- Wall Street rebounds on Friday

- European stocks mostly lower on inflation worries

- Cryptocurrencies rose sharpy

- The dollar weakens at the end of the week

European indices finished today's session mostly lower as inflation fears resurfaced again. Preliminary data showed the Eurozone consumer price inflation jumped to a 13-year high of 3.4% in September. This is in contrast to what ECB President Lagarde said recently that there are no signs that recent price increases are becoming broad-based across the economy. Meanwhile, retail sales in Germany increased less than expected in August and manufacturing PMI data came in line with market expectations for both the Euro Area and Germany. For the week, the DAX fell over 3%, the most since the end of January.

US indices are trading higher during today’s volatile session as potentially game-changing news on the pandemic front lifted market sentiment. Merck (MRK.US) announced that its experimental Covid-19 drug reduces the risk of death and hospitalization by 50% in a study. On the data front, personal spending beat market expectations and PCE prices continued to point to high inflationary pressure. The ISM Manufacturing PMI pointed to another month of strong growth in factory activity in September.

Today's session ends negatively for the dollar. NZD gained 0.7%, GBP added 0.67% and AUD jumped 0.63% against the US currency. Other major currencies also strengthened in relation to the greenback.

We could observe strong movements in the cryptocurrency market today. In the evening hours, Bitcoin and Ethereum strengthen around 9%. Prices have left the consolidation zone, which may result in a resumption of an uptrend. Altcoins were also doing phenomenal on Friday. Among the new cryptocurrencies available in XTB's offer, Chainlink and Polkadot recorded the strongest 11% increases.

Precious metals are also having a good day, thanks to the weakening of the USD. Silver gained over 1.75% today, while platinum went up 1.15% and palladium added 0.8%. On the other hand, the situation on the gold, which strengthened only 0.15%, may be puzzling, however this may be related to the technical situation.

Next week, investors will focus on data from the US labor market.Also the decisions of Australian and New Zealand central banks will be in the spotlight. Crude oil traders will focus on OPEC meeting and decisions regarding oil production levels.

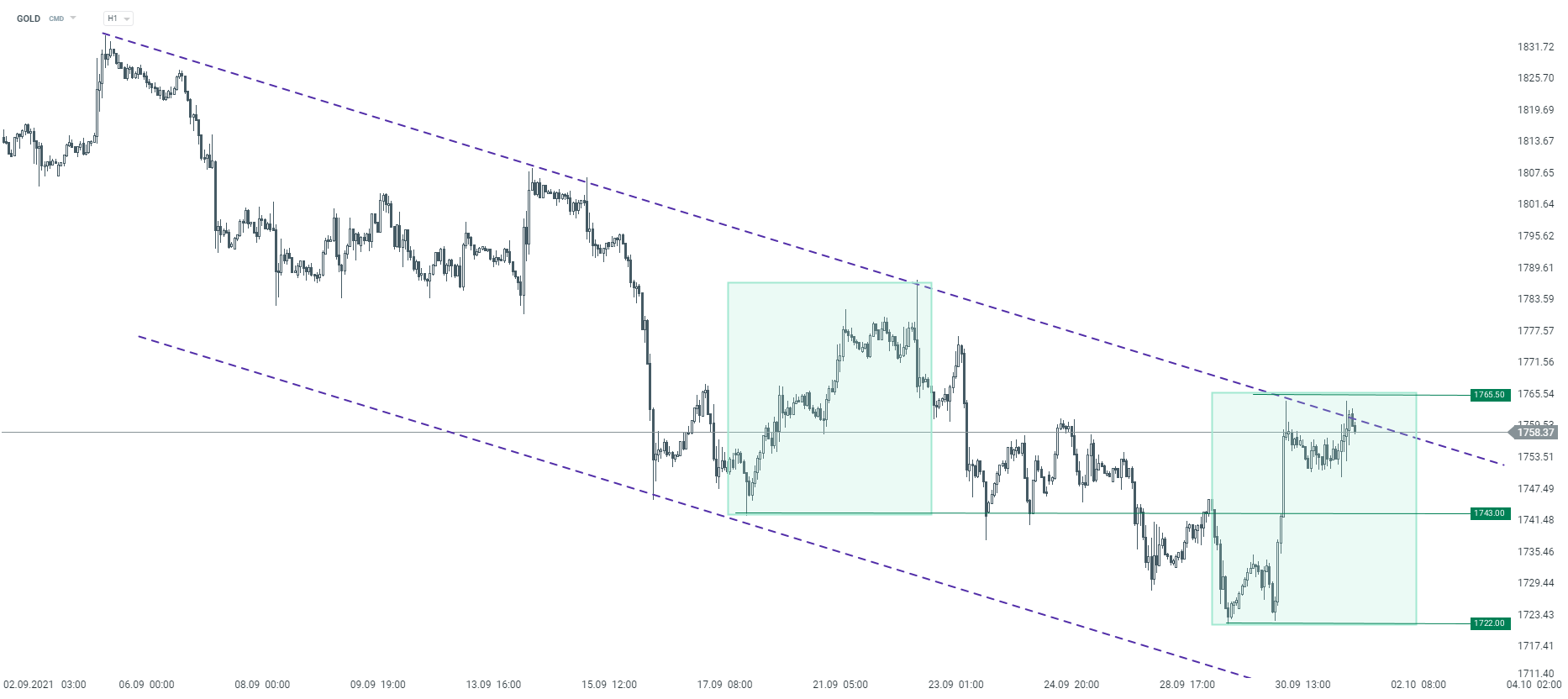

Gold prices made a dynamic upward correction yesterday, but today precious metals swing between gains and losses. Nevertheless, the situation on the H1 interval looks quite interesting. Price tests the upper limit of the downward channel, which is additionally strengthened by the upper limit of the 1:1 structure. According to the Overbalance methodology, as long as the price remains below the $ 1,765.5 level, continuation of the downward move looks probable. If current sentiment prevails, the next targets for sellers are located around $1743 and $ 1722 levels.

GOLD interval H1. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report