- The US currency strengthened on Friday

- A pullback in the stock market

- Gold and silver fell slightly

During today's Forex session we could observe the strength of the US currency. In the evening hours, the dollar gained the most against NZD, which fell by 1%. The EURUSD and GBPUSD currency pairs dropped around 0.8%, while the AUDUSD is down 0.7%. USD also appreciates 0.5% against CHF and 0.3% against JPY. CAD is also slightly losing to USD, but the movement here does not exceed 0.1%.

Looking at the precious metals market, today we could observe pullback in gold and silver, which can be associated with the stronger dollar. In the evening hours, gold loses 0.25% and silver falls 0.85%. Palladium, on the other hand, reached new historical heights during the European session, breaking above the level of $ 3,000, however buyers failed to uphold momentum and the price pulleb back sharply.

As for the stock market, Wall Street's main indexes are down between 0.4% and 0.6% on the day. The US Bureau of Economic Analysis reported on Friday that Personal Income in March surged by 21.1% and Personal Spending increased by 4.2%. Both of these readings came in stronger than analysts' estimates. Additionally, the Core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's preferred gauge of inflation, rose to 1.8% on a yearly basis from 1.4% in February as expected. Finally, the University of Michigan's Consumer Sentiment Index improved to 88.3 (final) in April from 84.9 in March. The declines are not significant, however, in Europe the vast majority of major stock indices moved in recent days in local consolidation and today's session was not decisive. In the US, we could also observe a similar movement, however US indices remain near their historical highs.

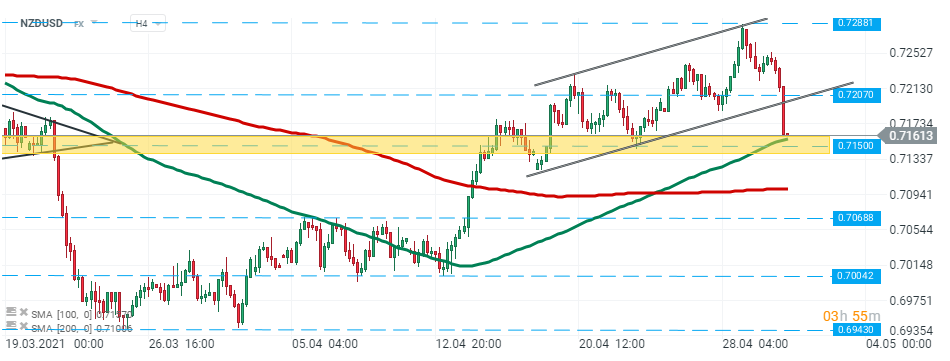

NZDUSD pair broke below the lower limit of the ascending channel during today’s session and is currently approaching major support at 0.7150 which coincides with 50 SMA (green line). Should break below occur then downward move may accelerate towards next support at 0.7068. On the other hand, ff the downward impulse loses its strength, then another upward move towards the resistance at 0.7207 is possible. Source: xStation5

NZDUSD pair broke below the lower limit of the ascending channel during today’s session and is currently approaching major support at 0.7150 which coincides with 50 SMA (green line). Should break below occur then downward move may accelerate towards next support at 0.7068. On the other hand, ff the downward impulse loses its strength, then another upward move towards the resistance at 0.7207 is possible. Source: xStation5

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Market wrap: European and US stocks try to rebound rebound 📈

Gold and silver rebound after the sell-off 📈