-

Wall Street indices are trading higher after recovering from early losses as continued streak of worse-than-expected jobs data from the United States makes Fed rate hike pause in May more likely

-

Tech Nasdaq is the best performing major Wall Street index while Dow Jones lags the most

-

Stock markets in Europe traded higher today with UK FTSE100, Italian FTSE MIB and Swiss SMI outperforming with over-1% gains. Some weakness could be spotted in the east with Polish WIG20 dropping 0.15%

-

Upbeat European session came in spite of a rather downbeat trading in Asia-Pacific where Japanese, Australian and South Korean indices traded lower. Indian Nifty 50 gained while indices from China traded mixed

-

Fed's Bullard said that the US central bank should continue on its rate path. Bullard also said that he expects financial stress caused by recent banking turmoil to continue to abate

-

ECB's Lane said that another rate hike would be appropriate at next meeting if macroeconomic situation develops in-line with projections

-

US Challenger report showed job cuts at 89.7k in March (exp. 65.0k) - an increase of almost 320% YoY

-

US initial jobless claims climbed to 228k (exp. 200k) in a week ended April 1, 2023. Previous reading was revised higher from 198k to 246k

-

US continuing claims climbed from 1817k, revised higher from 1689k, to 1823k (exp. 1700k)

-

Canadian jobs data for March showed a 34.7k increase in employment (exp. +12.9k), with 18.8k increase in full-time jobs and 15.9k increase in part-time jobs. Unemployment rate stayed unchanged at 5.0% (exp. 5.1%)

-

German industrial production increased 2.0% MoM in February (exp. +0.1% MoM)

-

US natural gas trades almost 5% lower after EIA report showed a 23 billion cubic feet drop in US natural gas inventories (exp. -21 bcf) and new forecasts for the United States continue to show a period of above-average temperatures ahead

-

Oil is trading a touch higher with Brent testing $85 area and WTI trading near $80.50 mark

-

Cryptocurrencies are trading mixed with major coins dropping slightly. Bitcoin drops 0.4% to $28,000 area

-

EUR and CHF are the best performing major currencies while NZD and AUD lag the most

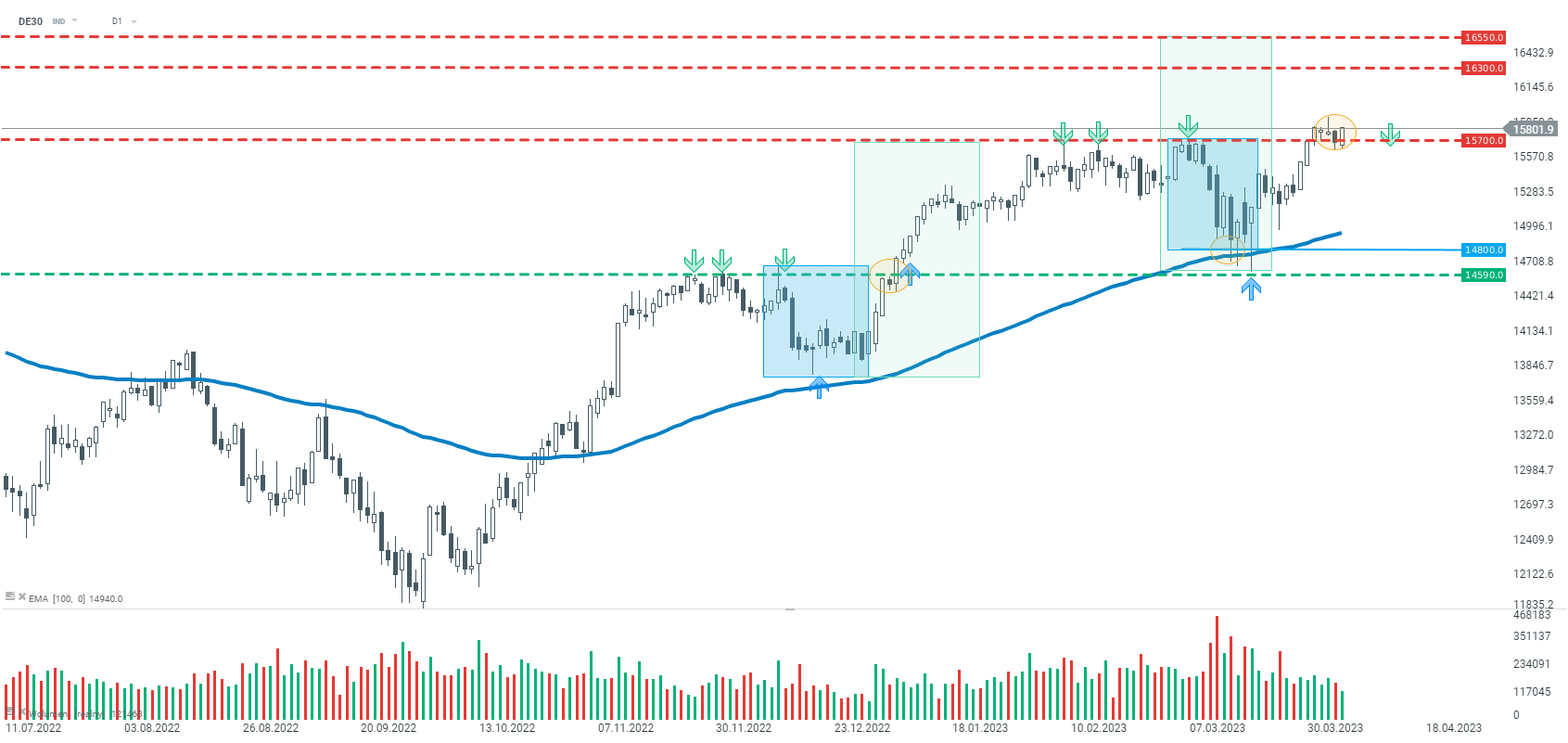

DE30 managed to defend 15,700 pts area, marked with previous local highs. According to classic technical analysis, such a situation suggests a high chance of continuation of the upward move. Source: xStation5

DE30 managed to defend 15,700 pts area, marked with previous local highs. According to classic technical analysis, such a situation suggests a high chance of continuation of the upward move. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report