- Markets reaction to Iranian retaliatory strikes against Israel over the weekend has been rather calm at first, with gold and oil opening slightly higher, and European and US index futures seeing no major moves

- Iran launched a massive drone and missile attack on Israel over the weekend in response to the Israeli attack on the Iranian consulate in Damascus two weeks ago

- Iran said that it concludes its response, but warned that it will respond if Israel retaliates for the attack

- European traded higher today - German DAX and French CAC40 added 0.4%, Dutch AEX gained 0.1%, Italian FTSE MIB moved 0.6% higher and UK FTSE 100 dropped 0.4%

- US stock markets opened higher but began to slide in the afternoon when media reports began to hint that Israel will respond to Iranian strike, rising concerns over all-out Israel-Iran war

- Israeli military chief of staff confirmed that there will be a response to Iran's attack but did not specify how and when

- Wall Street indices erased all the gains and are now trading lower on the day. S&P 500 trades 1% lower, Dow Jones drops 0.5%, Nasdaq slumps 1.5% and small-cap Russel 2000 declines 1.4%

- Energy commodities traded lower - oil drops 0.6-0.7%, while US natural gas prices plunged over 5%

- Gold and silver trades higher, benefiting from safe haven flows. Gold gains 1% while silver jumps 2.4%. Platinum and palladium drop over 1%

- Aluminium jumped 4% to the highest level since early-2023 after US and UK impose sanctions that banned trading in Russian aluminium, copper and nickel. Copper gained over 1% while nickel traded over 2% higher

- GBP and USD are the best performing major currencies, while JPY and NZD lag the most

- Cryptocurrencies trade higher, with Bitcoin adding 0.2%, Ethereum trading 1.4% higher and Dogecoin jumping 0.8%

- Fed Williams said he does not see recent inflation data as a turning point and that he sees monetary policy to be in a good place

- US retail sales increased 0.7% MoM in March (exp. 0.3% MoM). Sales excluding autos increased 1.1% (exp. 0.4% MoM), while sales excluding autos and fuel increased 1.0% (exp. 0.3% MoM)

- Atlanta Fed GDPNow indicator suggests a 2.8% annualized growth in Q1 2024, up from 2.4%, after retail sales data.

- US business inventories increased 0.4% MoM in February, in-line with market expectations

- New York Fed manufacturing index improved from -20.9 to -14.3 in April (exp. -7.5)

- Japanese machinery orders surged 7.7% MoM in February (exp. 0.8% MoM)

- European industrial production declined 6.4% YoY in February (exp. -5.7% YoY)

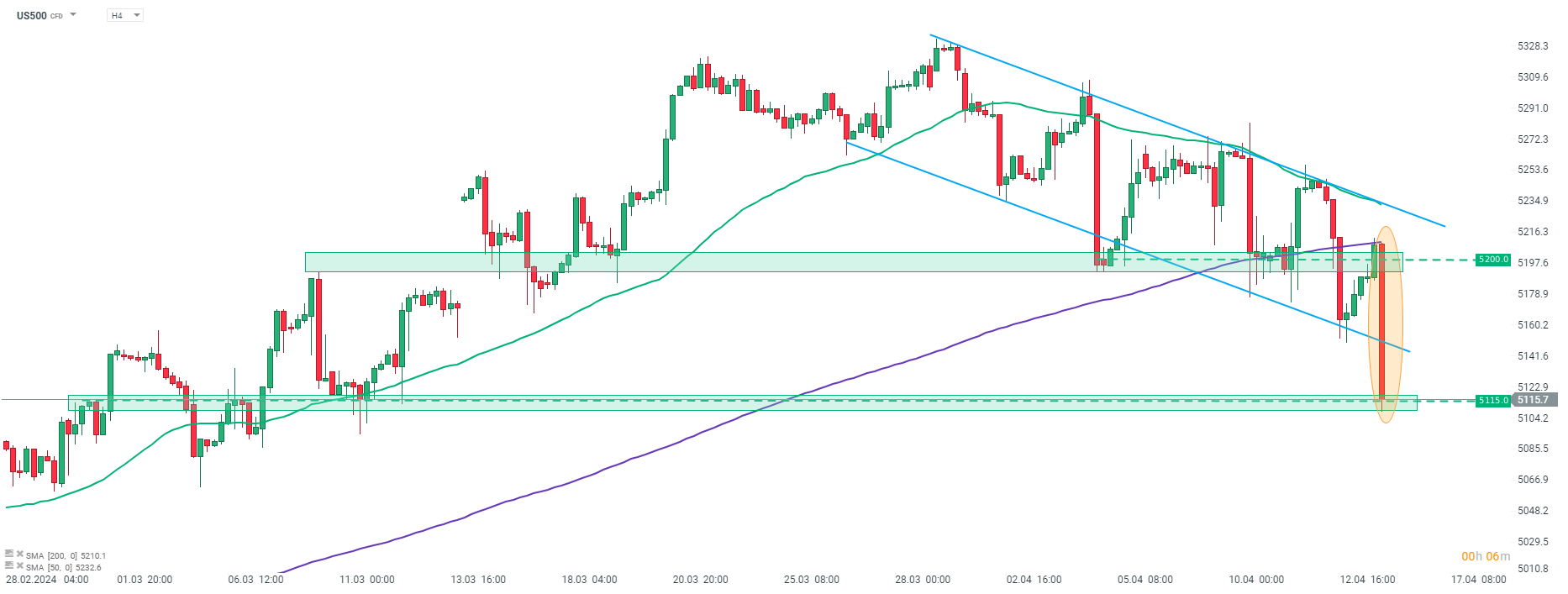

S&P 500 futures (US500) plunged on Middle East tensions and broke below the lower limit of the short-term downward channel. US500 trades at the lowest level in a month. Source: xStation5

S&P 500 futures (US500) plunged on Middle East tensions and broke below the lower limit of the short-term downward channel. US500 trades at the lowest level in a month. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report