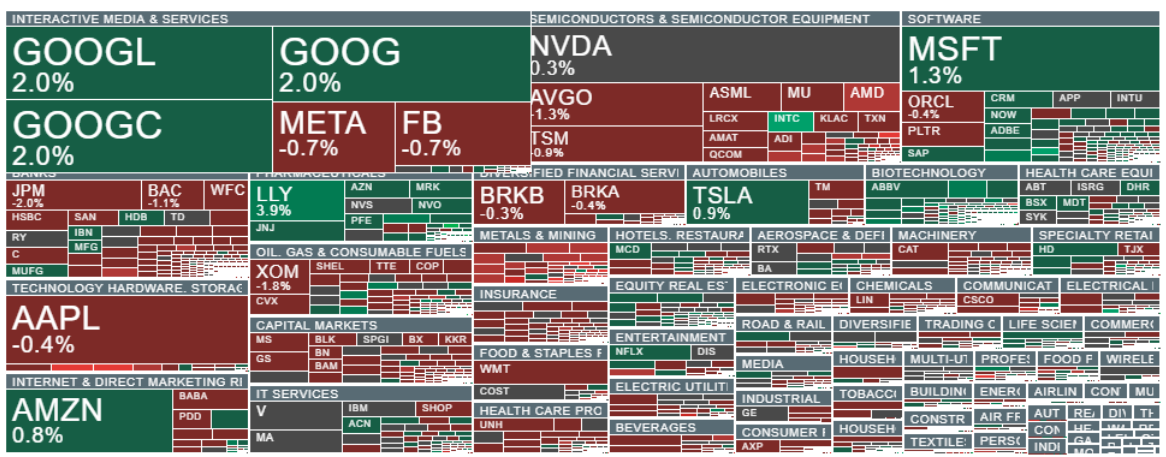

The U.S. stock market is recording gains today, with Eli Lilly (LLY.US) and Intel (INTC.US) standing out the most. Recently, Nvidia raised its revenue forecast, which has clearly eased concerns about a “tech bubble” and the high valuations of the U.S. equity market. However, the S&P 500 is almost flat and DJIA is falling almost 0.4%

Other companies attracting investor attention include Applied Digital, Constellation Brands, and Caterpillar, due to earnings results or scheduled management presentations. On the other hand, SanDisk shares are down nearly 3% following a jump of almost 27% in the previous session.

Economic data

-

US ADP private payrolls showed slightly weaker-than-expected employment growth.

-

Factory orders in Neico dropped more sharply than anticipated.

-

JOLTS data indicated lower job vacancies.

-

Meanwhile, the ISM Services index came in higher than expected.

Following reports that Venezuela will deliver 30–50 million barrels of previously sanctioned crude to the U.S., oil prices remain near $60 per barrel globally. The increased supply from Venezuela could deepen the existing downward trend in oil prices and offset gains driven by geopolitical tensions. Lower oil prices support the stock market rally and ease inflation concerns.

Source: xStation5

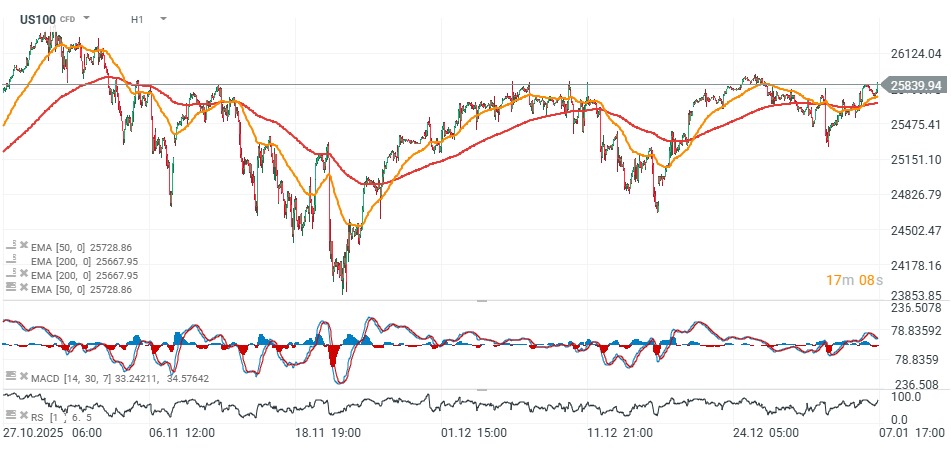

US100 (H1 interval)

Source: xStation5

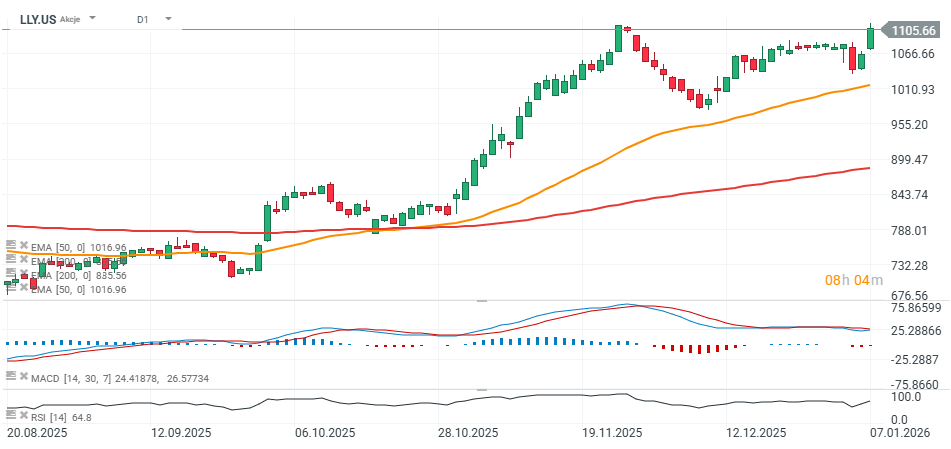

Eli Lilly on a Winning Streak

Eli Lilly shares are up nearly 4% on news of its acquisition of Ventyx Biosciences, a deal potentially exceeding $1 billion, according to the Wall Street Journal, citing sources familiar with the matter. The announcement could come imminently.

About Ventyx Biosciences:

-

Produces drugs for immunological and inflammatory diseases.

Acquisition goals for Eli Lilly:

-

Develop new therapies for inflammatory bowel diseases, including Crohn’s disease and ulcerative colitis.

-

Treatments for Parkinson’s disease.

-

Drugs addressing cardiovascular problems related to obesity.

Following the announcement, Ventyx shares surged over 50% in after-hours trading, reflecting investor optimism. Neither Eli Lilly nor Ventyx has commented on further commercial development talks. The acquisition aligns with Eli Lilly’s strategy to expand beyond its diabetes and obesity segments, strengthening its presence in immunology and neuroscience. Shares have reached near all-time highs today.

Source: xStation5

Intel Shares Surge

Intel shares are up nearly 7% after news of a new gaming-focused processor and platform.

-

Intel is developing a dedicated gaming processor.

-

A broader gaming platform combining hardware and software is also in the works.

-

The platform will be based on Intel Core Series 3 processors, forming the foundation for the new gaming lineup.

-

The company aims to strengthen its competitive position against AMD and Nvidia, which have been expanding their gaming processor portfolios for years.

-

Intel expects to capitalize on growing demand for high-performance gaming hardware.

Investors see the plan as promising, viewing it as a potential growth driver in the gaming segment. More details on the processor and platform are expected to be released later this year.

Sources: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment