Summary:

- Deep falls on Bitcoin weighed on other cryptocurrencies

- Ripple breaks out of the overbalance structure

This week has not been the best for cryptocurrencies to say the least. A huge decline that occurred on Bitcoin on Wednesday (it took only 15 minutes take BTC down by 7.5%!) weighed on other digital currencies. Overall market capitalization has fallen $12 billion as a result of this week’s losses. This substantial pullback may have had something to do with Zuckerberg’s hearing as well as the Facebook’s project called Libra. Let us remind that last week we wrote about seven payment processors withdrawing their support for the Libra project.

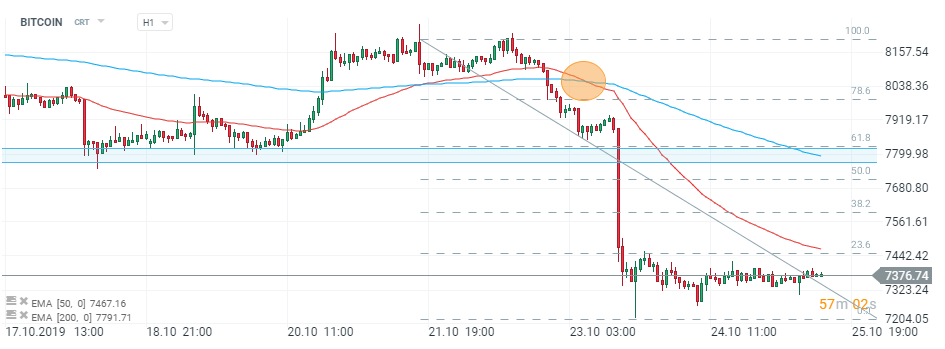

Technically we may notice that before a steep decline on Bitcoin, the price was moving within a tight range indicating investors were undecided where to head next. Breaking below the 50DMA was a trigger which subsequently pushed the price well lower. When we look at the daily time frame we see that both 200DMA and 50DMA are closing in, which could result in a death cross pattern. When this pattern occurred lastly it pushed Bitcoin down by roughly 60%. The major resistance could be found nearby $7825. Source: xStation5

Technically we may notice that before a steep decline on Bitcoin, the price was moving within a tight range indicating investors were undecided where to head next. Breaking below the 50DMA was a trigger which subsequently pushed the price well lower. When we look at the daily time frame we see that both 200DMA and 50DMA are closing in, which could result in a death cross pattern. When this pattern occurred lastly it pushed Bitcoin down by roughly 60%. The major resistance could be found nearby $7825. Source: xStation5

Ripple broke out of the overbalance structure earlier this week and then fell toward $0.264, the level underpinned by the 50% retracement of the latest price movement. Currently bulls are struggling with the important technical level placed at $0.277. Once they are successful, it could see the price rising up to $0.3. Otherwise, the strong support could be found nearby $0.264 and then at $0.233. Source: xStation5

Ripple broke out of the overbalance structure earlier this week and then fell toward $0.264, the level underpinned by the 50% retracement of the latest price movement. Currently bulls are struggling with the important technical level placed at $0.277. Once they are successful, it could see the price rising up to $0.3. Otherwise, the strong support could be found nearby $0.264 and then at $0.233. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?