- European indices extended yesterday gains

- Fed officials believe tapering "may soon be warranted"

- US crude oil inventories fall for 7th week

European indices finished today’s session higher, extending yesterday gains as Evergrande concerns eased after the company Hengda which one of the subsidiaries said it would make a coupon payment on Evergrande domestic bonds tomorrow. Also, preliminary data showed consumer sentiment in the Euro Area jumped to a 2-month high in September.

US indexes rose sharply after the Federal Reserve left interest rates near zero as expected and bond-buying at the current $120 billion monthly pace during the September 2021 meeting. Central bank said that if economic recovery progress continues as expected, a taper may soon be warranted. The Fed also signaled interest rates may need to rise faster than initially expected, with 9 of 18 policymakers projecting borrowing costs to rise in 2022.

On the commodities markets, WTI crude rose more than 2.40% and is trading above $72.20 a barrel, while Brent is trading nearly 2.50% higher above $74.20 a barrel. EIA data showed crude oil inventory stocks fell almost by 3.5 million barrels in the week ending September 17th, more than market expectations of a 2.4 million draw. Earlier API figures showed US oil inventories fell by 6.108 million barrels last week, the biggest draw since the week ended on July 2nd, 2021, and marking the eighth straight fall. Elsewhere gold rose 0.10% to $ 1,775.00 / oz, while silver is trading 1.6 % higher, above $ 22.80 / oz amid a weaker dollar. Cryptocurrencies moved higher following the FED decision. Bitcoin trades below $43,500 while Ethereum trades above $3,000 mark.

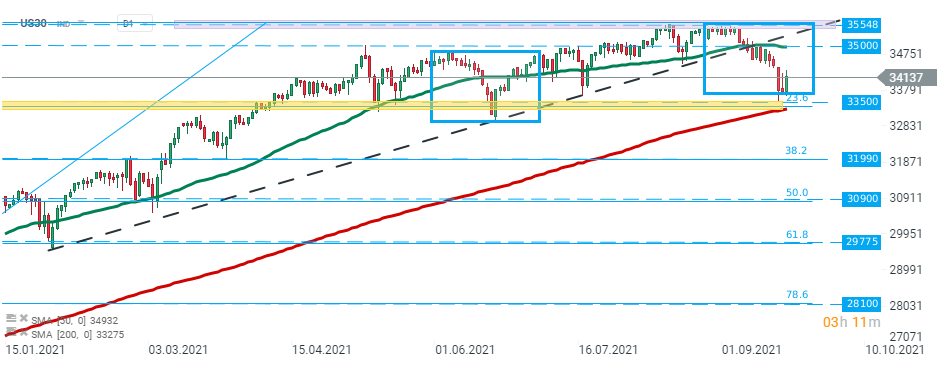

US30 bounced off the lower limit of the 1:1 structure and rose sharply following the FED decision. If current sentiment prevails, then upward move may accelerate towards resistance at 3500 pts. Source: xStation5

US30 bounced off the lower limit of the 1:1 structure and rose sharply following the FED decision. If current sentiment prevails, then upward move may accelerate towards resistance at 3500 pts. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?