- Sentiment in Europe was mixed today. Germany’s DAX fell more than 2% amid a sharp sell-off in software heavyweight SAP, which disappointed on backlog and raised concerns about demand for the company’s solutions. Britain’s FTSE gained just under 0.2%, while France’s CAC40 finished flat.

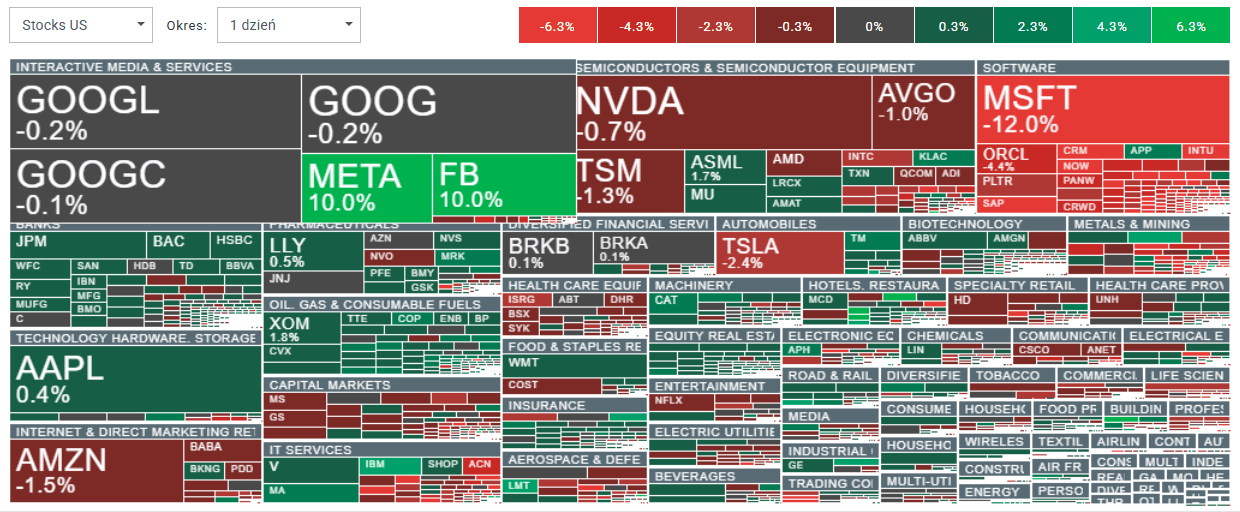

- The sell-off in U.S. equities accelerated after a drop of more than 10% in Microsoft dragged down the entire software sector. Microsoft shares are now down nearly 12% on fears that AI-related investment spending (CAPEX) is becoming excessive. Even a surge of more than 10% in Meta Platforms was not enough to turn sentiment across Big Tech, and investors are now bracing for Apple’s earnings release after the U.S. close.

- US100 initially fell almost 2.2%, but is currently down about 1.6%, making a tentative attempt to stabilize after the sharp sell-off. The DJIA (US30) is holding up best, while the less tech-concentrated US500 is down 0.8%. Among large caps, Meta, IBM, Lockheed Martin and Caterpillar are leading the upside today - all four delivered positive quarterly surprises.

- The equity sell-off also spilled over into other assets that had been rising recently, including precious metals. Gold pulled back from its all-time high near $5,600/oz and is now trading around $5,350/oz, while silver rebounded from $106/oz to nearly $115/oz.

- Oil prices are up almost 3% and approaching $70 amid rising risk of a potential U.S. strike on Iran. The United States has concentrated significant U.S. Navy forces around Iran, and Trump warned that if Tehran does not sign a nuclear agreement, the U.S. would be forced to act.

- According to EIA data, the weekly change in U.S. natural gas inventories came in at -242 bcf, versus -238 bcf expected and -120 bcf previously. U.S. Henry Hub natural gas futures moved lower after the report, as the drawdown was almost perfectly in line with forecasts - but in the evening price rebounded towards $3.85 per MMBtu

- In FX, EURUSD “defended” the 1.19 area and is slowly moving back above 1.195. Cryptocurrencies are sliding alongside a weaker Bitcoin, which is down more than 5% to just under $84,000; Ethereum is about 6% lower, around $2,850.

(summary in progress)

Source: xStation5

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks