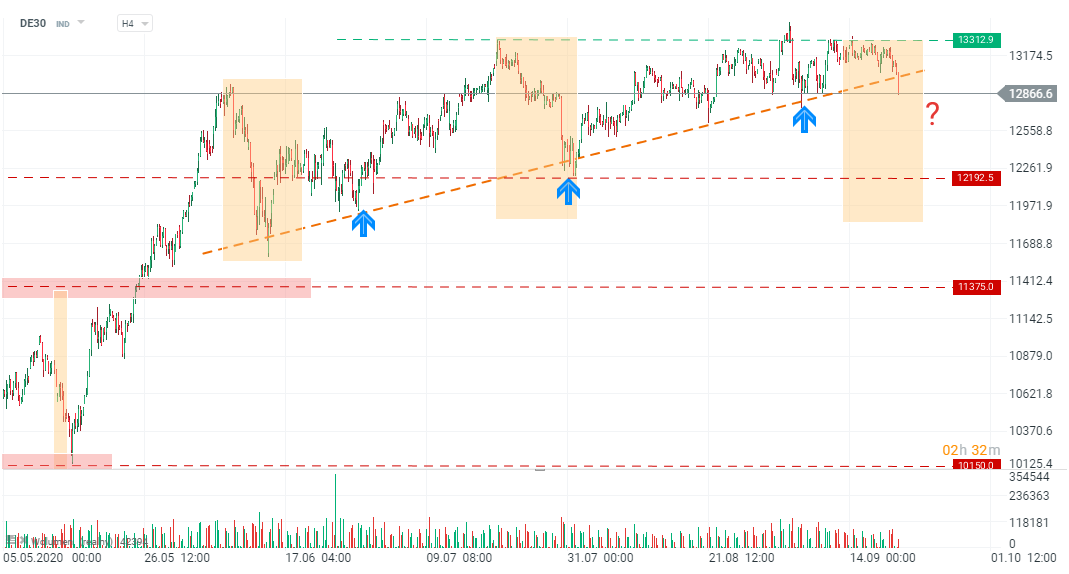

DE30 is already down 2% at the beginning of Monday trading in what could be the first step towards a deeper correction. European markets generally ignored Wall Street volatility in the first half of the month but US100 broke the key 10930 points support on Friday and together with surging COVID cases across the Old Continent this caused investors to give up on DE30 as well.

One should observe that DE30 broke out of the tightening triangle formation sending a bearish signal. The first key support is just below 12200 points. Looking ahead we have the first of 3 speeches from Jerome Powell today (3pm BST) but will it mean anything to investors after they ignored very dovish Fed last week?

One should observe that DE30 broke out of the tightening triangle formation sending a bearish signal. The first key support is just below 12200 points. Looking ahead we have the first of 3 speeches from Jerome Powell today (3pm BST) but will it mean anything to investors after they ignored very dovish Fed last week?

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%