Investors have reacted with palpable relief to a pivot in rhetoric from Donald Trump, who signalled a move away from military posturing regarding the acquisition of Greenland. Speaking at the World Economic Forum in Davos, the President adopted a uncharacteristically measured tone, notably omitting any mention of retaliatory tariffs against nations that recently deployed armed forces to the territory.

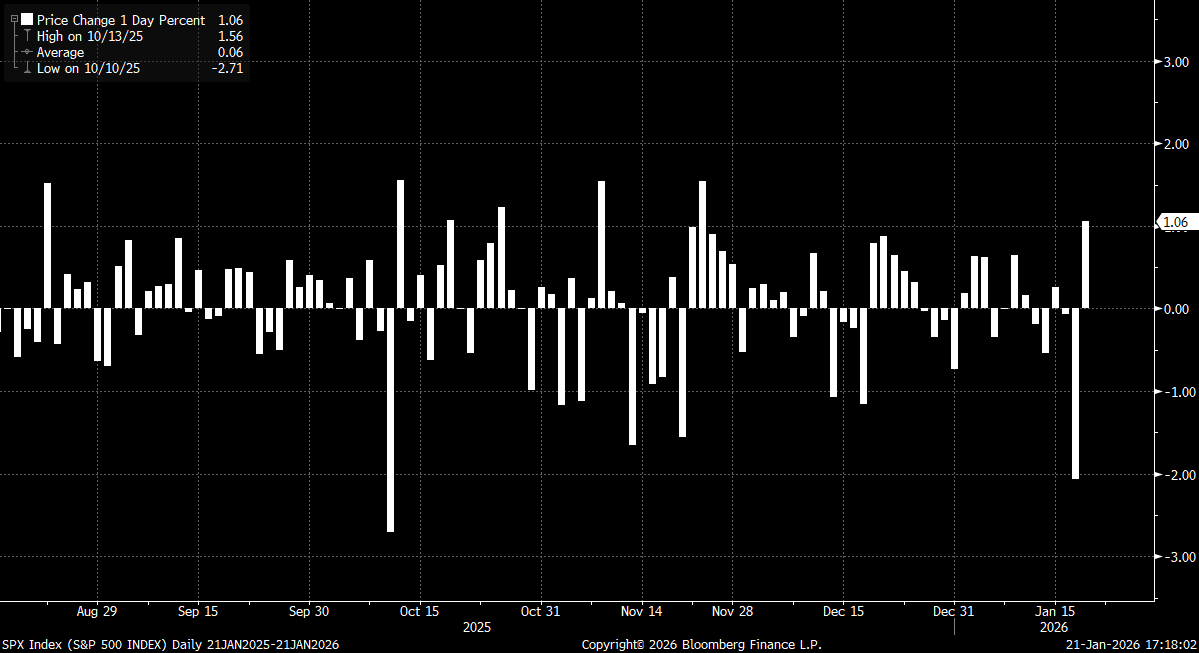

The US500 contract, tracking the S&P 500, gained approximately 1% in early trading. While the move initially mirrored the rally seen on December 19, the momentum quickly accelerated, marking the index's strongest daily performance since November. Market observers have noted that the current price action bears a striking resemblance to the October "V-shaped" recovery; following a sharp 2% pullback, the index established a local bottom before embarking on a sustained march toward fresh record highs.

S&P 500 daily changes. Source: Bloomberg Finance LP

Wall Street commentators suggest that the decision to de-escalate the Greenland standoff—coupled with the President’s silence on proposed credit card interest rate caps—points toward a "quiet retreat" from some of his more contentious policy proposals.

On a technical basis, the US500 is currently testing the 6,900 handle. A decisive break above the 23.6% Fibonacci retracement of the most recent major impulsive wave would bolster the case for a resumption of the primary bullish trend, keeping the current decline within the bounds of a standard correction.

However, the spectre of protectionism remains. The tariff saga is far from resolved, particularly as markets await a definitive ruling from the Supreme Court on the President’s use of executive powers to bypass Congress on trade levies. While the Court issued three unrelated rulings on Tuesday, its continued silence on the tariff mandate maintains a floor of underlying uncertainty for global investors.

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

🚨 EURUSD deepens decline, falls to key support zone