-

Market pessimism in Europe, U.S. tries to rebound

-

EURUSD trading flat

-

The CBRT raises interest rates

European markets closed below the flatline today as coronavirus fears are still having enormous impact on investors’ sentiment - U.K. reported highest number of daily cases since the pandemic began (6,634 new infections). DAX finished the day 0.29% lower while CAC 40 lost 0.83%. FTSE 100 tumbled 1.30%, even though British Finance Minister announced a new emergency package of measures to contain unemployment.

U.S. indices started the day lower, yet American equities try to rebound. At press time all major indices are adding some gains with Nasdaq rising the most. In the second part of the day precious metals gain steam as well, earlier silver prices fell below the $22 mark today. EURUSD is trading more or less flat.

In terms of economic calendar, the SNB and Norges Bank decided to keep interest rates unchanged, but the CBRT unexpectedly raised repo rate by 200 basis points to 10.25% which caused Lira to surge. German Ifo Business Climate climbed to 93.4, the result was worse than expected though. U.S. initial jobless claims came in below expectations as another 870k workers filed new unemployment claims. On the other hand, new home sales in the U.S. climbed to highest level since 2006, exceeding 1 million threshold.

Tomorrow the U.S. will publish its durable goods orders report. In the evening oil traders might be interested in Baker Hughes rig count. Investors will certainly be focused on the newsflow as no other major events are planned for tomorrow.

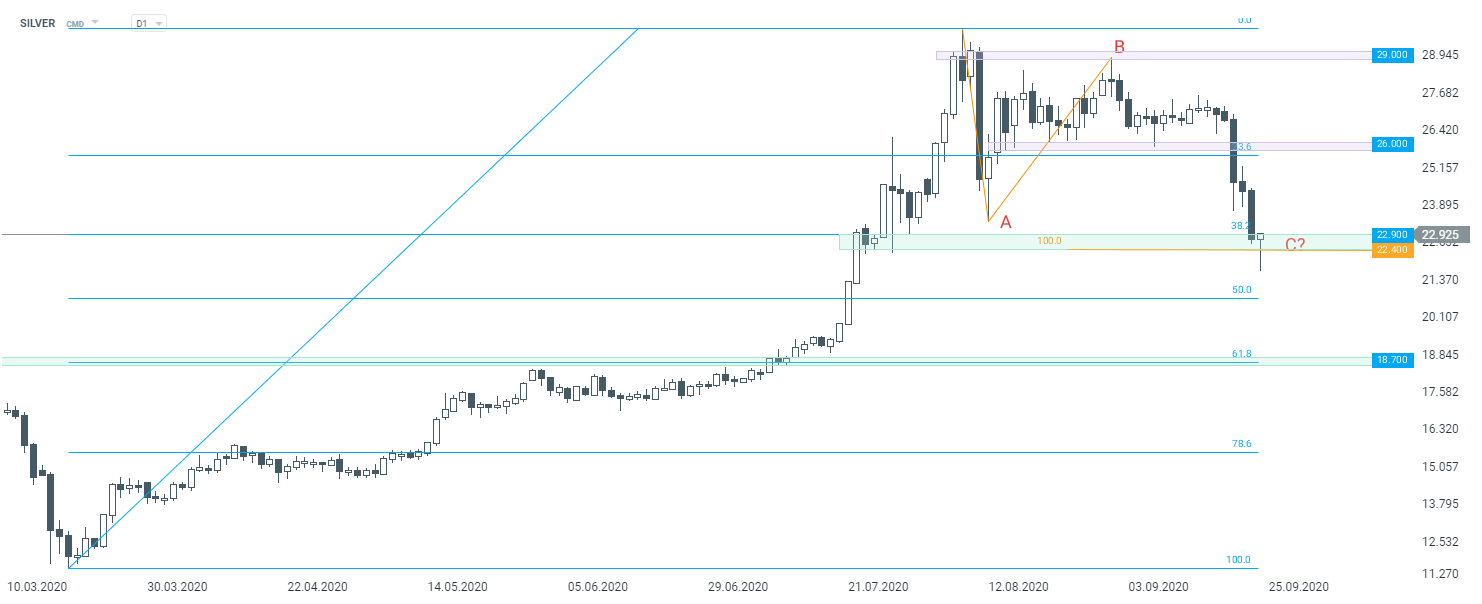

Silver started the day lower, yet one might spot a rebound in the second part of the day. There is a chance that a pin bar pattern will be formed on the daily chart (which should be perceived bullish). Source: xStation5

Silver started the day lower, yet one might spot a rebound in the second part of the day. There is a chance that a pin bar pattern will be formed on the daily chart (which should be perceived bullish). Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report