- European indices snapped a six-day selloff to end Wednesday’s session higher, with DAX 40 adding 1.36%, mainly thanks to solid performance of the financial and technology sectors;

- ECB said it would skew reinvestments of maturing debt while announcing the speed-up of a new tool kit to rein on soaring borrowing costs;

- US stocks extend gains on Wednesday, with the Dow rising over 2.0%, the S&P 500 climbing 2.6% and the Nasdaq 3.7%;

- The yield on the 10-year US Treasury note fell below the 3.4% level after the Federal Reserve hiked its funds rate by 75bps, in line with analysts’ estimates;

- Chairman Powell said a 75bps rate hike is not a common occasion and left the magnitude of the next rate increase open;

- US retail sales unexpectedly fell in May, indicating that American consumers are already cutting back on spending;

- AUD and GBP are the best performing major currencies while USD and EUR lag the most;

- EIA data showed an unexpected jump in US crude production that hit its highest level since April 2020;

- Oil prices continue to move south. Brent and WTI fell more than 1%, while NATGAS is trying to recover from yesterday's sell-off and is gaining over 3%;

- Precious metals are performing quite well, gold adds more than 1.5%, and silver gains over 3.5%;

- Major cryptocurrencies inches slightly higher on Wednesday. Nevertheless, today's gains are not very impressive given the scale of recent sell-off;

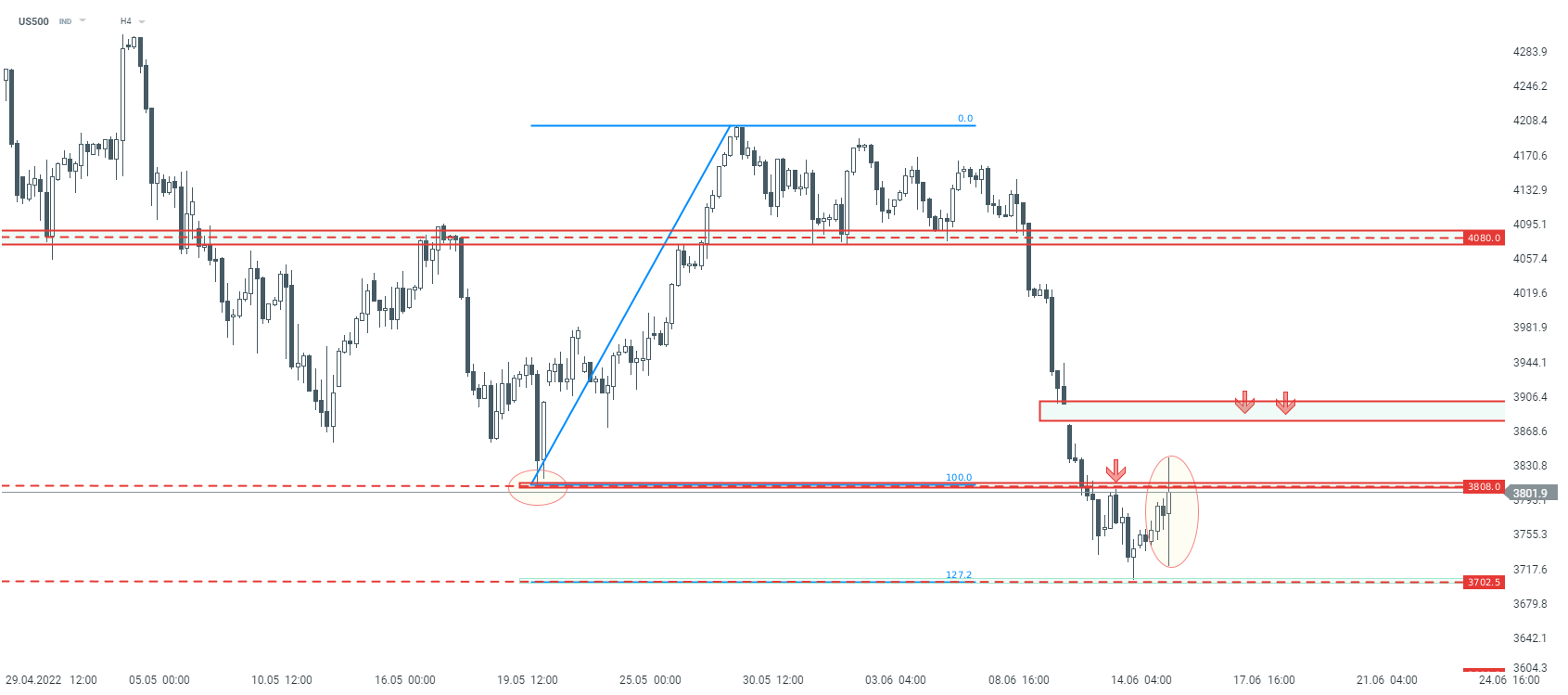

After today's Fed decision, we could observe a positive reaction of major Wall Street indices. US500 defended the support at 3702.5 pts, which coincides with 127.2% external Fibonacci retracement and next buyers managed to above the resistance at 3808 pts. Source: xStation5

After today's Fed decision, we could observe a positive reaction of major Wall Street indices. US500 defended the support at 3702.5 pts, which coincides with 127.2% external Fibonacci retracement and next buyers managed to above the resistance at 3808 pts. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Three markets to watch next week (06.03.2026)