-

European markets continue recovery

-

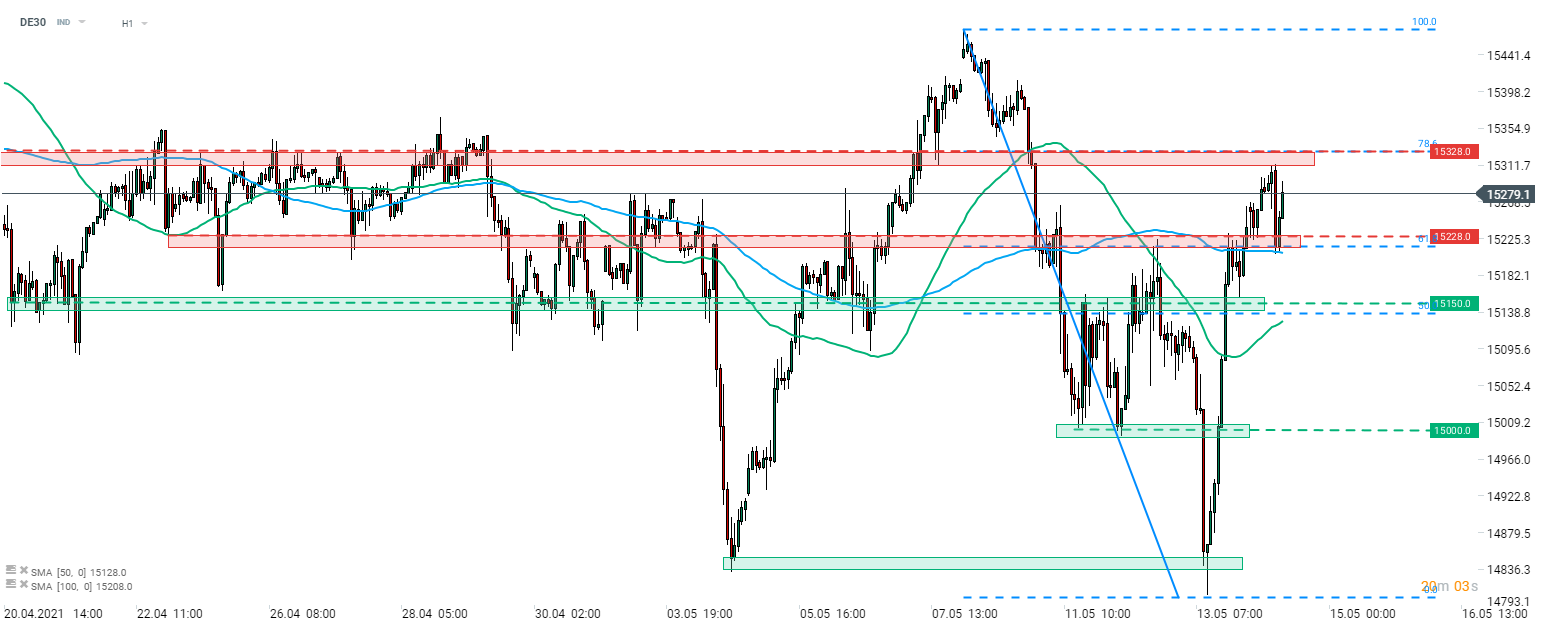

DE30 trades near 15,300 pts

-

Volkswagen's deliveries jumped 75.2% in April

European stock markets continue to recover from the sell-off that occured in the first half of the week. Gains can be spotted all across the Old Continent with Polish WIG20 (W20) being the laggard trading 0.7% down at press time. Indices from Portugal and Spain are European top perfromers today.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appDE30 staged a massive reversal yesterday. The index was trading almost 2% lower at one point of yesterday's trading but has managed to recover losses and finish the day around 1% higher. DE30 climbed during the Asian session and tested resistance zone ranging below 78.6% retracement (15,328 pts). However, index was unable to break above it and pulled back after the opening of the cash session. Pullback was halted at the price zone marked with 61.8% retracement and 100-hour moving average (blue line). Two key near-term levels to watch are marked with the aforementioned retracements - 61.8% (support) and 78.6% (resistance). US retail sales data release at 1:30 pm BST may trigger a jump in volatility so traders should stay on guard.

Company News

Volkswagen (VOW1.DE) announced that Group deliveries jumped 75.2% YoY, to 829.8 thousand units. Year-to-date deliveries (January - April) reached 2.48 million units and were 31.5% YoY higher.

Allianz Global Investors, asset management unit of Allianz (ALV.DE), is evaluating potential opportunities for consolidation within the sector. Tobias Pross, CEO of Allianz Global Investors, said that the company may pursue deals but only under condition that value creation is clear and tangible.

Siemens Digital Industries Software, a business unit of Siemens (SIE.DE), announced that it acquired Fractal Technologies, the Dutch company developing IP validation solutions. Acquisition will help Siemens improve the quality of its integrated circuit designs as well as help their customers more quickly and more easily validate internal and external IPs. Acquisition was closed in May but no financial details were disclosed.

Allianz (ALV.DE) launched today's trading with a bullish price gap as stock markets continued to recover from this week's sell-off. Stock jumped back above the 200-hour moving average for the first time since May 5, 2021 and continued to move higher after session launch. The near-term resistance zone for Allianz can be found ranging between €218.30 handle and the 78.6% retracement of the drop started on May 5. Source: xStation5

Allianz (ALV.DE) launched today's trading with a bullish price gap as stock markets continued to recover from this week's sell-off. Stock jumped back above the 200-hour moving average for the first time since May 5, 2021 and continued to move higher after session launch. The near-term resistance zone for Allianz can be found ranging between €218.30 handle and the 78.6% retracement of the drop started on May 5. Source: xStation5