-

NFP report for August well below expectations

-

USD tumbles after jobs data, precious metals gain

-

European equity markets pull back

Friday was all about key labour market report from the United States for August. The long-awaited data disappointed as the headline non-farm payrolls came in at just 235k, well below the consensus estimate of 750k. The report also showed that wage growth accelerated. As a result, the US dollar plunged against major currencies - it is said that weak jobs data may be an excuse for the Fed not to taper so soon as previously expected. EURUSD tested the 1.19 mark (+0,20%) while USDJPY fell to 109.65 (-0.25%).

Precious metals gained on the weaker USD. The move on the gold market was significant indeed as the price jumped from $1,813 to $1,830 an ounce. Silver prices advanced as well. Meanwhile, European equity markets pulled back on Friday. The German DAX (DE30) plunged by almost 200 points, but managed to erase some losses. The cash index finished the day 0.37% lower. US indices declined after jobs data as well. Nasdaq100 (US100) has already recovered losses and is trading higher on the day while other major indices are lagging behind.

ISM services PMI data from the United States were interesting as well. The headline figure fell to 61.7 from 64.1 a month ago (but still, slightly above forecasts). "There was a pullback in the rate of expansion in the month of August; however, growth remains strong for the services sector. The tight labor market, materials shortages, inflation and logistics issues continue to cause capacity constraints", said Anthony Nieves, Chair of the ISM.

Traders from the United States and Canada will have a day off on Monday due to Labor Day. With no major events in economic calendar, Monday’s session is likely to be a muted trading day.

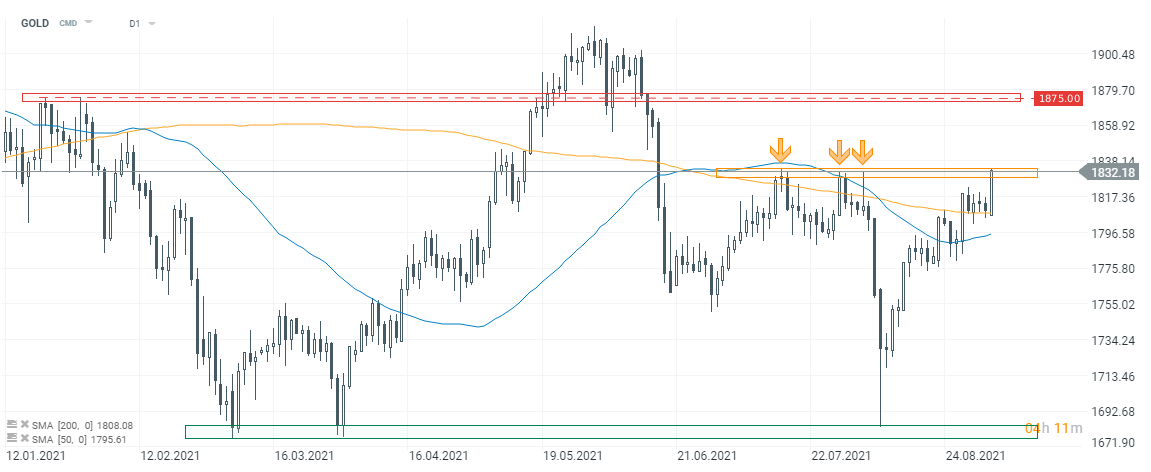

The situation on the gold market is getting interesting these days. The recovery move started in August continues and gold bulls are currently testing the $1,830 an ounce mark - a major resistance for now. Note that buyers were unable to smash through this level three times in July and August 2021. Should they succeed this time, the attention may shift towards next major resistance near $1,875. Gold prices could be impacted by central bankers’ speeches next week - 6 Fed members will deliver speeches on Wednesday alone! Traders will surely tune in. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