Bitcoin dipped below $43000 today, shedding around 2% during the trading session. This marks the cryptocurrency's lowest level since December 20. If the price closes today at or below its present level, a bearish engulfing pattern will emerge. However, seasonality suggests that upward momentum should persist until January 7. Moreover, it's important to note that significant corrections in recent months have occurred after the 50-day moving average was breached. This average is currently below a crucial support level of $40500.

The drop in prices on the crypto market during the Asian session is attributed to notable spikes in periodic payment rates, also known as funding rates. These payments stem from discrepancies between futures market prices and spot market prices - depending on their positions, investors either receive or incur payments. Considering the current extremely high "funding rates," some investors may have liquidated their long positions on futures contracts.

Source: xStation5

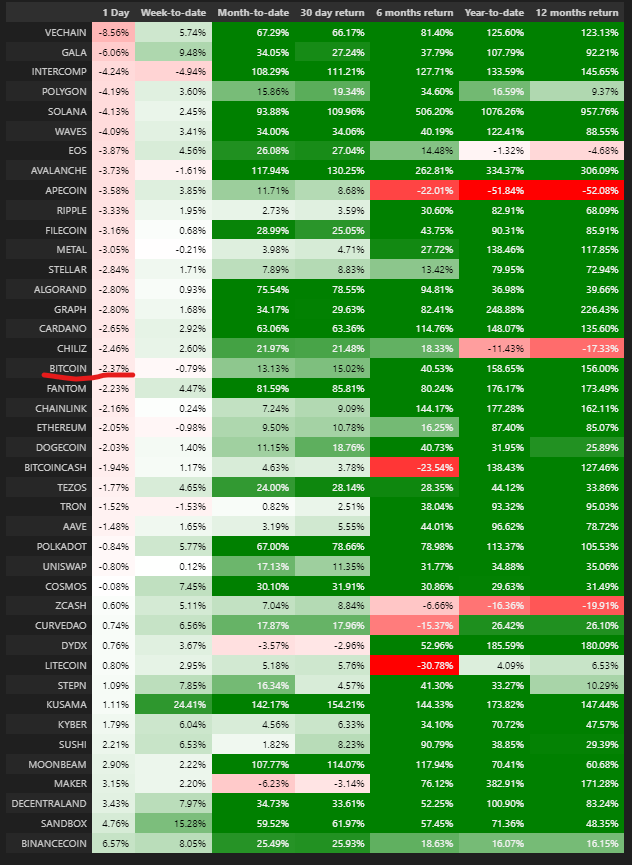

The crypto market is under slling pressure today but long-term gains remain visible. Source: XTB

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?