-

On Thursday, we saw slightly better sentiment in the stock market, the main indices from the Old Continent ended the session higher, nevertheless, volatility was limited, the German DAX gained 0.39%, and London's FTSE added 0.11%, while the French CAC40 closed slightly below the bar - 0.08%,

-

Slightly better sentiment is also observed in the US, where the Dow Jones adds 0.1%, the S&P500 is cannily 0.5% higher and the Nasdaq gains 0.77%

-

The dollar gave up some ground to other currencies on Thursday, the best performer being AUD, which strengthened as much as 0.9% in terms of the U.S. dollar

-

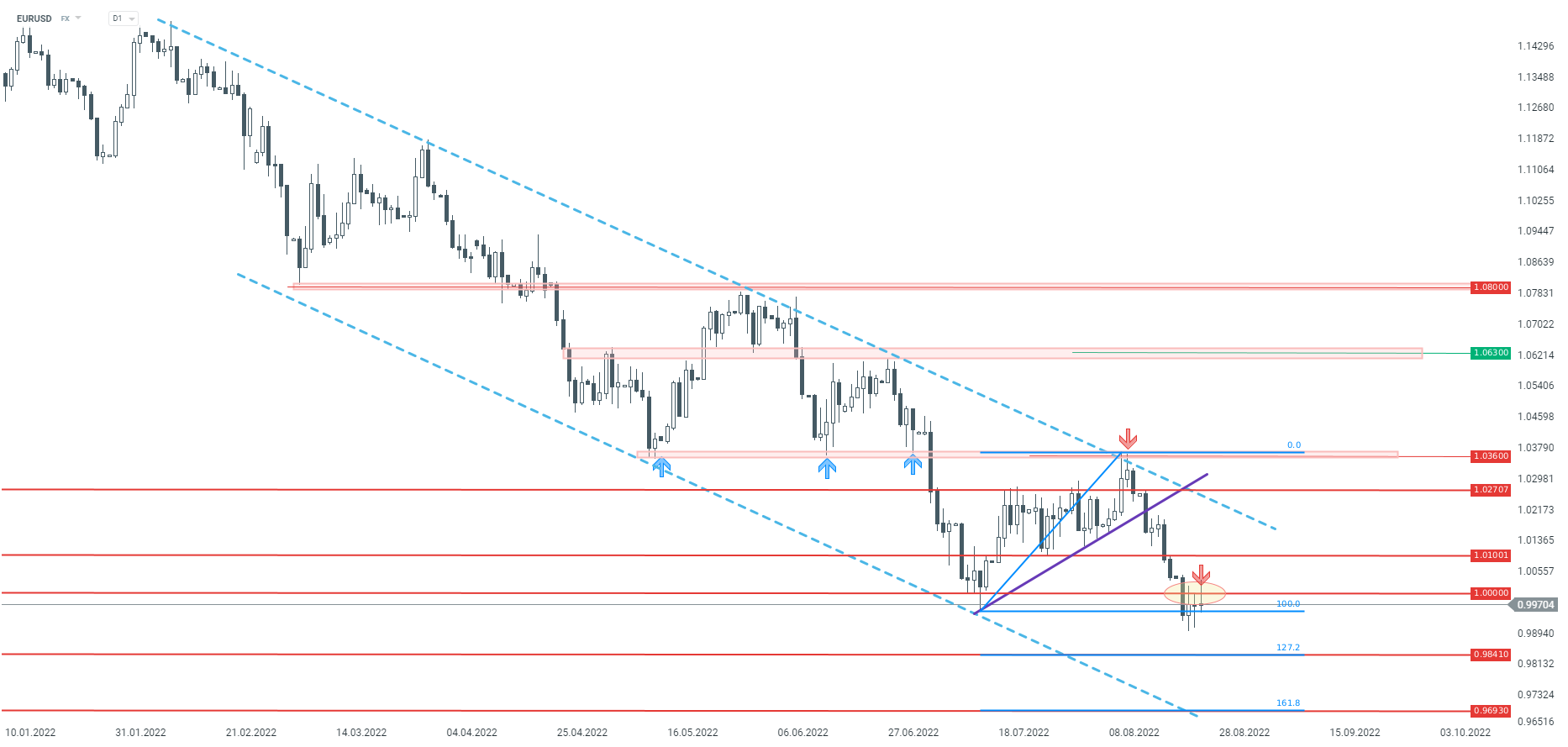

The rebound, however, is not seen on the main currency pair, it is having great difficulty getting back above the round level of 1.0000 (this level remains a key resistance for tomorrow)

-

In the commodities market, the price of WTI crude oil is losing some ground and is settling around 94.5 USD. Gold, on the other hand, is trading on the upside, for an ounce of bullion we will pay 1758.5 USD

-

On the cryptocurrencies, we can see less volatility and local consolidation in recent days, Bitcoin has been moving in a narrow price range (around 1,000 USD) for almost a week and is waiting for an excuse to break out

-

Today the symposium in Jackson Hole began, and investors are looking forward to Powell's speech tomorrow and maintaining his hawkish stance

-

The money market is currently pricing in a 68% chance of a 75bp hike

Despite the attempt at a rebound, the 1.0000 level is effectively holding back a larger correction on EURUSD. Source: xStation5

Despite the attempt at a rebound, the 1.0000 level is effectively holding back a larger correction on EURUSD. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report