Today, Wall Street is characterized by an atmosphere of anticipation and slight unease. The main indices closed Thursday at new records, but today they are giving back some of the gains. The US500 remains around the previous opening. The US100 is up by 0.2%, while the US2000 is down by 0.5%. Investors seem to be balancing between the joy of record valuations and growing concerns about the labor market.

The Dow Jones index has surpassed the 46,000 point level for the first time, largely due to the good condition of companies and weaker-than-expected macroeconomic data, which increase the likelihood of interest rate cuts. Both the S&P 500 and Nasdaq also finished Thursday at historical highs.

Macroeconomic Data:

Although investors are still hoping for a soft landing of the economy, potential problems related to the labor market and consumption are becoming increasingly apparent. The rising number of new unemployment benefit claims and very weak NFP suggest significant cooling in employment, which in the long term may limit consumer spending.

At the same time, high household debt, driven by more expensive loans and record credit card burdens, weakens consumers' resilience to further slowdown.

Additionally, the issue of public debt, which in the USA is reaching historical levels and, combined with rising costs of servicing it, is becoming an increasing challenge for the federal budget. This situation raises the risk that even with the Fed's easing policy, economic growth in the coming quarters may be difficult to maintain.

The University of Michigan Index in August showed mixed results. The main reading and the assessment of the current situation were close to forecasts, but consumer expectations fell significantly below expectations, and long-term inflation forecasts rose above consensus. This setup may suggest weaker consumer demand while maintaining price pressure, which limits the Fed's ability to quickly ease monetary policy.

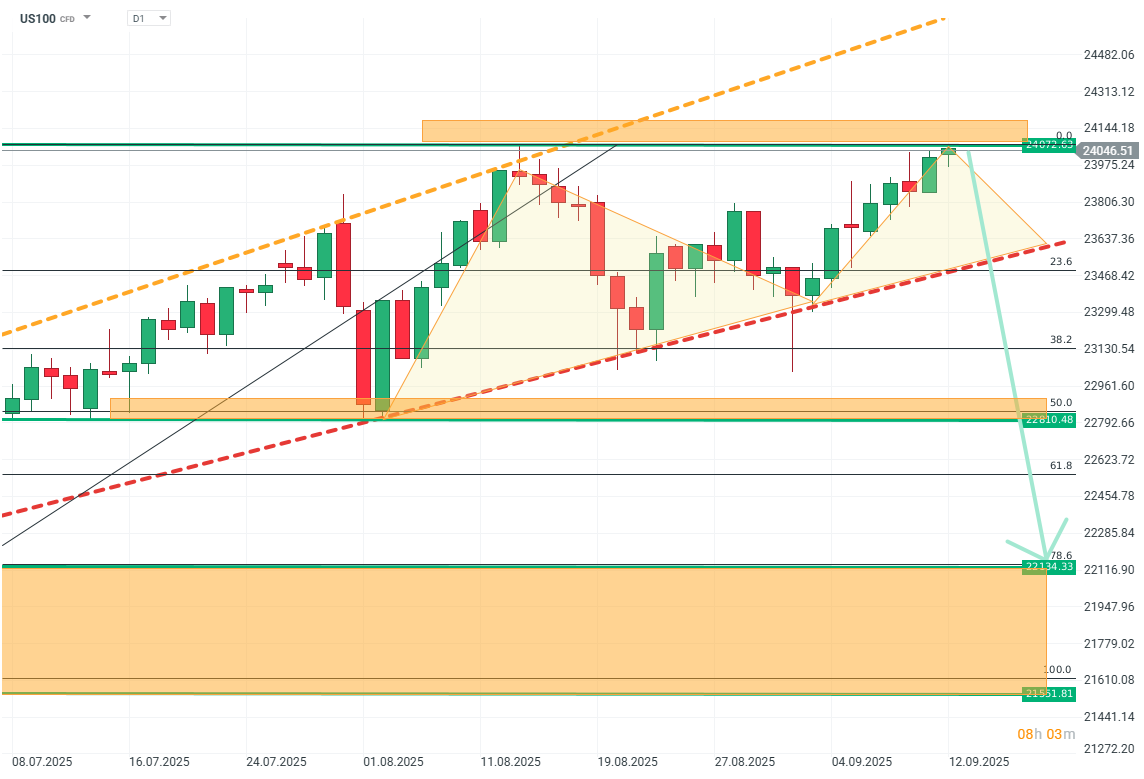

US100 (D1)

Source: Xstation

The chart shows the formation of a potential double top pattern. If the price rebounds from the resistance zone at the 24,000 level, a correction in the upward trend is likely, first towards FIBO 23.6, and then testing the very strong support around 22,800 dollars, reinforced by FIBO 50. If this level is breached, it opens the way for further correction with the first strong resistance at the 22,100 level, where we find FIBO 78, and a further zone around 21,600, marked by the beginning of the current upward wave.

Company News:

Adobe (ADBE.US) - The company is up by nearly 4% following the publication of strong quarterly revenue forecasts; the firm benefits from increasing monetization of AI features.

RH (RH.US) - The company's stock is down by nearly 10% after lowering its full-year sales forecast. The company pointed to the negative impact of new US tariffs and delays.

Super Micro Computer (SMCI.US) - Up by over 5% at the opening after launching deliveries of Nvidia Blackwell Ultra systems.

Warner Bros. Discovery (WBD.US) - The media giant continues to rise following reports of a planned acquisition by Paramount Skydance. The company is up by over 7% at the opening.

Stellantis (STLA.US) - The vehicle manufacturer is correcting previous gains. UBS announced that the short-term risk/reward profile is "unattractive." The company is down by over 2%.

Array Technologies (ARRY.US) - The company is down by 5% after Bank of America issued a negative recommendation, pointing to potential risks related to tariffs.

Record revenues for AMD. Is the company confirming its leading position?

Gold surges 2.5% after beating record from 2008 📈

Economic calendar: Alphabet's earnings in the spotlight 💡

Morning Wrap (04.02.2026)