- Indexes on Wall Street are currently posting intraday declines. The Nasdaq is losing 0.43%, while the S&P500 is down 0.19%. Intel shares are currently losing nearly 12.5% on weak earnings forecasts for Q1 2024.

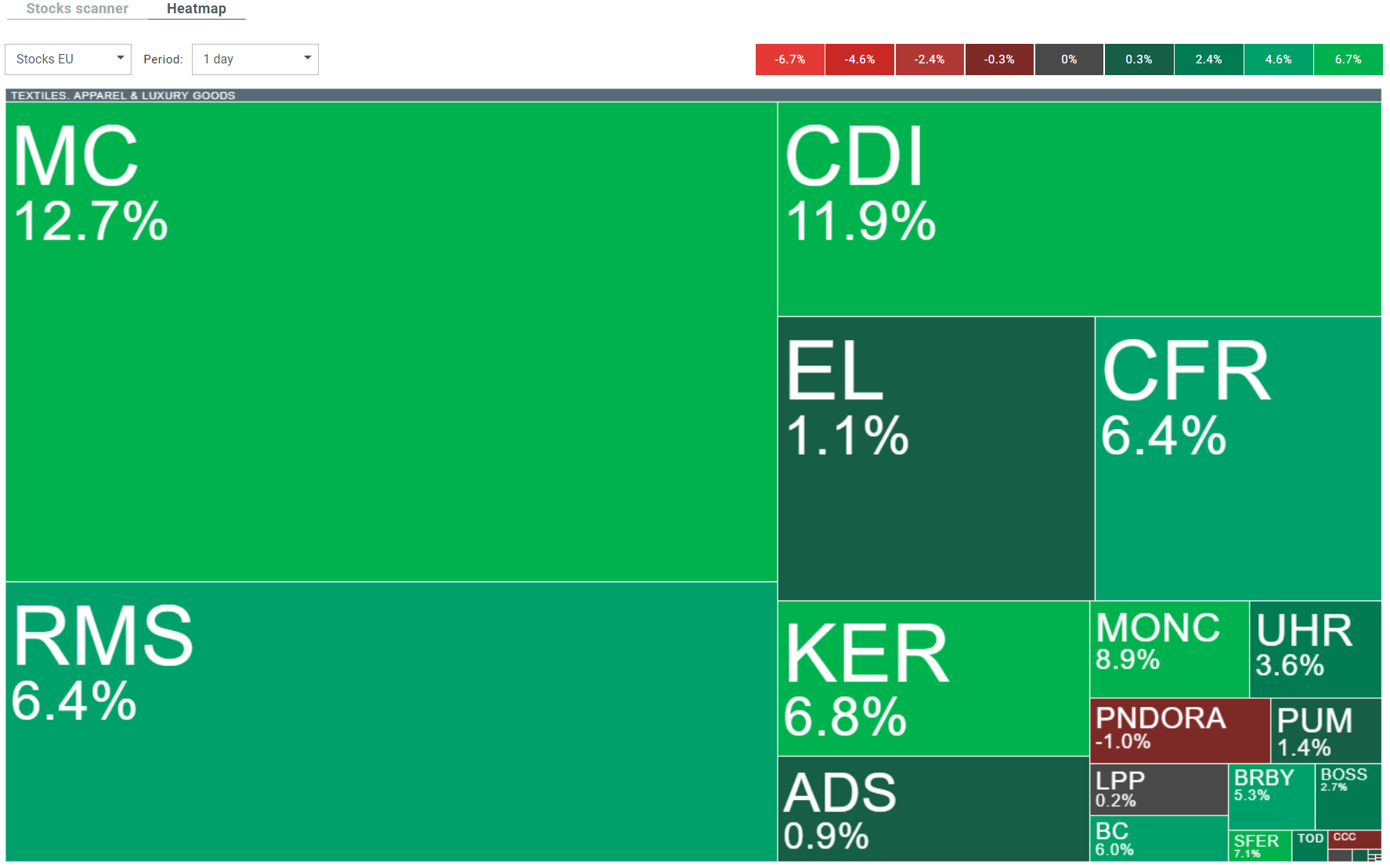

- In Europe, investors' attention was focused on the luxury goods sector, which saw powerful gains following the release of LVMH's better-than-expected quarterly results. Shares of the world's largest fashion company ended today's session nearly 13% higher. Also, another luxury companies stocks like Kering, Richemont and Hermes surged today

- The Fed's preferred measure of core PCE inflation, for December 2023, came in at 2.9% versus 3% forecast and 3.1% previously. The headline reading came in at 2.6%, in line with forecasts and coinciding with the previous reading. The monthly dynamics turned out to be in line with forecasts

- Americans' personal income in December rose 0.3% m/m and turned out to be in line with forecasts (previous reading of 0.4%). Spending rose 0.7% vs. 0.5% estimates and 0.4% previously. In real terms, they also turned out to be 0.2% higher than forecasts

- White House economic advisors Boushey and Brainard spoke optimistically about the U.S. economy, highlighting the limited risk of external shocks and solid readings suggesting higher productivity, despite lower inflation

- The reading of pending home sales data for January brought a big upward surprise. The number of pending home sales in the U.S. rose significantly, by 8.3% y/y vs. 2% forecast and 0% growth previously

- EURUSD is trading up a modest 0.15%, but the largest currency pair erased some of the initial gains. S&P analysts stressed that the risk of a recession in the US has declined, but remains elevated

- In the FX market, the Swiss franc is currently doing best. The largest declines are currently seen in the Japanese yen and the New Zealand dollar.

- Wheat contracts traded on the CBOT are trading down nearly 2% after traders reacted to higher inventory readings, and covering short positions failed to produce the expected wave of price rebound. As a result, wheat once again settled below $6 per bushel, with pressure intensified by higher ship activity at Ukrainian ports and declines in Russian grain prices

- The mood of the cryptocurrency market is positive, with Bitcoin gaining nearly 5% and trading near $42,000, after data indicated that selling pressure from Grayscale is beginning to ease.

- The SEC dismissed the iShares Ethereum Trust application from BlackRock in the current term, but the second largest cryptocurrency did not react to the news with a drop, as the decision did not disappoint analysts and investors. Ethereum is currently gaining 2%.

WHEAT (M15)

Source: xStation5

Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026