European stock market indices started a new week on the back foot. Declines can be spotted all across the Old Continent with majority of blue chips indices from the Western Europe trading over 1% lower today. Equities are pulling back amid a pick-up in bond yields with US 10-year Treasury yield jumping 8 basis points today, to 4.52% at press time. Opening of the cash session in the United States was also downbeat with major Wall Street indices trading 0.2-0.3% lower at the session launch.

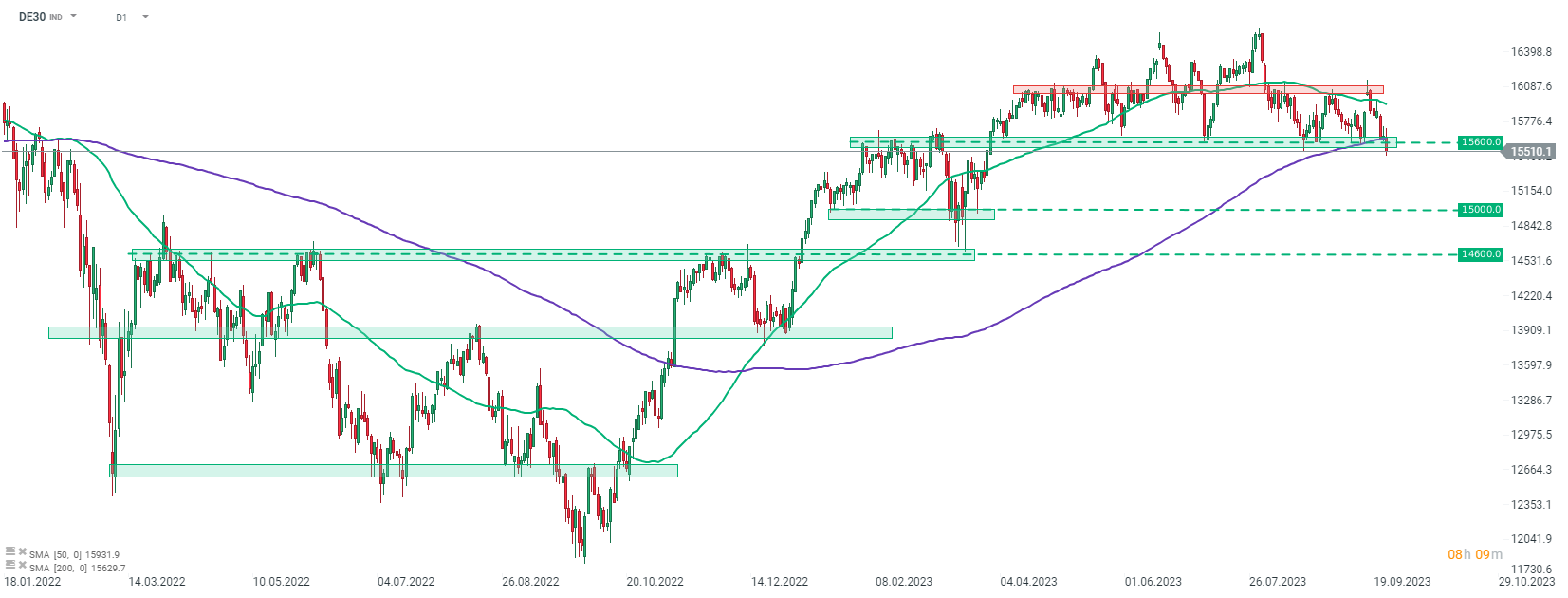

German DAX futures (DE30) are dropping around 1% today and are moving below a key medium-term support zone in the 15,600% pts area. The zone marked with 200-session moving average (purple line) was tested a number of times in recent months but no breakout occurred until now. The German index is now trading at the lowest level since late-March 2023 and unless bulls manage to regain control, the next two support zones to watch can be found near 15,000 pts and 14,600 pts.

Source: xStation5

US OPEN: The market looks for direction after inflation data

BREAKING: US CPI below expectations! 🚨📉

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)