Cryptocurrencies showed resilience on Friday by cushioning well the declines in major stock market indices. Is this enough to trumpet an oversold and imminent upward move? Probability and technical analysis indicate that bitcoin is very close to a major price move, with the potential to disappoint the bulls:

- During the 2020 - 2021 bull market, cryptocurrencies 'romanced' the Fed's dovish actions and unprecedented scale of additions, which was also an indirect catalyst for their rise in the fall of 2020. This year, the opposite is true, with cryptocurrencies weighing down on the Fed's aggressive in restrictive monetary policy, and the likelihood of changes in the Federal Reserve's further actions is low in the context of still strong data from the US labor market;

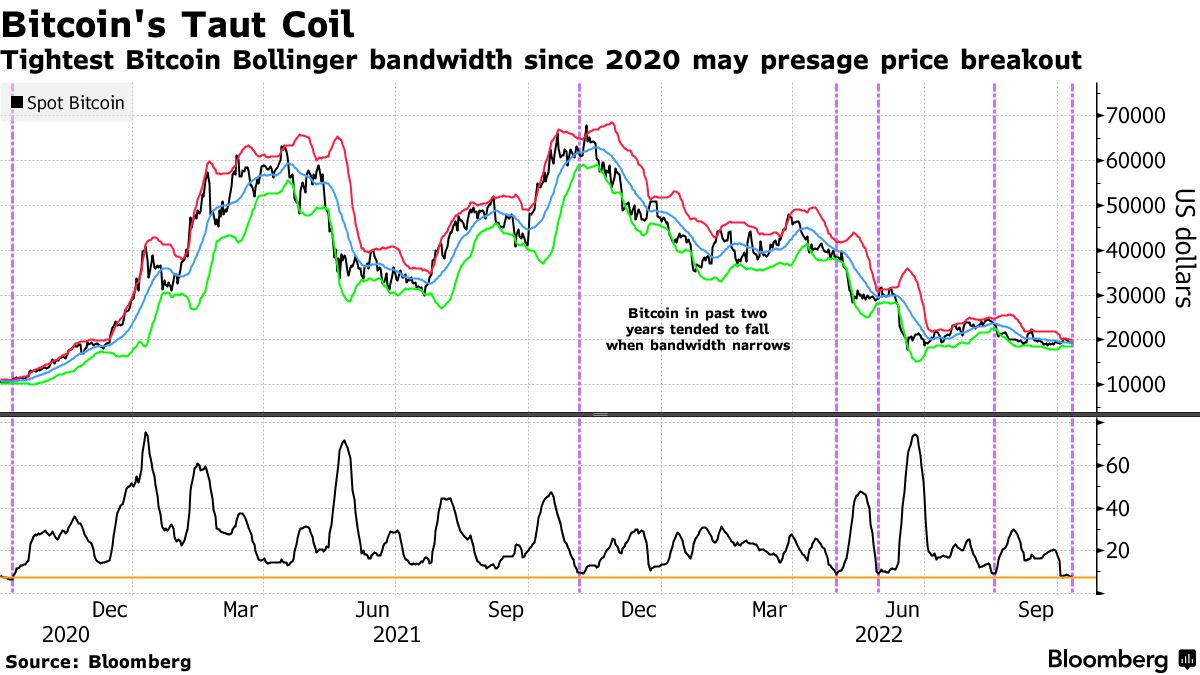

- The width of the Bollinger Bands over the past 2 years has been this narrow only 5 times with 4 out of 5 cases ending in a sell-off and falling by an average of 16% in 20 days. Bitcoin has lost nearly 65% from its peaks this year, in previous bull markets the sell-off often reached as high as 80% before the king of cryptocurrencies began to recover. On the other hand, however, this year's bull market, which ended at levels near $69,000 according to Glassnode, did not show the 'overheating' so characteristic of previous cycles by which some analysts indicate that Bitcoin's declines will not be as deep as in previous bull markets;

- The Ethereum network continues to grow and recorded a new record for new addresses on the network, by 11.1% beating the previous record of 2022 on January 3. According to Santiment analysts, the growth in the utility of the Ethereum blockchain foreshadows the upcoming growth of digital assets. At the same time, the number of transactions on the ETH blockchain fell to levels unseen until nearly 21 months ago. Ethereum's popularity on social networks has also declined.

The chart showing the Bollinger bands shows that Bitcoin is very close to exiting the sideways trend. Previously, in 4 cases out of 5, the consolidation ended in declines. Exclusively in the fall of 2020, Bitcoin surprised with an upward movement after central banks moved 'to help' the economy. By the fact that the chances of a Fed pivot appear to be very low, a downward move remains more likely. Source: Bloomberg The volatility of cryptocurrency prices in the top 100 has fallen and approached levels last seen in 2020, with previous years never at such low levels. Source: Bloomberg

The volatility of cryptocurrency prices in the top 100 has fallen and approached levels last seen in 2020, with previous years never at such low levels. Source: Bloomberg The Ethereum blockchain is growing although it is experiencing a crisis caused by a drop in investor interest after the successful The Merge. On Saturday, October 8, a new record number of addresses were added to the Ethereum network. In one day, 135,780 addresses were added to the network, indicating a new annual record. Source: Santiment

