-

Fed delivered a 75 basis point rate hike, putting Fed funds rate in the 3.75-4.00% range. Decision was in-line with market expectations

-

USD dropped while indices and gold gained in response to Fed decision as Fed noted that there is a lag between policy actions and their impact, and investors took those remarks as dovish

-

However, Powell was in no way dovish during the press conference, stressing that it is very premature to even think about slowing rate hikes and that ultimate level of rates may be higher than previously expected. USD regained strength and US indices moved to session lows during the presser

-

Gold also completed U-turn during the press conference and trades back where it did at decision announcement time

-

European stock markets traded lower today with German DAX and UK FTSE 100 dropping 0.6%. Italian FTSE MIB managed to finish flat while Polish WIG20 jumped over 2%

-

Wheat price plunged after Russia said that it will return to Black Sea exports agreement

-

Oil prices rose to a 3-week high on media reports saying that Iran may soon attack Saudi Arabia. Iran, however, dismissed reports and said that no such action is planned

-

ADP report showed a 239k increase in US employment in October (exp. 195k). Increase was entirely driven by leisure and hospitality as well as transportation sectors

-

German trade data for September missed expectations with exports and imports unexpectedly dropping. However, a drop in imports outpaced drop in exports leading to a higher-than-expected trade balance for the month

-

DOE report pointed to a smaller draw in US oil inventories than was signaled by API data yesterday. Reports also showed a spike in US imports of Saudi crude

-

NZD and JPY are the best performing major currencies while GBP and CAD are top laggards

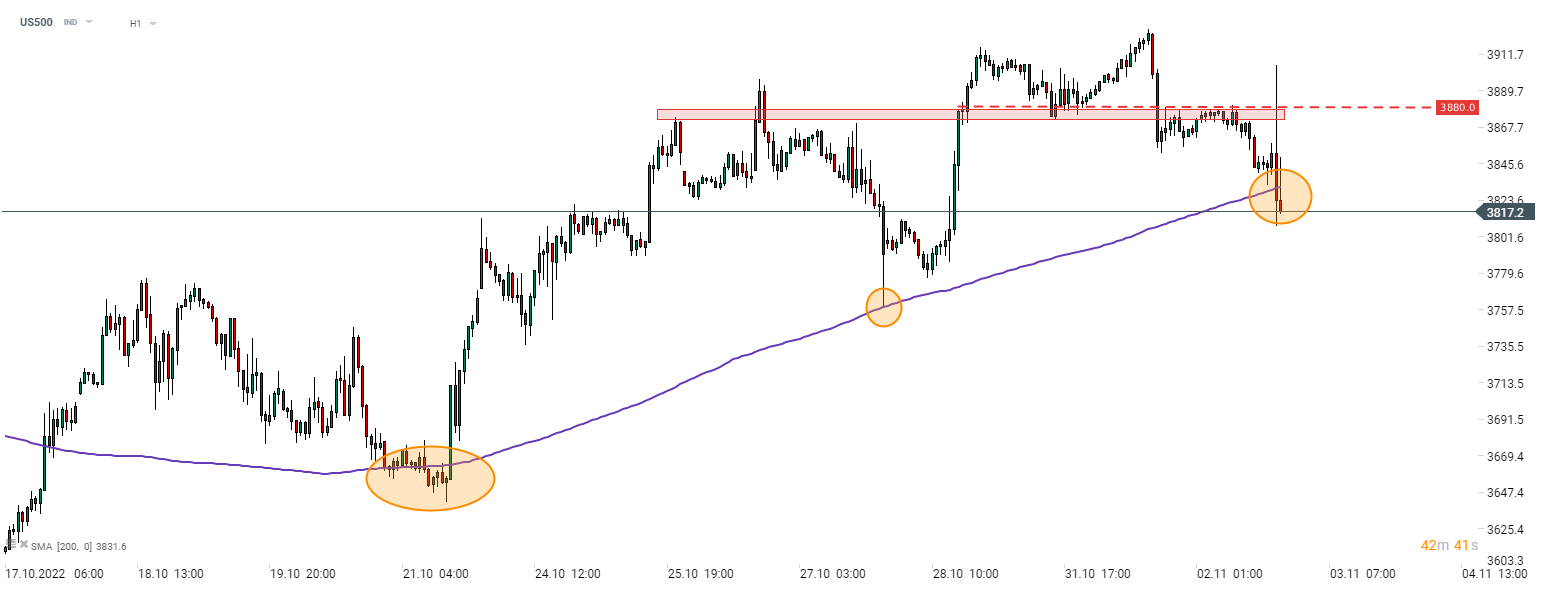

US500 erased post-decision gain during Powell's press conference and is now making a break below 200-hour moving average. Source: xStation5

US500 erased post-decision gain during Powell's press conference and is now making a break below 200-hour moving average. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected