- Mixed moods in Europe

- S&P and Dow reached new ATH after Powell nomination

- Cryptocurrencies swing between gains and losses

- Precious metals under selling pressure

Although Mondays are usually quiet, today we could observe quite significant moves. The cryptocurrency market attracted the greatest attention, after the Phunware company confirmed the purchase of a large amount of Bitcoin, which in turn led to a dynamic strengthening of the prices of the main digital assets. However, in the evening hours, one can see that almost all of the early gains have been erased. It is therefore possible that the correction in the crypto market may even deepen.

As for the traditional market, the major European stock indices had a problem with defining a clear direction after last week's sell-off. Resurgence of COVID-19 and possible lockdown in other countries took the center stage and weighed on market sentiment. European indices finished today's session in mixed moods, with Germany's DAX fell 0.3% and London's FTSE 100 gained over 0.4%.

US stocks waver on Monday, the S&P rose around 0.3% to a fresh record high and the Dow Jones added as much as 250 points, boosted by gains in banks shares after President Biden nominated Federal Reserve Chair Jerome Powell for a second four-year term, fueled bets in a sooner rate hike in the US during 2022. Lael Brainard, who was the other top candidate, will be vice-chair. Meanwhile, the Nasdaq erased early gains to trade below the redline.

Powell's nomination also affected the Forex market. The US dollar appreciated immediately after the news hit the market, and upward move continued later in the session. The American currency gained 0.7% against JPY, while CAD and NZD lost around 0.5%. Elsewhere EUR, CHF and GBP dropped over 0.3% against the USD.

When it comes to the commodity market, gold is doing very poorly today, mainly due to the stronger dollar. Other precious metals are also under pressure, while crude oil rose by about 1%.

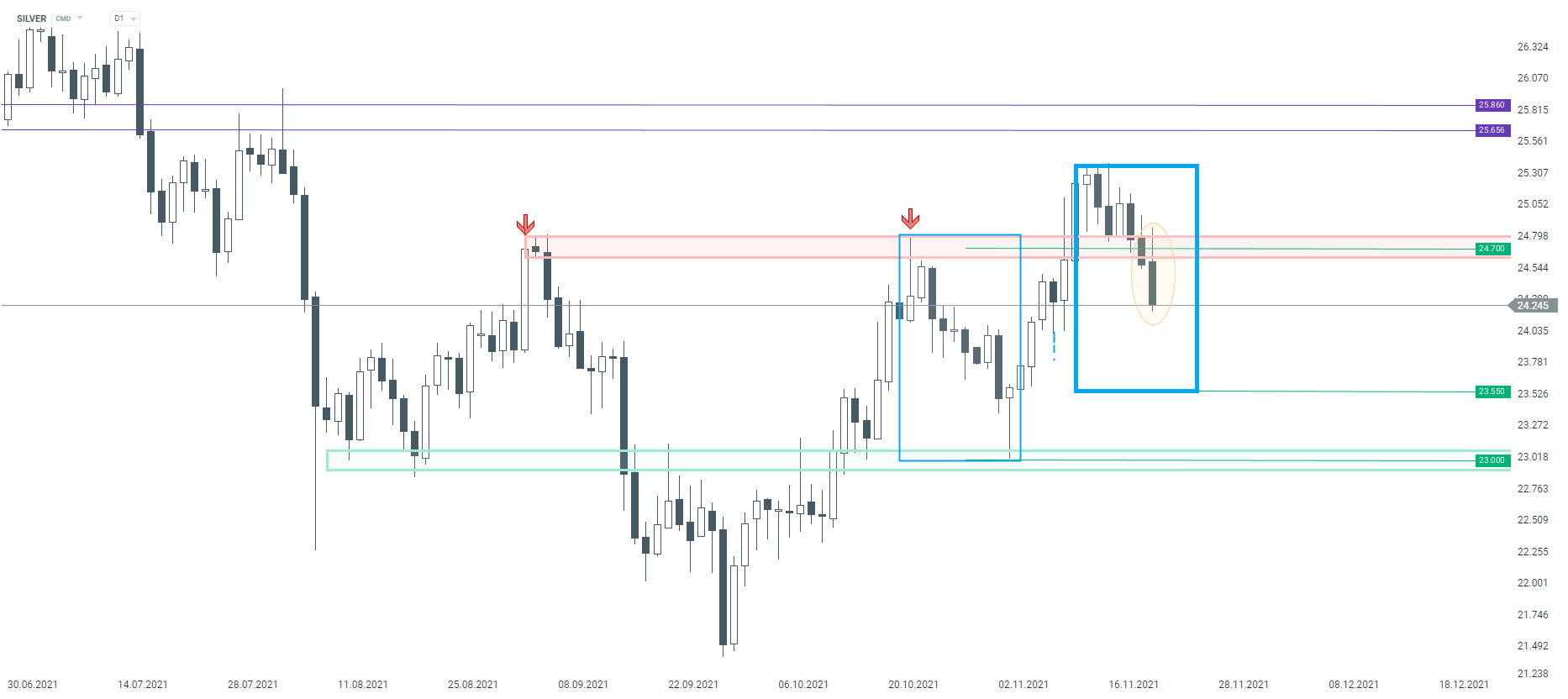

The technical situation on the silver market does not look very favourable for buyers. Last week one could observe a wide formation of inverted head and shoulders on the D1 interval, however today the price has receded below the key neckline at $ 24.70, thus there is a risk that decline could deepen. In this case, investors should focus on support at $ 23.55, which is marked by the lower limit of the 1:1 structure.

Silver interval D1. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected