- DE40 edges slightly higher on German banks and automakers stocks

- Mercedes net profit plunged more than 30% but stock is up almost 6% today

- DE40 edges slightly higher on German banks and automakers stocks

- Mercedes net profit plunged more than 30% but stock is up almost 6% today

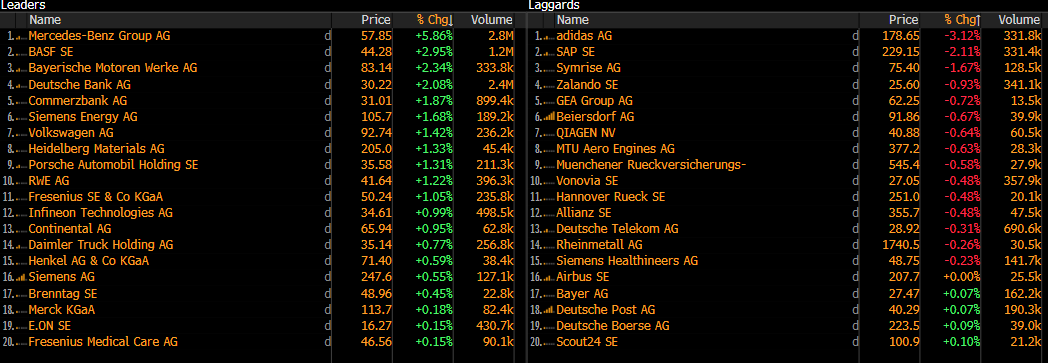

DAX stocks are moving slightly higher today, driven by BASF, Mercedes, BMW and German banks. Markets await the Fed decision at 7 PM GMT and Federal Reserve chairman Powell press conference today scheduled at 7:30 PM GMT. DE40 consolidates in the tight trading range, trying to hold EMA50 as a major support (24300 points).

Source: xStation5

Volatility of stocks in German DAX today. Source: Bloomberg Finance L.P

Mercedes-Benz Q3 2025: Chip Concerns and Profit Drop

-

Q3 net profit plunged 30.8% to €1.19 billion, down from €1.71 billion a year earlier. Despite the decline, results beat analyst forecasts of €1.09 billion, sending shares up 6% in Frankfurt.

-

Mercedes reassured investors on chip supply, saying short-term needs are covered, though global sourcing efforts continue.

-

The chip shortage follows Dutch authorities seizing Nexperia, triggering a Chinese export ban on its components.

-

CEO Ola Källenius said the disruption is a “politically induced shortfall” amid U.S.–China trade tensions.

-

The automaker faces high U.S. tariffs: 15% on EU exports and 25% on imported car parts outside North America.

-

Sales in China dropped 27%, contributing to a 12% overall decline in global sales volume.

-

Mercedes is partnering with Chinese autonomous driving firm Momenta to stay competitive in the local market.

-

Källenius warned that “hyper competition in China is not going away anytime soon.”

-

The broader auto industry, including Nissan and Volkswagen, is also warning of potential production stoppages due to the Nexperia chip crisis.

Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending