- European indices finished today’s session higher, with DAX0 up 1.14% led by autos and healthcare stocks. Deutsche Bank stock rose over 6% amid mood improvement in the banking sector.

-

Latest solvency figures of other major banks turned out to be better compared to Credit Suisse, to be acquired by UBS

-

Germany's IFO survey rose to 93.3 in March, the highest level in a year.

-

Some of the fears of a broader threat to the global financial system eased somehow after US lender First Citizens BancShares said it would purchase the loans and deposits of Silicon Valley Bank.

-

In addition, the US authorities are considering increasing deposit guarantees for regional banks so that they have time to improve their balance sheets

-

On the other hand, sentiment on Wall Street is mixed. The S&P 500 is up about 0.8%, S%P500 rose 0.45% while the Nasdaq 100 is down almost 0.20%.

-

With less chance of banking collapse and a repeat of 2007-2009 scenario, crude oil rebounds 4% today end reached level not seen since March 15

-

On the other hand, NATGAS tumbles nearly 5% due to low consumption and high temperatures in the US

-

US 10 Year Treasury yield jumped above 3.50%,however EURUSD is testing resistance at 1.0800

-

The cryptocurrency market pulled back quite sharply on news that Binance and its CEO were sued by the CFTC over trading and derivatives violations.

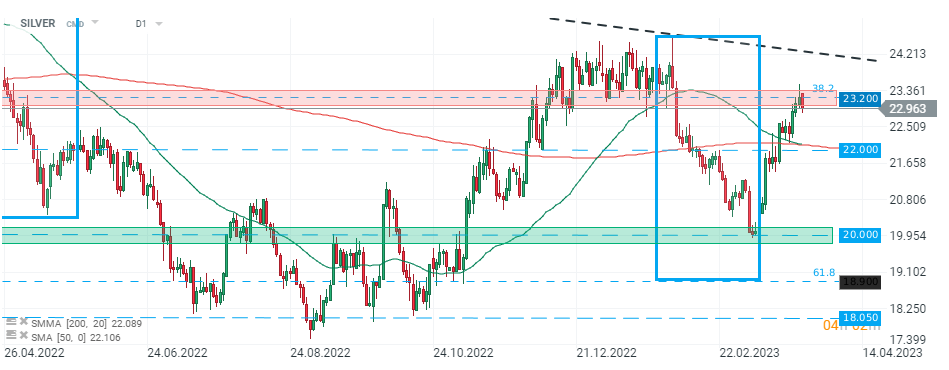

SILVER failed to stay above crucial resistance at $23.20. As long as price sits below the aforementioned level, downward impulse towards crucial support at $22.00 may be launched. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?