- Tougher lockdowns in Europe

- Runoff elections in Georgia

- New OPEC+ production agreement

European indices finished today's session mostly lower after more countries introduce new lockdowns due to the ever-increasing number of coronavirus cases. England imposed a third national lockdown to prevent the health service from being overwhelmed by soaring coronavirus infections. The new restrictive measures are expected to remain in place until at least February 22nd. Chancellor Rishi Sunak announced a new £4.6 billion support package for businesses hit by the new measures. German Chancellor Angela Merkel confirmed extension of the current lockdown until January 31st, according to Reuters. Meanwhile, better-than-expected retail trade data from Germany helped to curb the losses. DAX 30 dropped 0.6%, CAC40 fell 0.4% and FTSE100 rose 0.6%.

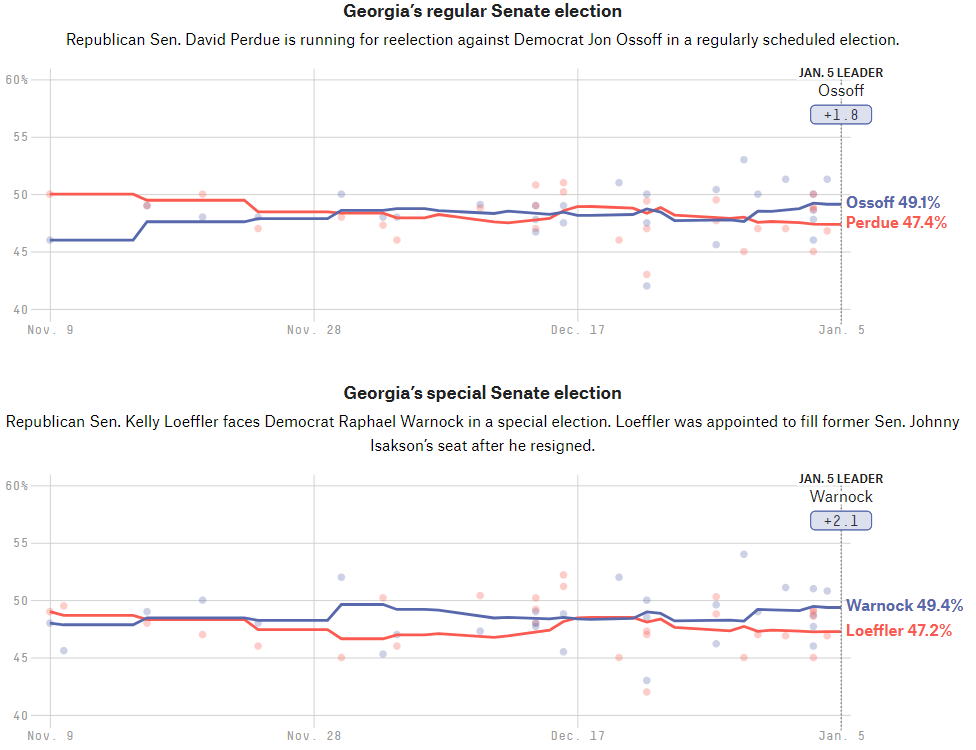

US stocks are trading higher recovering some of their sharp losses from the previous session, as investrs turned their focus on Georgia's Senate runoff elections. The outcome- which is only expected to be clear on Wednesday morning according to state officials - will determine who has control of the Senate for the next two years. A Democratic victory in both races could pave the way to the approval of more fiscal stimulus in Washington, but it could also mean greater corporate regulation and higher taxes. Latest polls from data website 538 gave a slight edge to both Democratic candidates in their respective races. On the data front, the Institute for Supply Management said its manufacturing index rose to 60.7 in December from 57.5 in November and well above analysts' expectations of 56.6.

Source: projects.fivethirtyeight.com

US crude futures are trading 4.1% higher at $ 49.83 a barrel, while Brent contract rose 4.1% to $ 53.20 after OPEC + decided to leave production levels unchanged for both February and March. Saudi Arabia voluntarily cut output below its quota, while Russia and Kazakhstan were allowed to raise production. Elsewhere, gold futures rose 0.35% to $ 1,949.00 / oz, while silver is trading 0.80% higher near $ 27.43 / oz. Bitcoin managed to climb back above $ 32,000 level.

USDCAD fell approximately 0.76% during today’s session amid general dollar weakness which came in after China's decision to lift its official yuan exchange rate by its highest margin since it abandoned the dollar peg in 2005. Currently pair is testing major support at 1.2674. Should a break below occurs, then downward move may accelerate towards 1.2545 level. On the other hand, if buyers manage to halt decline here, upward impulse towards 1.2770 could be launched. Source: xStation5

USDCAD fell approximately 0.76% during today’s session amid general dollar weakness which came in after China's decision to lift its official yuan exchange rate by its highest margin since it abandoned the dollar peg in 2005. Currently pair is testing major support at 1.2674. Should a break below occurs, then downward move may accelerate towards 1.2545 level. On the other hand, if buyers manage to halt decline here, upward impulse towards 1.2770 could be launched. Source: xStation5

Will the Fed minutes confirm a pause in further easing? 🔎

BREAKING: GBPUSD ticks lower after mixed UK CPI print

Daily summary: Wall Street tries to rebound 📈Amazon and Microsoft under pressure of Rotschild & Co Redburn

Cocoa tries to stabilize after autumn sell-off 📌