-

Markets slip as Trump continues to question elections results

-

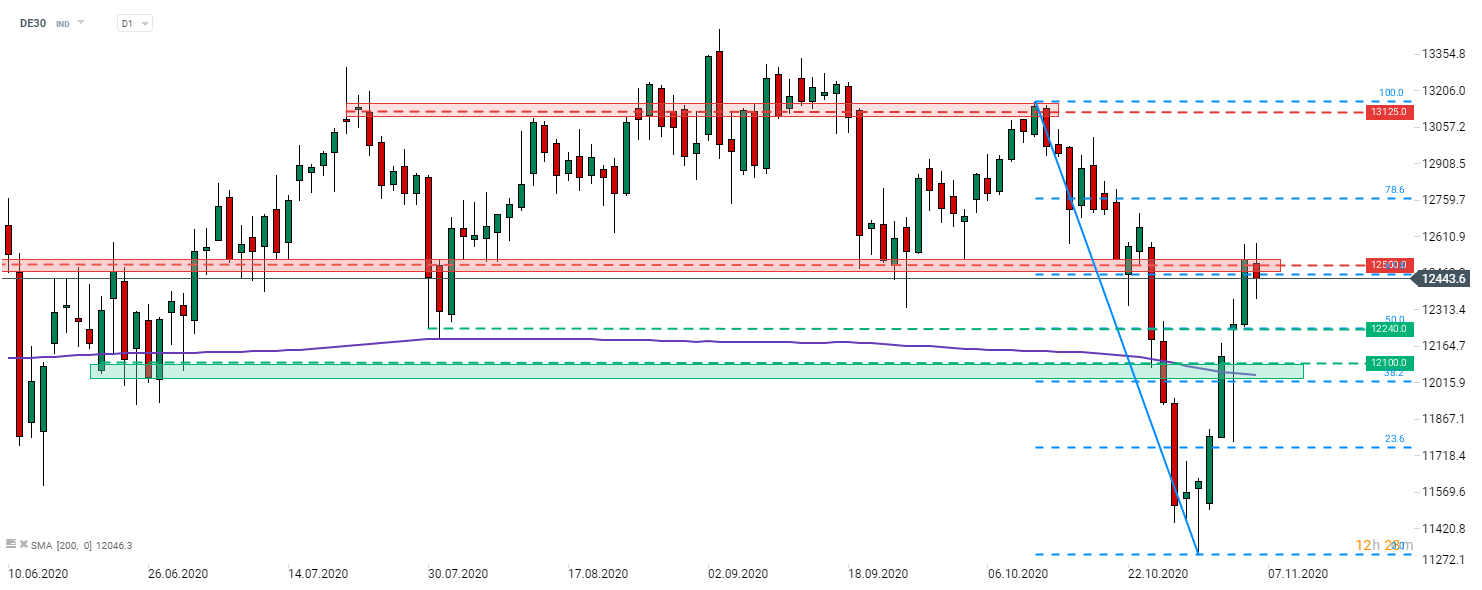

DE30 pulls back from 12,500 pts

-

Allianz cancels remaining 2020 share buybacks

Rally on the equity markets is being put to the test on Friday with European indices and US futures pulling back. Trump continues to question legitimacy of the US elections as Biden continues to gain ground in some key battleground states.

NFP report for October (1:30 pm GMT) is a key macro release of the day and is expected to show continued slowdown in jobs market recovery. Weak reading could support today's risk-off moods.

DE30 halted the rally at 12,500 pts resistance. The index is pulling back below the 61.8% retracement of recent drop as investors are getting ready for post-elections legal battles. Support marked by 50% retracement and low from the turn of July and August is the near-term level to watch (12,240 pts) while zone ranging below 12,100 pts remains the main hurdle for bulls. Elevated volatility is expected in the early afternoon when NFP report is released and more election results will be reported. Source: xStation5

DE30 halted the rally at 12,500 pts resistance. The index is pulling back below the 61.8% retracement of recent drop as investors are getting ready for post-elections legal battles. Support marked by 50% retracement and low from the turn of July and August is the near-term level to watch (12,240 pts) while zone ranging below 12,100 pts remains the main hurdle for bulls. Elevated volatility is expected in the early afternoon when NFP report is released and more election results will be reported. Source: xStation5

Company News

Allianz (ALV.DE) released Q3 earnings today. The German insurance company reported net income of €2.1 billion, or 5.9% year-over-year higher. This translates into EPS of €4.89, up from €4.66 in Q3 2019. On the other hand, revenue and operating profit declined. Revenue came in at €31.4 billion (-6.1% YoY) while operating profit dropped 2.6% YoY to €2.91 billion. Allianz said that because of the pandemic uncertainty it has decided to cancel the outstanding €650 million part of its 2020 buyback programme.

Bilfinger (GBF.DE), industrial services provider from Germany, is rallying over 10% today. Company said that it will explore sale as it has attracted interest from buyout firms. Company's market capitalization sits at around €840 million.

According to the Spiegel report, the German government thinks that Lufthansa (LHA.DE) may need additional state aid in 2021. Magazine based its claim on internal government paper it has reportedly seen.

Rheinmetall (RHM.DE) reported a 7% YoY decline in Q3 revenue, to €4 billion. Q3 operating result at €101 million was higher than a year ago. Company said that some improvement has been spotted in the July-September period but automotive sales are still down on the year. Defence segment continues to perform well with revenue increasing 12% YoY in the first 9 months of 2020. Company upgraded outlook and now expects positive operating results on the full-year basis.

DAX members at 10:17 am GMT. Source: Bloomberg

DAX members at 10:17 am GMT. Source: Bloomberg

US100 loses 0.5% 📉Meta shares decline extends on AI CAPEX worries & Deutsche Bank remarks

CHN.cash under pressure despite positive Trump remarks 🚩

Wall Street optimism tempers amid falling odds of December Fed rate cut

DE40: Decline of sentiment in Europe