The Ethereum blockchain is growing although it is experiencing a crisis caused by a drop in investor interest after the successful The Merge. On Saturday, October 8, a new record number of addresses were added to the Ethereum network. In one day, 135,780 addresses were added to the network, indicating a new annual record. Source: Santiment

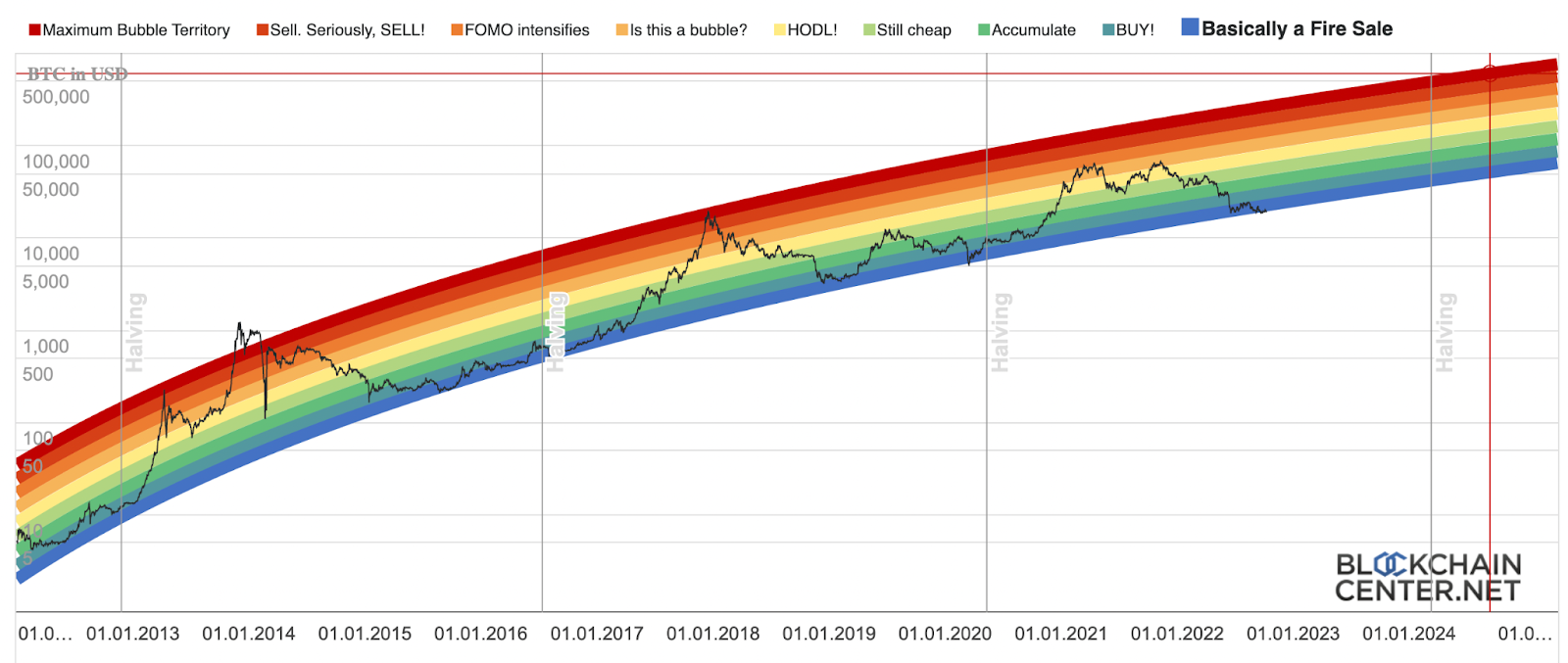

Bitcoin's famous 'Rainbow chart' shows the extreme oversold levels from which Bitcoin usually bounced. These levels proved to be bargains especially for long-term investors, as it took Bitcoin a significant amount of time to leave the trend. According to the chart, Bitcoin's next price peak will be in October 2024. Source: Blockchaincenter, Finbold Bitcoin, H4 interval. The price of the major cryptocurrency is still below the SMA 200 and below the SMA50, which raises concerns around a possible capitulation. In the second half of August we saw the so-called "death cross", when the 50-session average dipped below the SMA200, and since then we have seen a decline in sentiment, with the SMA50 unable to threaten the 200-session average. At the moment, a reverse cut of the SMA50 above the SMA200 could herald a change in trend and a 'golden cross' formation. However, this seems unlikely in the context of the dire atmosphere on the stock markets. RSI levels still look neutral. Source: xStation5.

Bitcoin, H4 interval. The price of the major cryptocurrency is still below the SMA 200 and below the SMA50, which raises concerns around a possible capitulation. In the second half of August we saw the so-called "death cross", when the 50-session average dipped below the SMA200, and since then we have seen a decline in sentiment, with the SMA50 unable to threaten the 200-session average. At the moment, a reverse cut of the SMA50 above the SMA200 could herald a change in trend and a 'golden cross' formation. However, this seems unlikely in the context of the dire atmosphere on the stock markets. RSI levels still look neutral. Source: xStation5.

Chart of the day: Bitcoin (21.10.2025)

Crypto news: Bitcoin and Ethereum on the rise again 📈

3 markets to watch next week - (17.10.2025)

Bitcoin drops below important support zone 📉