A software update from Nasdaq-listed cybersecurity giant, CrowdStrike (CRWD.US) possible caused global IT systems outage and some chaos in financial and flight sector. The stock market reacted accordingly, selling stock due to potential marketing loses and still-possible claim risk. Yesterday, analysts from Redburn Atlantic downgraded Crowdstrike share price target to $275 per share, from $380 before.

CrowdStrike CEO commented that "CrowdStrike is actively working with customers impacted by a defect found in a single content update for Windows hosts. Mac and Linux hosts are not impacted. This is not a security incident or cyberattack. The issue has been identified, isolated and a fix has been deployed (...) Our team is fully mobilized to ensure the security and stability of CrowdStrike customers.'

- According to Redburn analysts endpoint protection market is maturing, while other growth markets like cloud, identity, and security information event management (SIEM) are highly competitive.

- They indicated that Crowdstrike valuation is high, despite signs of slowdown in the market it operates.

- Despite high quality products, according to Redburn 'the company faces challenges in penetrating the large enterprise market to maximize cross-sell opportunities'

- Crowdstrike 45% year-to-date gain has placed it at a demanding FY 2024 EV/sales multiple of 23x, more than double the cybersecurity peers group.

CRWD.US (D1 interval)

Current pre-market share price suggest test of the SMA200 (red line) at $280. Yesterday, stock tested SMA100 (black line).

Źródło: xStation5

Źródło: xStation5

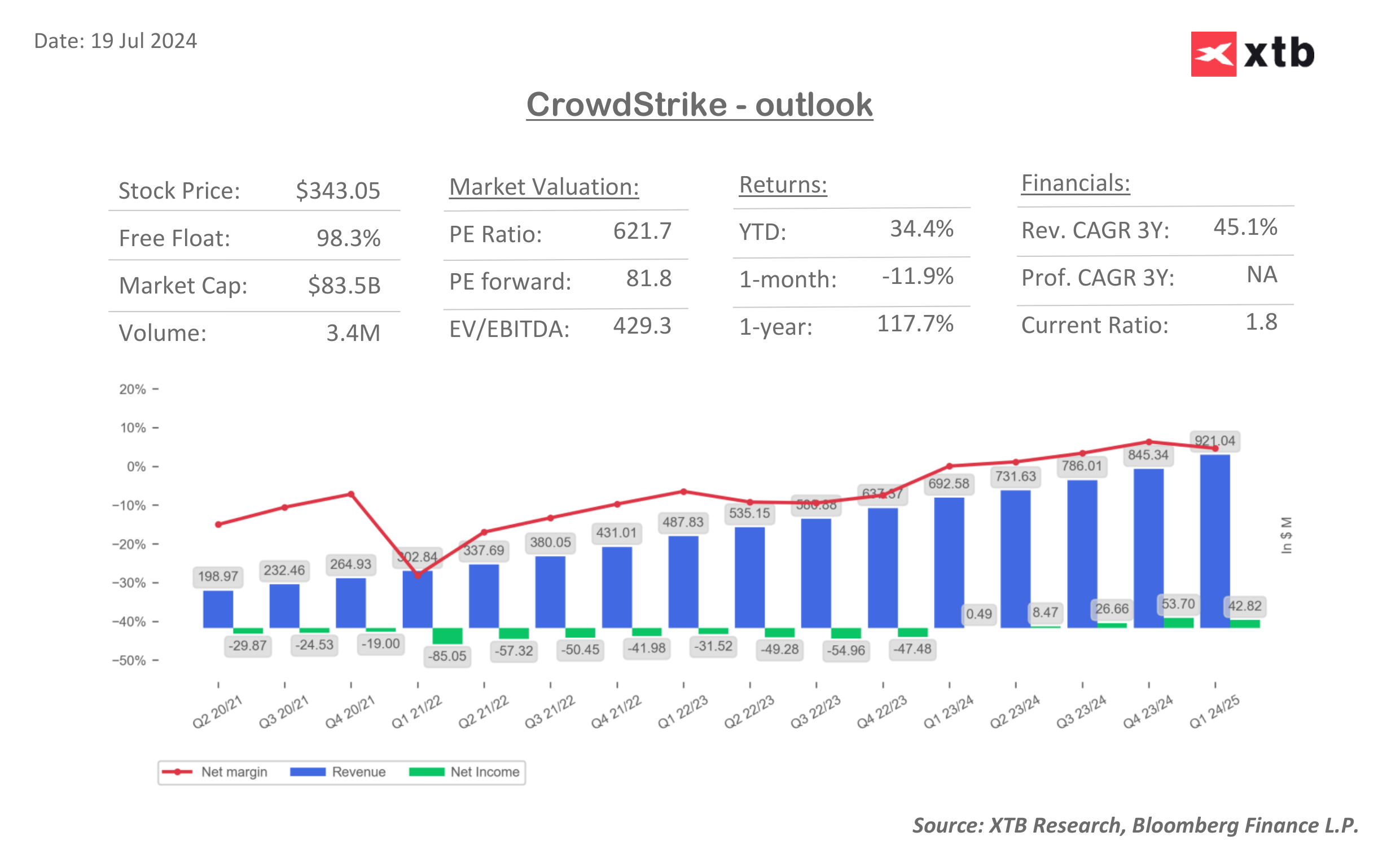

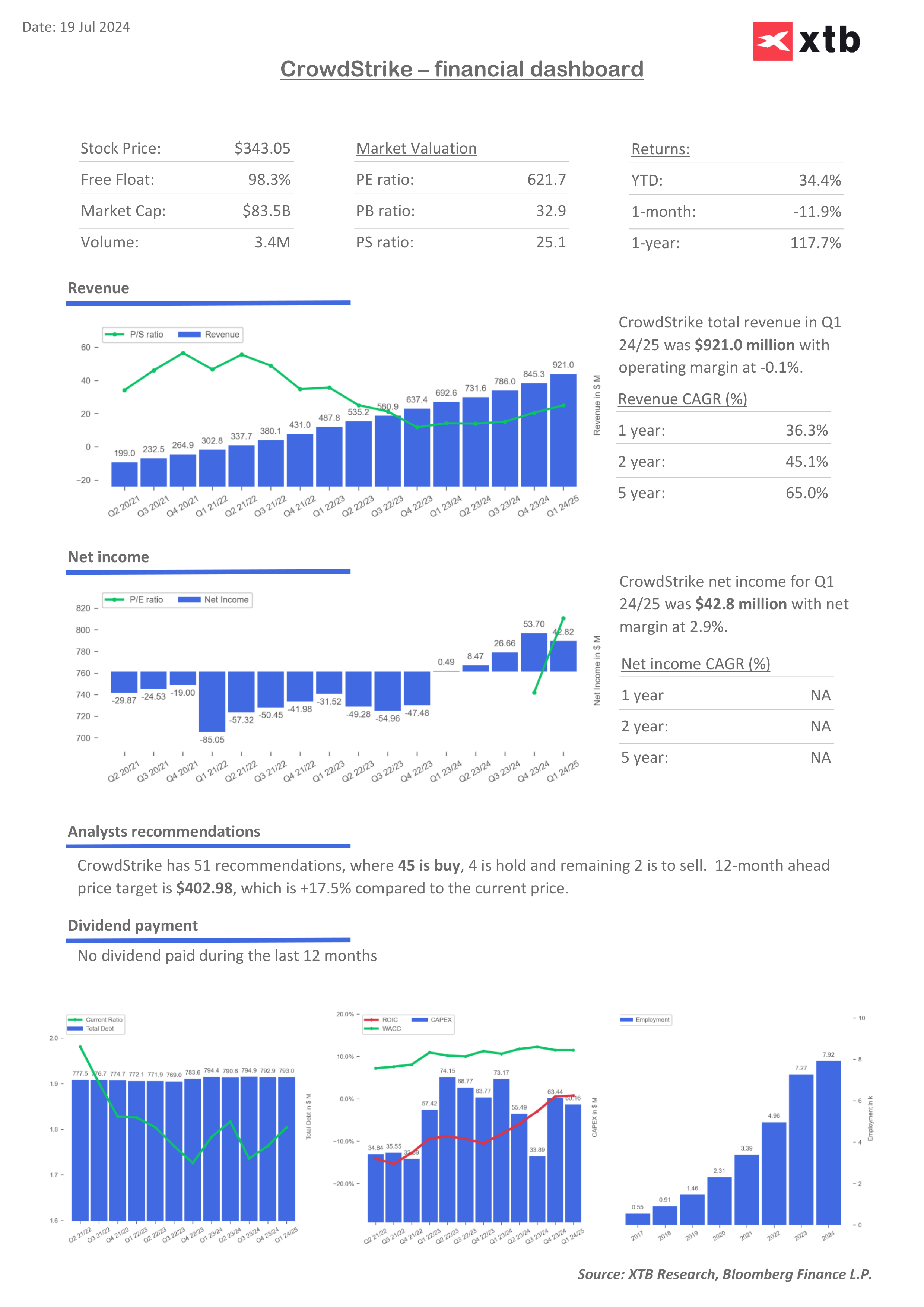

CrowdStrike valuation and financial multiples

Looking at financial multiples we can see very high P/E ratio with forward P/E at 80x; those levels are really rarely to see. The company become profitable Q1 2023. The revenue growth and net earnings expansions is quite stable since then.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P

Source: XTB Research, Bloomberg Finance L.P

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment