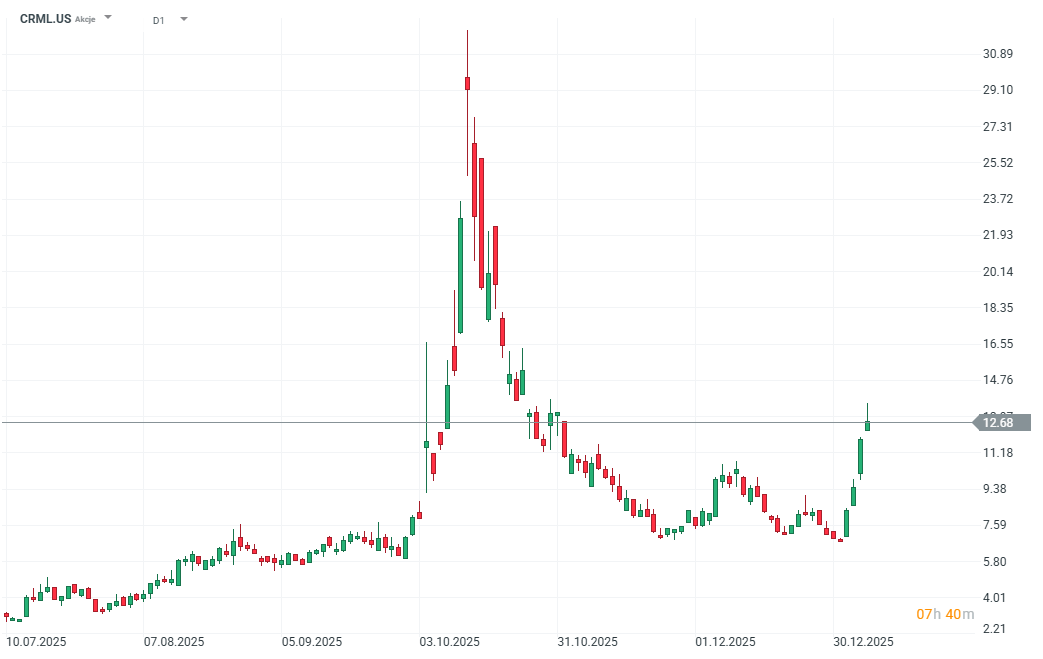

Shares of Critical Metals Corp are up another 7% today, extending their total rebound to more than 80%. The main driver behind the move is the renewed focus on US interest in Greenland.

Critical Metals is highly dependent on developments in the relationship between Greenland and the United States, as its key asset is the Tanbreez rare-earth metals project located in Greenland. This means that permits, export rights and the project’s long-term viability remain under the authority of Greenlandic and Danish regulators, while potential customers, financing partners and strategic backing are expected to come largely from the United States.

At present, the company’s valuation is largely driven by how the Greenland–US relationship evolves. Closer strategic cooperation could unlock financing and demand, while diplomatic tension or political uncertainty could delay project development and increase risk.

The White House has said that President Donald Trump is considering “a broad range of options” regarding the acquisition of Greenland — including the potential use of US military forces — describing the Arctic island as a national-security priority. European leaders issued a coordinated response expressing support for Denmark and Greenland, emphasizing sovereignty and territorial integrity under international law, while NATO partners warned that any US military action could destabilize the alliance.

From a strategic perspective, Critical Metals is positioning itself as a Western supplier of critical raw materials within a growing portfolio of projects. Tanbreez is regarded as one of the largest rare-earth deposits in the world.

The latest gains are the result of renewed speculation around possible US involvement in resource extraction in Greenland — a pattern similar to what was seen at the turn of September and October last year.

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment