- Bitcon broke above major resistance zone

- Dogecoin's whales become more active

- Cardano approaches key resistance after impressive rally

The last seven days were great again for the cryptocurrency market. Bitcoin was able to break above 45,000 USD, providing an additional boost that the market needed in order to go higher despite continued escalation of Russia's invasion of Ukraine with its economic fallout. Rally was fueled by massive short liquidations on crypto exchanges which was accompanied by rising volume. This development has allowed plenty of altcoins to trigger an exponential uptrend. Bitcoin's market dominance increased to 42.1%. The capitalization of all digital assets in circulation rose to 2.12 trillion, while an average daily trading volume is registered at $ 119.9 billion.

Bitcoin:

Start investing today or test a free demo

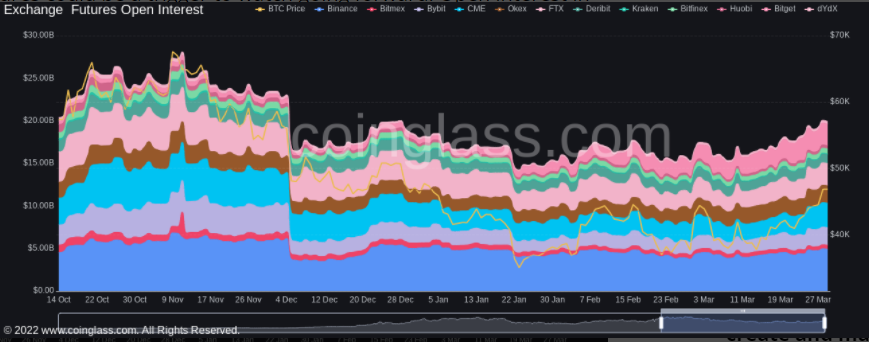

Create account Try a demo Download mobile app Download mobile app- Return of interest in Bitcoin futures could be a sign that the most popular cryptocurrency has shaken off the impact of the Russian aggression and plans for tightening by the FED.

Open interest in Bitcoin futures reached levels not seen since December. Source: Coinglass

Open interest in Bitcoin futures reached levels not seen since December. Source: Coinglass

- For the first time this year the Fear and greed index entered “Greed” territory. This is an impressive move, taking into account that last week the index was in the "extreme fear" area.

Fear and greed index reached its highest level since November 2021. Source: Alternative.me

Fear and greed index reached its highest level since November 2021. Source: Alternative.me

Bitcoin managed to break above major resistance around $45,000 which is marked with lower limit of the triangle formation and 61.8% Fibonacci retracement of the upward wave launched in July 2021. If current sentiment prevails, an upward move may accelerate towards next resistance at $49,500 which is marked with upper limit of the 1:1 structure and 50% Fibonacci retracement. On the other hand, if sellers manage to regain control, another downward impulse towards aforementioned $45,000 may be launched. Source: xStation5

ETHEREUM:

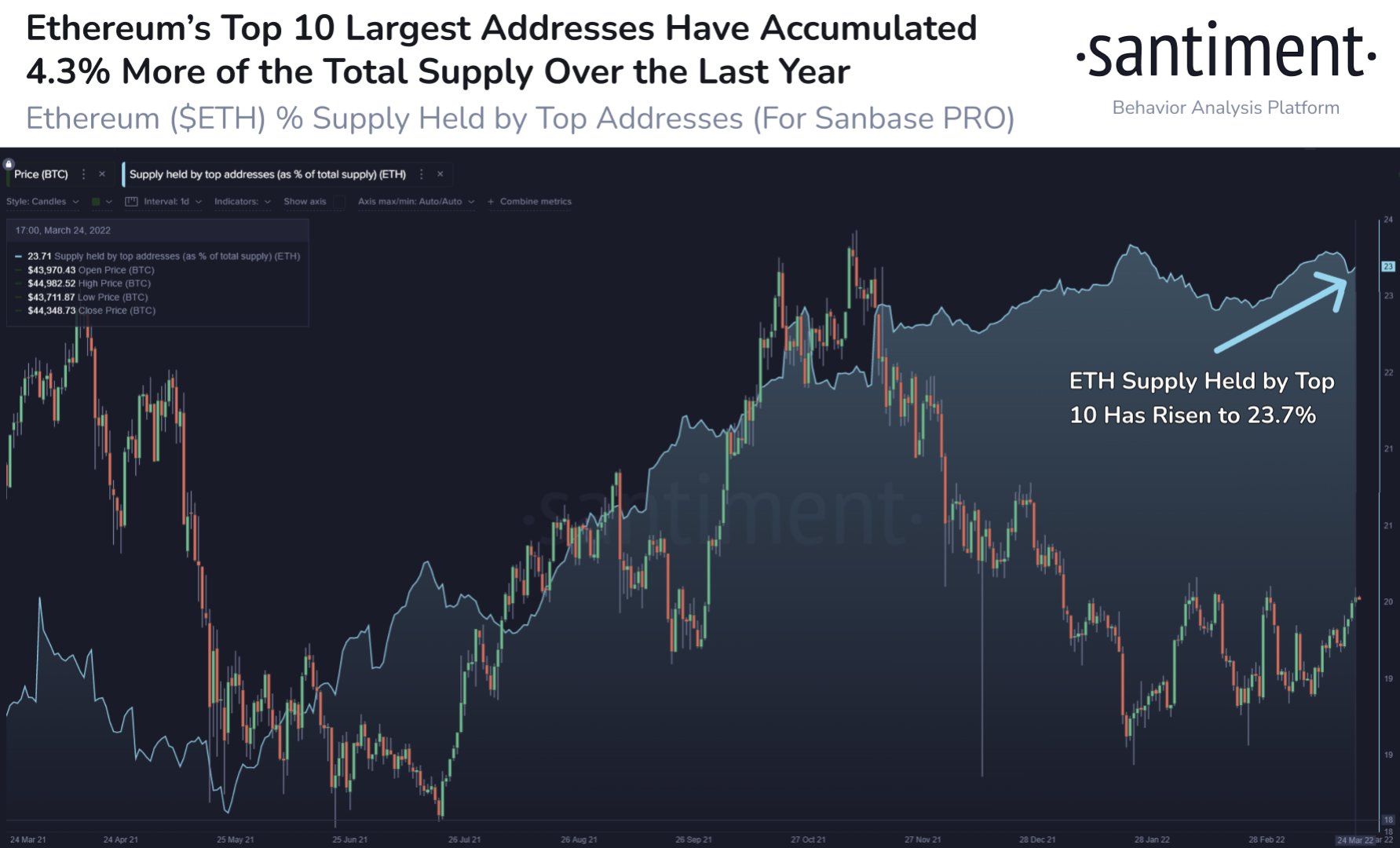

- The top 10 Ethereum whales now hold 4.3% more of the altcoin's supply compared to 2021 which is considered bullish by investors.

Ethereum whale holdings rose significantly in recent days. In the past, reduction in circulating supply often sparked price rally. Source: Santiment

Ethereum whale holdings rose significantly in recent days. In the past, reduction in circulating supply often sparked price rally. Source: Santiment

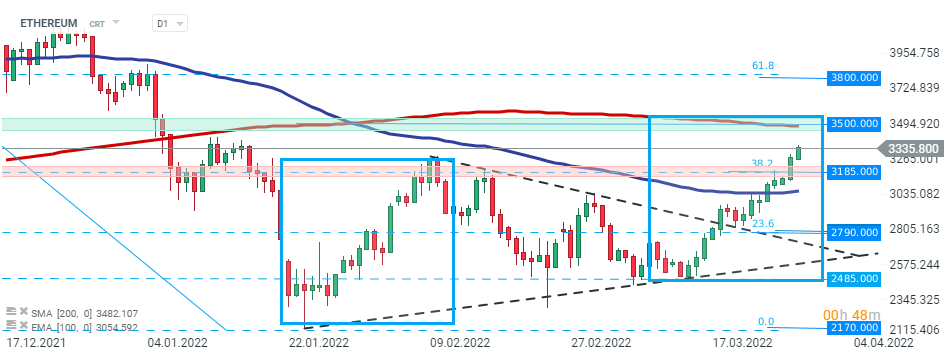

Ethereum managed to break above major resistance at $3185, which is marked with 38.2% Fibonacci retracement of the last downward correction and now acts as nearest support. Next target for buyers is located at $3500 and coincides with 200 SMA (red line) and upper limit of the 1:1 structure. Source: xStation5

