-

European stocks mixed

-

U.K. set to continue negotiations with the EU

-

PPI from the U.S. in line with expectations

European shares ended the day mixed. The German DAX added 0.07%, CAC 40 lost 0.12% while FTSE 100 closed 0.58% lower. As coronavirus cases are constantly on the rise in Europe, the U.K. (among many other countries) is under pressure to impose more restrictions or even a short lockdown in order to contain the virus. American stocks sink in the afternoon after Mnuchin stimulus remarks. The Treasury Secretary mentioned that the two sides were still far apart on certain issues. Nasdaq Composite is trading almost 1% lower at press time.

Precious metals try to erase yesterday’s losses today, gold prices managed to return above the $1,900 mark. One could have spotted some significant GBP volatility today as U.K. announced that it will continue talks with the EU on Brexit. GBPUSD climbed back above 1.30 in the afternoon.

Japanese industrial production rose 1% MoM in August vs expected 1.7% while figures from the euro zone suggested an increase of 0.7% (vs exp. 0.8%). PPI from the U.S. rose 0.4% MoM in September (in line with expectations). As far as year-over-year basis in concerned, PPI added 0.4%

Tomorrow investors might want to pay attention to labour market data from Australia as well as jobless claims from the U.S. Apart from that, EIA will release its crude oil inventories report. Markets will obviously monitor earnings reports from the U.S. as well.

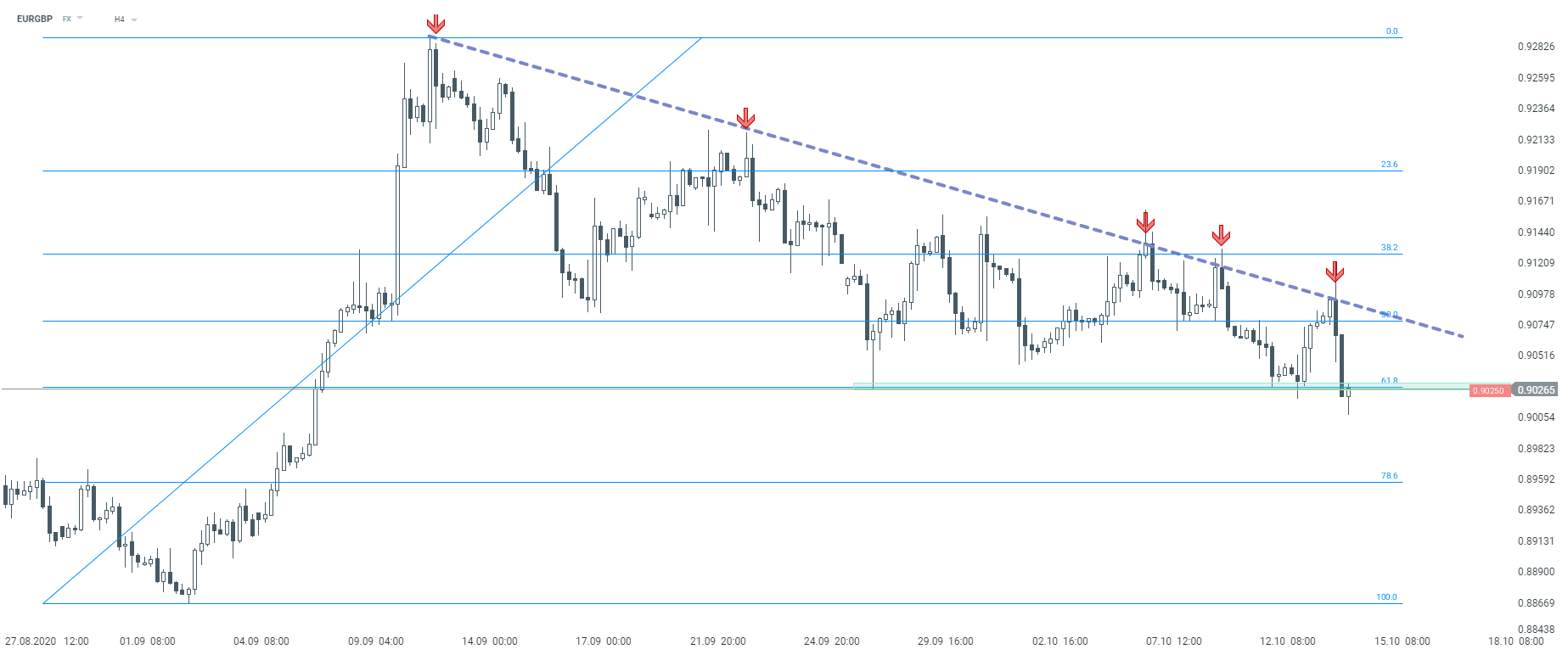

EURGBP tends to be in a downward movement these days. Looking at H4 time frame, one might spot that the currency pair dived again. Should market participants broke below the support level near the 61.8% Fibo retracement, the downward movement might actually accelerate. Source: xStation5

EURGBP tends to be in a downward movement these days. Looking at H4 time frame, one might spot that the currency pair dived again. Should market participants broke below the support level near the 61.8% Fibo retracement, the downward movement might actually accelerate. Source: xStation5

US Open: Nasdaq continue to climb📈Intel and Eli Lilly stocks surge

Chart of the day: CHN.cash (07.01.2026) China's rally hits the wall 📉 🇨🇳

Morning wrap (07.01.2026)

BREAKING: EURUSD muted; US services growth cools in December as demand softens 📌