- Upbeat earnings reports from major US banks

- Coinbase (COIN.US) soars in market debut

- US crude oil stocks fall more than forecast

Most of the European indices finished today's session higher as investors digest the beginning of the earnings season and rising number of new Covid-19 infections. Meantime, Europe’s regulator will issue a recommendation on Johnson & Johnson vaccine next week, after the US halted its use amid reports of blood clots. On the data front, Eurozone industrial output dropped 1.0 % from a month earlier in February, following a 0.8 % increase in January and compared with market expectations of a 1.1% decline. It was the largest decline in industrial activity since April's 2020 record contraction, as many countries across Europe remained under strict coronavirus restrictions. DAX fell 0.17%, hovering just below its record high, CAC40 rose 0.40% and FTSE100 finished 0.7% higher.

Mixed moods prevail on Wall Street. The Dow Jones rose 0.60% and reached a new record, boosted by the banking sector. Goldman Sachs stock rose nearly 3% after the bank posted record net profits and revenues in Q1. JPMorgan Chase and Wells Fargo also posted upbeat quarterly figures which boosted investor expectations of a strong rebound for corporate America. S&P 500 is trading near the flatline while Nasdaq fell 0.55%. Meanwhile Coinbase shares surged in their market debut. Coinbase began trading at $381 a share, over 50% higher compared to a $250 reference price set by Nasdaq on Tuesday, and rose sharply to $409 a share. On the coronavirus front, US officials said the pause on the use of the J&J vaccine will not slow down the vaccination campaign. At the moment 75 million citizens have been fully vaccinated according to the CDC.

WTI crude rose more than 5.0% and is trading slightly below $63.30 a barrel, while Brent is trading nearly 4.9% higher around $66.70 a barrel after IEA and OPEC lifted their 2021 oil demand forecasts by 230,000 bpd and 100,000 bpd, respectively. Also, both the EIA and API reported a larger-than-expected draw in crude oil inventories. Elsewhere gold fell 0.50% to $ 1,735.00 / oz, while silver is trading 0.20 % higher, around $ 25.37 / oz amid weaker dollar and lower US Treasury yields, which retreated further from recent highs.

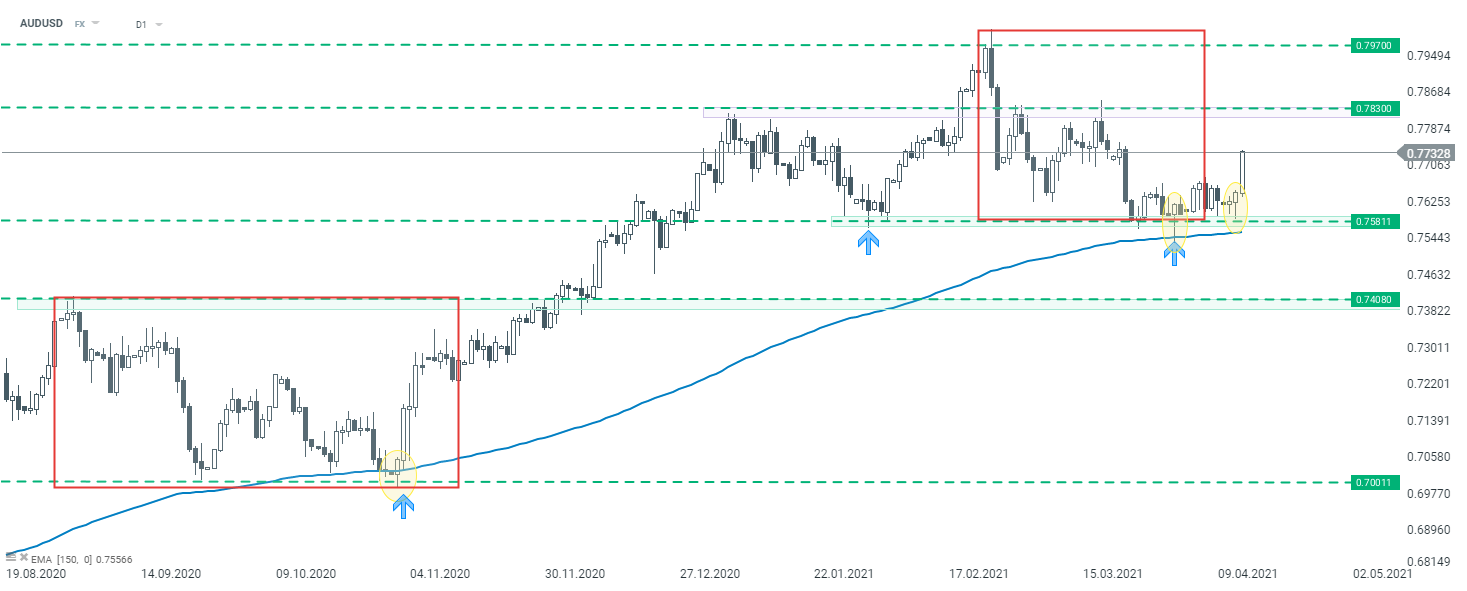

AUDUSD bounced off the major support at 0.7581 which is marked with a lower limit of the 1:1 structure and 150 EMA (blue line). If the current sentiment prevails, then upward move could be extended to the 0.7830 handle or even resistance at 0.7970.Source: xStation5

AUDUSD bounced off the major support at 0.7581 which is marked with a lower limit of the 1:1 structure and 150 EMA (blue line). If the current sentiment prevails, then upward move could be extended to the 0.7830 handle or even resistance at 0.7970.Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause