- China’s economy grew faster than expected in Q4

- European equities close slightly higher

- Public holiday in the US

European indices finished today’s session mostly higher as the political turmoil continues across the continent. Italy's PM Giuseppe Conte faces two days of parliamentary votes that will decide if his coalition has enough support to remain in power. In Germany, Armin Laschet, who is known as Angela Merkel's loyalist, was elected as the new leader of the CDU party. Meanwhile, rising coronavirus infections and restrictions and a slow vaccination rollout remain in the spotlight. German Finance Minister Olaf Scholz warned that the current lockdown could be extended until mid-February. German government will talk about implementing additional restrictions tomorrow, including the possibility of forcing or incentivizing companies to have more people work from home, compulsory wearing of heavy duty FFP2 masks in certain areas, restrictions on public transport and the introduction of curfews. Elsewhere, better-than-expected data from China lifted market sentiment. Second largest economy expanded 2.3% in 2020, as its GDP jumped by 6.5% in the 4Q from a year ago. DAX 30 rose 0.4% ,CAC 40 gained 0.10% and FTSE 100 finished 0.22% lower.

US financial markets are closed Monday for the Martin Luther King holiday. On Wednesday markets attention will focus on events in Washington, where President-elect Joe Biden’s inauguration will take place amid risks of violence and security concerns. Also investors are trying to assess how much of his proposed $1.9 trillion stimulus plan will get through Congress given Republican opposition. Coronavirus deaths in the US are approaching 400K and the number is expected to reach 500K next month, according to the incoming CDC director.

Meanwhile some market participants wonder if we are already dealing with a bubble on the stock market. In a monthly letter to clients from last week, Mark Haefele, chief investment officer at UBS Global Wealth Management, said all of the preconditions for a bubble are in place. "Financing costs are at record lows, new participants are being drawn into markets, and the combination of high accumulated savings and low prospective returns on traditional assets create both the means and the desire to engage in speculative activity," he said, warning that in the months ahead, investors will need to pay particular attention to "risks of a monetary policy reversal, rising equity valuations, and the rate of the post-pandemic recovery."Haefele said however that while he sees pockets of speculation, the broader equity market is not in a bubble.

US crude futures are trading 0.55% lower at $52.07 per barrel, while Brent contract fell 0.6% below $ 54.80 per barrel as the imposition of fresh lockdowns in Europe and China clouded the outlook on fuel demand recovery. Elsewhere, gold futures rose 0.60% at $ 1,837.00 / oz, while silver is trading nearly 0.90% higher near $ 24.90 / oz. Bitcoin again fell below $36,000 level.

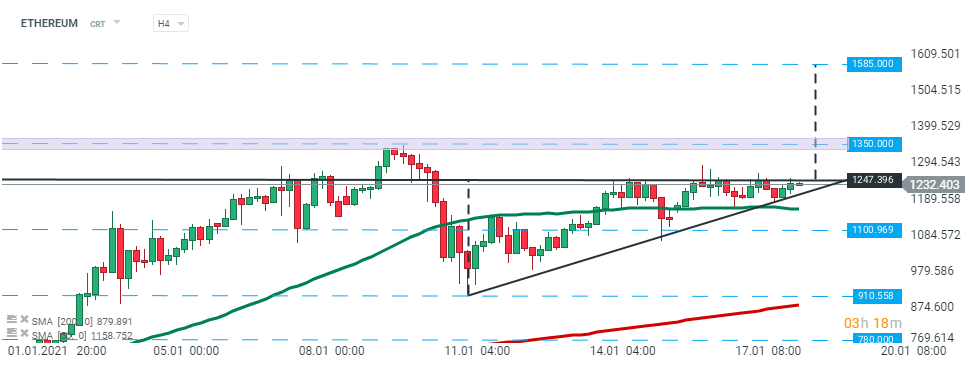

Ethereum price is testing the upper limit of the ascending triangle pattern at $1,247.00 and breakout above can push the price towards all time high at $ 1350.00. However the distance between the triangle's highest points suggests that Ethereum price may reach new ATH around $1585 level. On the other hand, if sellers manage to halt declines here and break below the lower limit of the formation, then larger correction could be on the cards. The nearest support lies at $1100. Source: xStation5

Ethereum price is testing the upper limit of the ascending triangle pattern at $1,247.00 and breakout above can push the price towards all time high at $ 1350.00. However the distance between the triangle's highest points suggests that Ethereum price may reach new ATH around $1585 level. On the other hand, if sellers manage to halt declines here and break below the lower limit of the formation, then larger correction could be on the cards. The nearest support lies at $1100. Source: xStation5

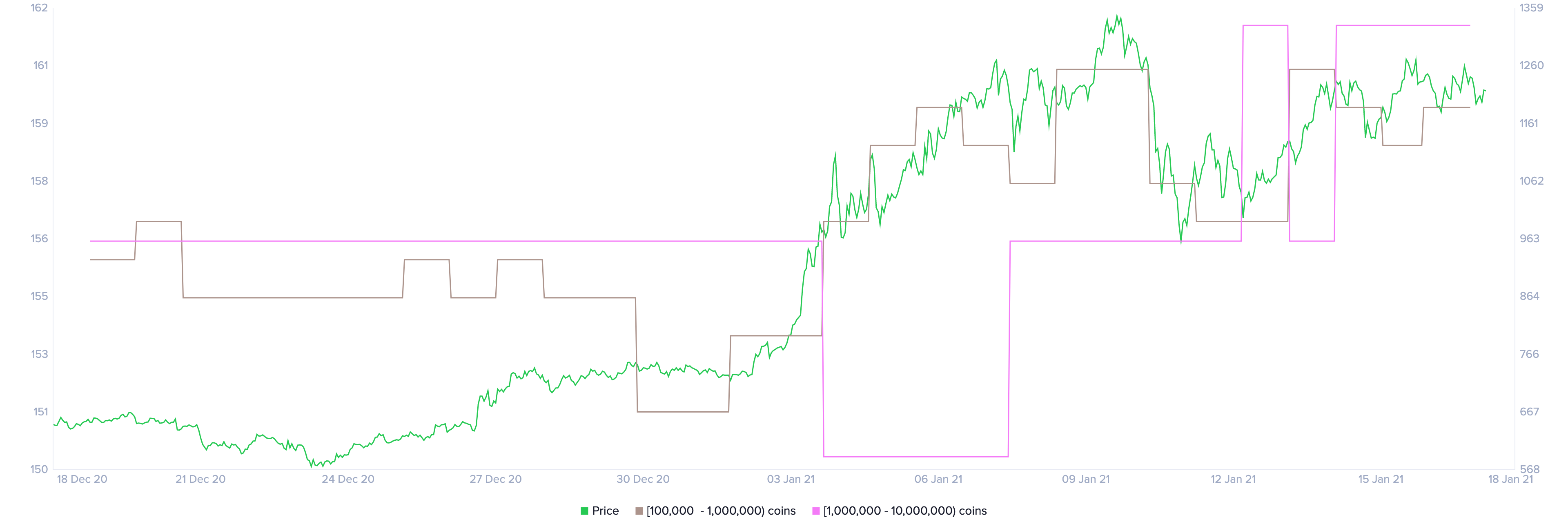

The bullish scenario is additionally supported by an increasing number of whales holding at least 1,000,000 ETH coins and large investors holding between 100,000 and 1,000,000 coins.

Number of big players which are investing in Ethereum continues to increase. Source: Santiment

Number of big players which are investing in Ethereum continues to increase. Source: Santiment

Daily summary: A day without excitement on the markets

When AI becomes a risk

Bank Holiday in USA and Wall Street is closed 🏛️

Crypto news: Will Bitcoin drop again? 🔍 Cryptocurrencies try to stabilize after the sell-off