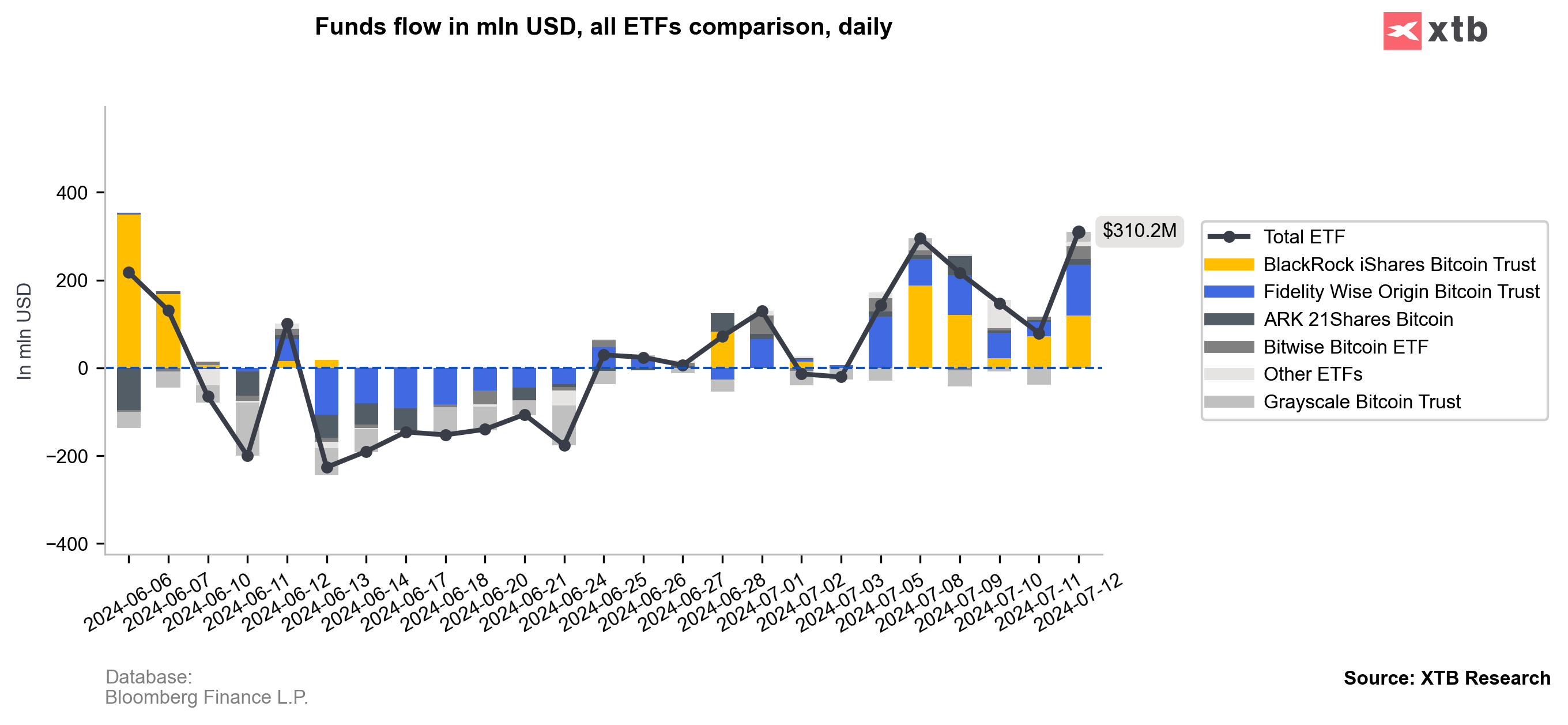

Cryptocurrencies are posting modest gains today, with the markets' attention focused on Bitcoin, which today overcame a key resistance level set by the 200-session moving average and broke through $60k. Currently, the largest cryptocurrency is trading at around $63,000. Ethereum is also gaining more than 3%. Data on flows into U.S. ETFs pointed to record net inflows in more than 30 days; last Friday they amounted to more than $310 million (the highest since June 6).

Crypto market drivers

- Bitcoin's additional positive reaction after the weekend may also be due, by leaps and bounds, to Donald Trump's chances of winning the election. After the failed assassination attempt on his life, the former U.S. president's ratings in the eyes of investors rose sharply.

- Trump, shortly after the events, was also expected to confirm his presence at a forum on Bitcoin in July. Trump's own stance on the cryptocurrency sector and Bitcoin is much more favourable than that of the Democratic environment, causing the market to fuel speculation about a possible 'boom' in the industry in the US, following a possible win in the November elections.

- Rising net inflows into ETFs suggest that the market is recovering from recent sell-offs, which may also encourage momentum-based strategy funds tracking demand for exchange-traded funds.

- Additionally, according to on-chain data, a wallet associated with the German state of Saxony has ended its BTC sales and is now out of digital assets

- Additional support for the cryptocurrency sector comes from on-chain data suggesting very low flows to exchanges, from miners' wallets which may suggest that the main phase of the post-phalving sell-off is behind us. The bankrupt FTX exchange will also begin the process of repaying investors, which is likely to begin by the middle of Q4, this year.

- As part of the repayments, FTX will transfer about $16 billion in assets to the victims, which some analysts see as a possible buying signal, as some of the exchange's former customers are likely to be willing to put some of the recovered funds into cryptocurrency purchases. The creditors' vote will take place on August 16, and on October 7 the market will learn the final plan for the exchange's liquidation.

US Bitcoin ETFs net inflows at local highs

Source: Bloomberg Finance L.P. , XTB Research

Bitcoin chart (D1 interval)

Looking at Bitcoin's today, we can see that the price has climbed above the SMA200 (red line) and is on track to test the SMA50, near $64k. A renewed drop below the SMA60 could suggest pressure to test the SMA51 where we see the 61.8 Fibonacci retracement of the upward wave from January, driven by inflows into ETFs in the US.

Source: xStation5

Chart of the day: Bitcoin (21.10.2025)

Crypto news: Bitcoin and Ethereum on the rise again 📈

3 markets to watch next week - (17.10.2025)

Bitcoin drops below important support zone 📉