• Europe braces for second wave of infections

• S&P500 (US500) contracts near record highs

• Gold price back above $2,000

European stocks finished session lower as recent surge of new COVID-19 cases could lead to fresh lockdown measures and damage the economic recovery. German Chancellor Angela Merkel announced that further loosening of restrictions will be stopped after the country reported the highest number of daily cases since late-April. Spanish Health Ministry reported on Monday 1,833 new COVID-19 cases, more than three times the average seen in July. DAX dropped 0.3%, CAC40 fell 0.7% and FTSE 100 finished 1% lower.

US indices are trading mixed as Sino-US relations continued to weigh after the Trump administration announced it will further tighten restrictions on China’s Huawei Technologies, aiming to prevent the company's access to commercially available chips. Meanwhile, Senate Republicans are planning to propose a narrow coronavirus relief bill, including $300 in weekly federal unemployment benefits, an extension of the Paycheck Protection Program and $10 billion for the U.S. Postal Service. On the earnings front 3 major US retailers - Home Depot, Walmart and Kohl’s posted better than expected quarterly results. Also US home construction starts and building permits beat analysts' estimates. During today's session Dow Jones is trading slightly lower while Nasdaq and S&P 500 hit an all-time high (however, in the futures market, the S&P500 is still a few points behind historical levels). However, there are no specific reasons behind today's increases which may indicate the growing disconnect between the stock market and the economy, which is yet to climb back to pre-pandemic levels.

Precious metals extended gains on Tuesday with spot gold near $2,016 an ounce and silver touched $28 an ounce, buoyed by a weaker dollar and a pull-back in US treasury yields.

Oil prices fell slightly, with WTI crude near $42.5 a barrel and Brent near $45.2 a barrel. OPEC+ said it is almost fully complying with output cuts to support prices, amid a fall in fuel demand due to the COVID-19 crisis. Compliance with OPEC+ oil output cuts was seen at around 97% in July, Reuters reported citing two OPEC+ sources. Oil traders also await the API crude report later in the day.

Tomorrow all eyes will be on the upcoming OPEC - JMMC meeting where major oil producers will officially investigate compliance with the production cut agreements, however, investors expect manufacturers may not cut production further from the previous agreement. Also investors’ attention will focus on FOMC Meeting Minutes. Policy parameters were left unchanged during the meeting but minutes may show whether there was discussion about more action. During the European session CPI figures from the Eurozone will published while EIA Crude Oil Stocks Change report and CPI figures from Canada will be on watch during the US trading hours.

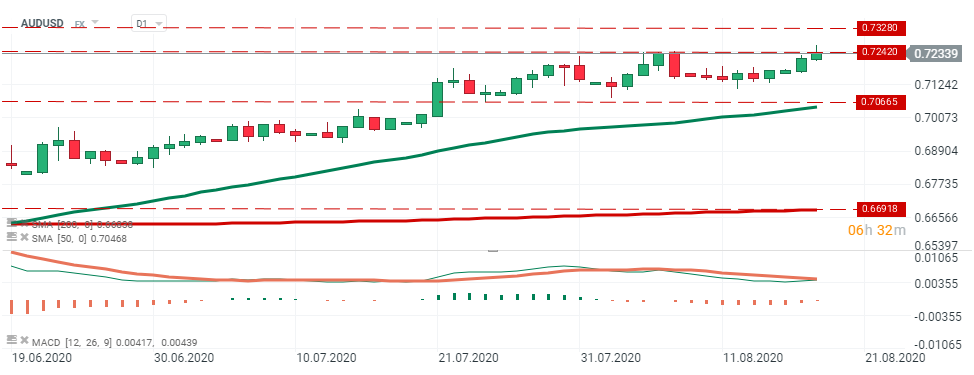

AUDUSD - pair broke above its August high at 0.72425 and hit the highest level since February 2019. However buyers failed to uphold momentum and the pair pulled back. Should downbeat moods prevail, support at 0.7066 may come into play. However, if buyers will manage to regain control then next upside target is located at 0.7328. Source: xStation5

AUDUSD - pair broke above its August high at 0.72425 and hit the highest level since February 2019. However buyers failed to uphold momentum and the pair pulled back. Should downbeat moods prevail, support at 0.7066 may come into play. However, if buyers will manage to regain control then next upside target is located at 0.7328. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report