- Upbeat moods on the stock market

- US Senate reach temporary deal on debt limit increase

- Increased volatility in the oil and gas market

European indices rebounded strongly on Thursday, as easing oil and gas prices offered relief to investors worried about rising inflation. ECB Minutes showed policymakers discussed a new bond-buying program as emergency programs are phased out. On the data front, industrial production in Germany dropped 4% mom in August, reversing from an upwardly revised 1.3% rise in July and worse than forecasts of a 0.4% drop as supply chain disruptions continue to hit the auto sector.

US indices are trading higher in a broad-based rally led by heavyweight technology stocks, as concerns over a US default soothed as congress reached a deal on a short-term debt limit extension. Today's data showed fewer-than expected Americans filed new claims for jobless benefits last week. It also showed layoffs increased from a 24-year low in September. Tomorrow investors will focus on the NFP report for an update on the labour market recovery. Better than expected reading would raise the odds of an early Fed tapering and interest rate hike.

We could observe increased volatility in the oil and gas markets during today’s session. Oil prices erased early losses following additional comments from the US Energy department and currently both Brent and WTI prices rose1.4% and 1.7% respectively. Meanwhile, the price of NATGAS is deepening the downward correction, and is currently trading 1% lower.

During today's session the dollar is not performing very well. USD weakened 0.6% against AUD and 0.4% against NZD. The euro is also gaining slightly, but volatility was limited.

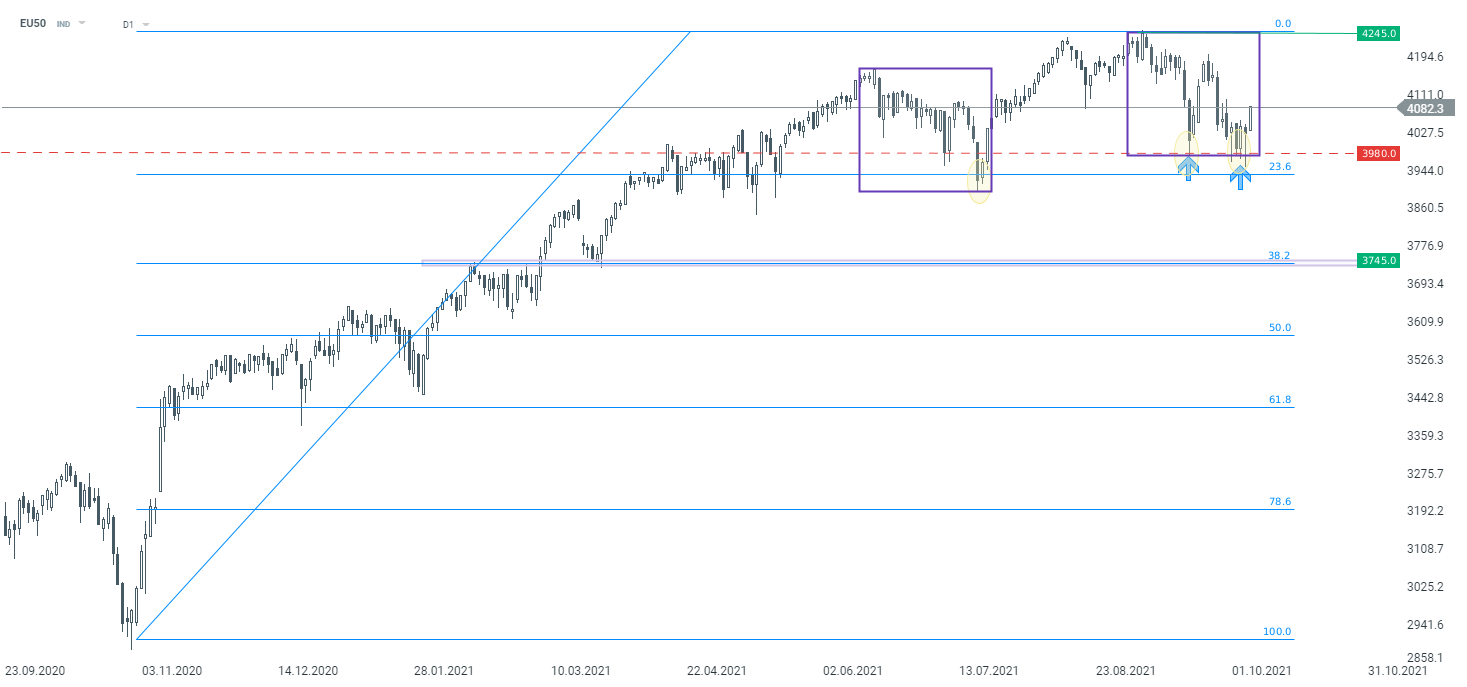

EU50 - buyers managed to halt the downward correction at the key support around 3980 pts which is marked with the lower limit of the 1:1 structure. If the current sentiment prevails, then another upward impulse may be launched towards recent highs at 4245 pts. EU50 interval D1. Source: xStation5

EU50 - buyers managed to halt the downward correction at the key support around 3980 pts which is marked with the lower limit of the 1:1 structure. If the current sentiment prevails, then another upward impulse may be launched towards recent highs at 4245 pts. EU50 interval D1. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report