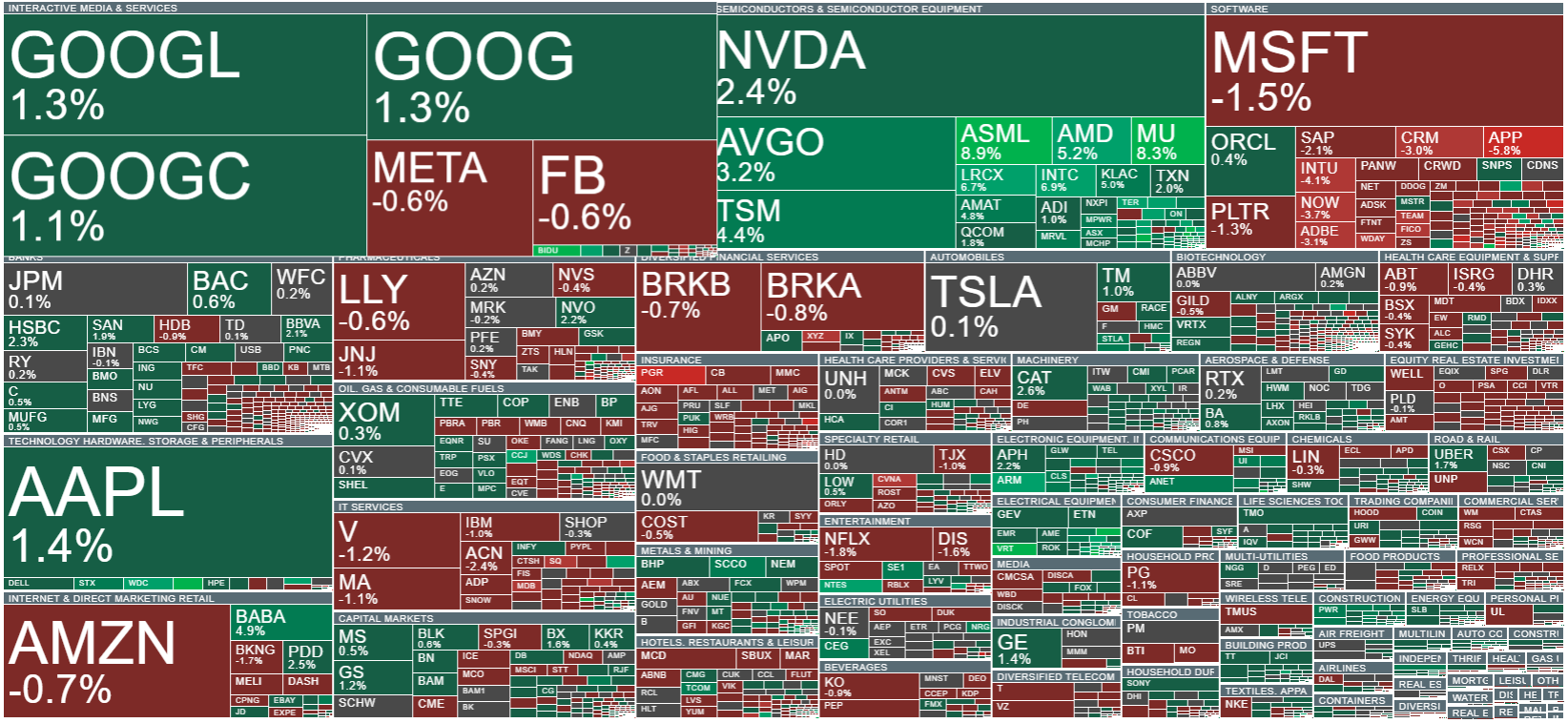

The American stock market began 2026 in a clearly positive mood, with early trading showing noticeable gains across major indices. The Nasdaq is up 0.5%, highlighting that the technology sector continues to attract attention, with enthusiasm around artificial intelligence driving demand for shares of innovative companies. The S&P 500 has risen 0.3%, while the Dow Jones shows a slight decline of 0.1%, suggesting that more conservative sectors of the market remain cautious amid new economic expectations. Despite minor fluctuations during the session, the overall market tone remains positive, and optimism is holding at the start of the new year.

At the same time, the final US manufacturing PMI was released at 51.8 points, exactly in line with analysts’ expectations. A reading above 50 points confirms that the industrial sector is still expanding, although the pace of growth has slightly slowed compared to the previous report. These data indicate stable conditions in American industry, suggesting that despite some signs of slowing, the economy is maintaining moderate growth and has not triggered significant reactions in financial markets.

Source: xStation5

Today, US100 (Nasdaq 100) futures are rising strongly, fueled by growing interest in the artificial intelligence sector and technology-driven optimism at the start of 2026. High demand for AI-related companies is translating into clear gains for the index. The chart shows that the price has broken above both the short-term and medium-term moving averages (EMA 30 and EMA 100), indicating potential momentum and strength in the upward move. The RSI is hovering around 55, signaling a neutral level and suggesting that further gains may still be possible without the market being overbought.

Source: xStation5

Company News

Baidu (BIDU.US) is up more than 10% after announcing plans to list its AI unit on the Hong Kong Stock Exchange. The move is seen as an opportunity to unlock the company’s value and create new financing options.

ASML (ASML.US) shares rise nearly 6% after Aletheia Capital upgraded its recommendation. Analysts point to growing demand for EUV chip production equipment driven by AI development, as well as factory expansion plans and increased production capacity, giving the company prospects for further growth.

Vertiv Holdings (VRT.US) gains 5% after Barclays raised its recommendation. Analysts believe the current valuation is attractive following recent fluctuations and offers potential to catch up with other companies linked to AI and energy technologies.

NIO (NIO.US) sets record electric vehicle deliveries in December and in Q4 overall. The results indicate that the company not only maintains its growth pace but also strengthens its position in the Chinese EV market, laying a solid foundation for further expansion.

Sable Offshore (SOC.US) rises more than 14% after receiving approval to restart a controversial pipeline in California. The regulatory decision gives the company an immediate boost, highlighting the significant impact such approvals have in the energy sector.

Outlook Therapeutics (OTLK.US) falls about 50% after the FDA rejected its application for a treatment for wet age-related macular degeneration in the US.

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook