• European equities mixed on Wednesday

• US stocks rose on hopes for piecemeal stimulus deal

• WTI Crude extend losses after EIA report

European finished today's session in mixed moods as investors remain concerned about surging numbers of new COVID-19 cases which may force European governments to implement further restrictions which would hurt block's economic recovery. On the data front, industrial output in Germany and Spain fell in August, while retail sales in Italy rebounded sharply. House prices in the UK rose 7.3% over a year earlier in September, the most since mid-2016. Dax 30 finished today’s session flat, CAC 40 fell 0.3% and FTSEE100 rose 0.1%.

Major US indices rose 1.5% higher on average today after US President Trump called for more economic relief, hours after his decision to halt stimulus talks until after the election. Airlines stocks rose after Trump urged Congress to pass a series of smaller, standalone bills that would include a bailout package for the battered airline industry and provide aid to small businesses and most individuals with payments of up to $1,200 under the Paycheck Protection Program. Speaker Nancy Pelosi signaled openness to a standalone airline relief bill in a conversation with Treasury Secretary Steven Mnuchin on Wednesday.

WTI crude fell more than 2.6% to trade around $39.6 a barrel and Brent dropped 2.3% to trade around $41.66 a barrel, pressured by US stimulus talks and a larger-than-expected rise in US crude oil inventories. Data from the EIA showed US crude oil stockpiles increased by 0.501 million barrels, following three consecutive weeks of declines and compared to analysts’ expectations of a 0.294 million rise. Meanwhile, energy companies evacuated offshore oil platforms as Hurricane Delta is expected to hit the US Gulf Coast as category 3.

Elsewhere, gold partially erased earlier gains to trade round $1885 an ounce while silver is trading 2.6% higher at $23.68 an ounce.

Investor focus will now turn to minutes from the Federal Reserve later in the day and from the ECB due tomorrow. Also Vice President Mike Pence and Democratic challenger Kamala Harris are set to square off today in their only debate.

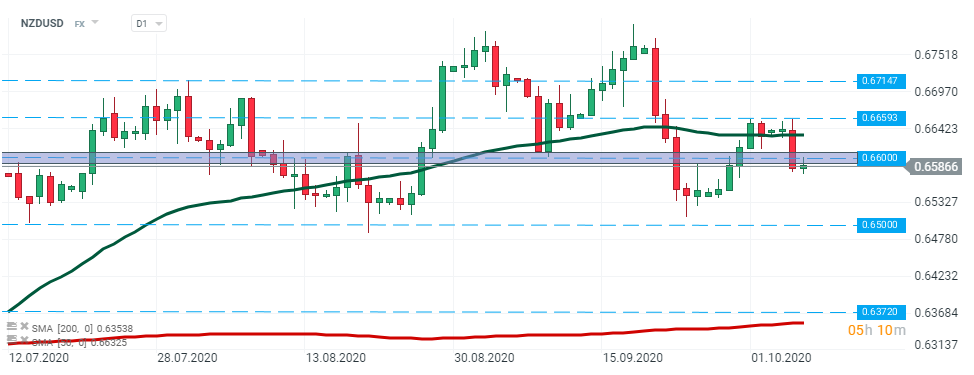

NZDUSD – yesterday sellers managed to broke below the major support at 0.66. Today pair retested the aforementioned level, however buyers failed to push the price above it. As long as the price sits below it, continuation of a downward trend seems more probable. The nearest support to watch lies at 0.65. However, if there is a change in market sentiment, then next local resistance could be found at 0.6659. Source: xStation5

NZDUSD – yesterday sellers managed to broke below the major support at 0.66. Today pair retested the aforementioned level, however buyers failed to push the price above it. As long as the price sits below it, continuation of a downward trend seems more probable. The nearest support to watch lies at 0.65. However, if there is a change in market sentiment, then next local resistance could be found at 0.6659. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report