-

European stock markets mostly higher

-

US indices trading flat amid subdued volatility

-

A wild rally in AMC Entertainment shares

-

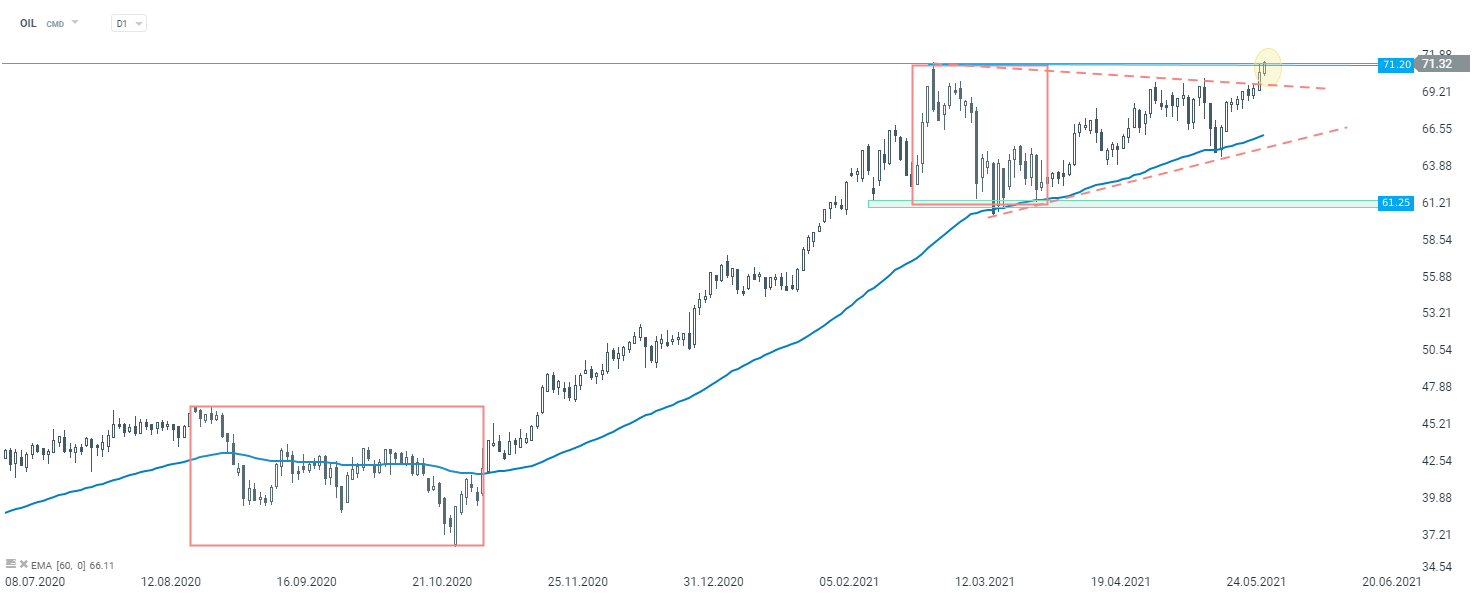

Oil continues to move higher after OPEC+ meeting

European stock indices finished Wednesday’s session mostly higher on a relatively calm trading day. Today’s calendar was rather empty, with few notable economic prints. Australia’s Q1 GDP figures surprised to the upside (1.8% QoQ vs exp. 1.5%), but the retail sales report from Germany for April disappointed (-5.5% MoM vs exp. -2.0% MoM). As a result, the volatility remains at relatively low levels and major US indices are trading flat today.

On the other hand, the “meme stock” mania is getting even more attention today due to a wild rally in AMC shares. The share price of the movie theater operator were surging more than 90%, which is why a stock exchange operator paused trading in AMC shares for a while.

Oil prices continue to move higher after OPEC+ meeting. Both Brent and WTI are up by more than 1.50%. WTI prices touched $69 a barrel, thus hitting a fresh post-pandemic high. Brent climbed to new pandemic-era highs as well. The FX market remains relatively calm in the evening European time, the main currency pair is trading flat near 1.2210.

Tomorrow’s trading day is set to be more vibrant. Australia will release its retail sales report for April (02:30 am BST) - another potentially market-moving event for the Australian dollar. Apart from that, European investors will be focused on multiple Services PMI reports from the region for the month of May. Later, markets will pay attention to a set of economic data from the US, including ADP report, jobless claims or ISM Services for May.

Brent prices (OIL) climbed to fresh post-pandemic highs following yesterday’s OPEC+ meeting. The price broke above the upper limit of the wedge pattern, which might be spotted on the daily interval. Source: xStation5

Brent prices (OIL) climbed to fresh post-pandemic highs following yesterday’s OPEC+ meeting. The price broke above the upper limit of the wedge pattern, which might be spotted on the daily interval. Source: xStation5

Morning wrap (22.01.2026)

Daily Summary: Trump signals restraint over Greenland, easing market jitters

⏫US500 climbs over 1%

US OPEN: Trump pivot lifts Wall Street sentiment