Ethereum managed to break above major resistance at $3185, which is marked with 38.2% Fibonacci retracement of the last downward correction and now acts as nearest support. Next target for buyers is located at $3500 and coincides with 200 SMA (red line) and upper limit of the 1:1 structure. Source: xStation5

CARDANO:

- Cardano price surged over 50% in the past two weeks from $0.776 to almost retesting the $1.20 resistance barrier.

- Community prepares for Milkomeda C1 mainnet. Proponents believe Cardano could hit a significant interoperability milestone with Ethereum, as Milkomeda goes live on March 28.

- However the 30-day Market Value to Realized Value (MVRV) model which shows the average profit/loss of investors that bought the coin over the past month jumped to 22.5%. This indicates that the majority of short-term traders recorded profits and profit taking may occur.

If short-term investors decide to close their positions, then a local downward correction may occur. Source: Santiment

If short-term investors decide to close their positions, then a local downward correction may occur. Source: Santiment

Cardano price broke above the upper limit of the wedge formation recently and is trading higher at the beginning of a new week. If current sentiment prevails, an upward move may accelerate towards resistance at $1.33 which is marked with upper limit of the market geometry coincides with 23.6% Fibonacci retracement of the last downward correction and 200 SMA (red line). Source: xStation5

Cardano price broke above the upper limit of the wedge formation recently and is trading higher at the beginning of a new week. If current sentiment prevails, an upward move may accelerate towards resistance at $1.33 which is marked with upper limit of the market geometry coincides with 23.6% Fibonacci retracement of the last downward correction and 200 SMA (red line). Source: xStation5

DOGECOIN

- The number of long-term investors of DOGE rose sharply in recent months despite the lackluster performance in the second half of 2021.

- Also large investors have become more active over the weekend. On Sunday the number of transactions exceeding $100,000 increased by 111%.

The number of long-term holders jumped 17.00% from 1.7 million addresses to 2 million since 2020. Source: intotheblock

The number of long-term holders jumped 17.00% from 1.7 million addresses to 2 million since 2020. Source: intotheblock

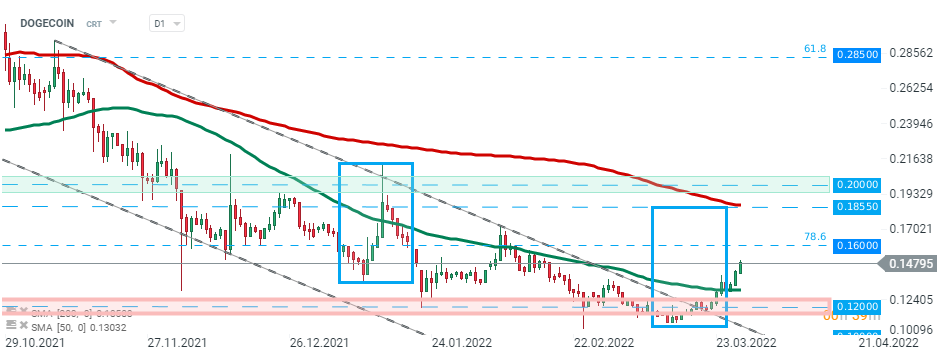

DOGECOIN - bulls managed to push the price above upper limit of the descending channel and price is currently heading towards key resistance at $0.1600 which coincides with 23.6% Fibonacci retracement. However if sellers manage to regain control, then support at $0.1200 may be at risk. Source: xStation5

DOGECOIN - bulls managed to push the price above upper limit of the descending channel and price is currently heading towards key resistance at $0.1600 which coincides with 23.6% Fibonacci retracement. However if sellers manage to regain control, then support at $0.1200 may be at risk. Source: xStation5