- European markets recover from corrections, mostly due to Donald's Trump ease of rhetoric towards China

- European pharmaceuticals producers make a bid to circumvent tariffs

- Automakers stocks up despite difficult situation

- France's new government forming puts some of the investors at ease

- European markets recover from corrections, mostly due to Donald's Trump ease of rhetoric towards China

- European pharmaceuticals producers make a bid to circumvent tariffs

- Automakers stocks up despite difficult situation

- France's new government forming puts some of the investors at ease

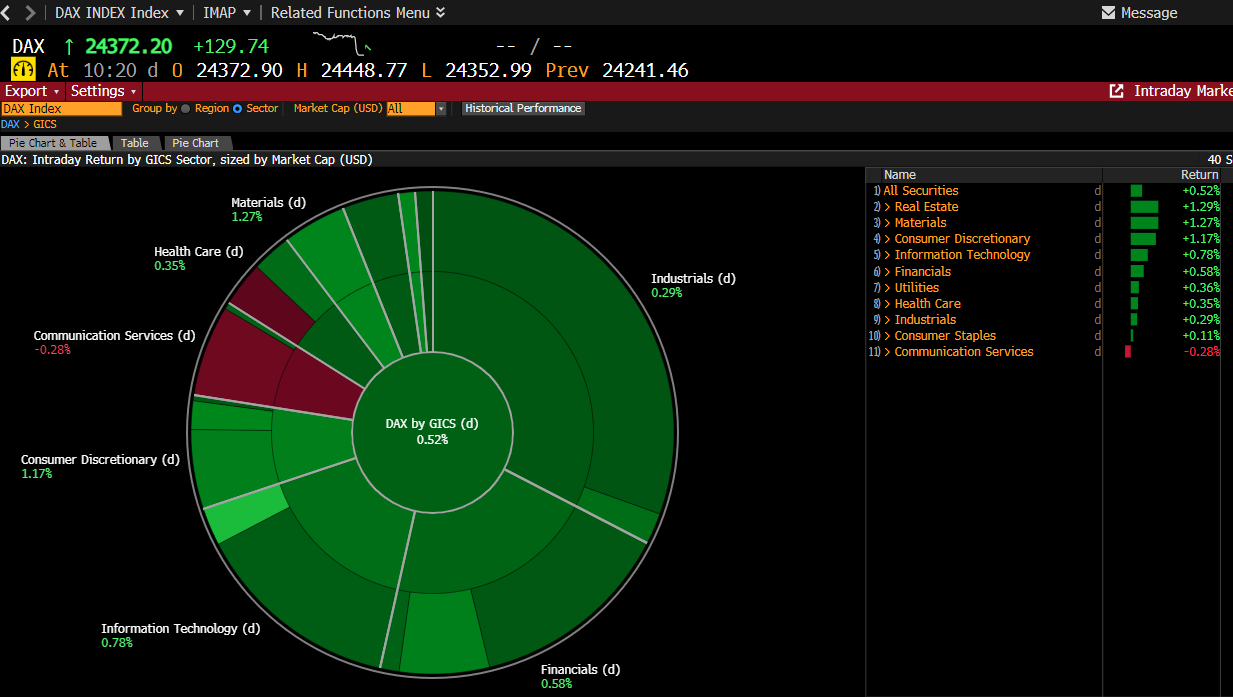

The week on European stock exchanges clearly begins with gains. Most major indices in Western Europe are experiencing a solid rebound, which can be interpreted as a corrective rise following last week's declines. The German DAX, along with CAC40 and the Italian FTSE MIB, gains on opening by an average of over 1%.

Despite the lack of significant macroeconomic publications, today's session brings large price movements. It is evident that investors in Europe are again reacting mainly to events from across the ocean, but this time the sentiment is positive. Donald Trump has noticeably toned down his policy and statements regarding the trade war with China, which has significantly reduced market tension. Additionally, a certain impulse for local markets came from France, where a new government was formed at an express pace. The partial resolution of the political impasse reduces uncertainty and gives investors a small but noticeable reason for optimism.

Source: Bloomberg Terminal LP

We are experiencing noticeable gains across whole sectors. Among the leaders of growth in Europe today are companies from the automotive sector, pharmaceutical firms, and the broadly defined IT sector.

DE40 (D1)

Source: Xstation5

The chart shows that after bouncing off the levels of the last ATH, the index temporarily fell below the medium- and long-term trend lines (orange and red). However, a quick breakout above them confirmed their technical significance. Currently, the quotations are in the area of the FIBO 23.6% retracement of the last upward wave - which constitutes a key point of resistance/support. To maintain a positive scenario, it is necessary to defend the resistance around 24380 points, as its breach could initiate a correction towards 24100 points. The RSI indicator remains in the moderate valuation zone, suggesting neutral sentiment.

Company news:

SUESS MicroTec (SMHN.DE) — The semiconductor manufacturing company is up over 13% after receiving a positive recommendation from an investment bank.

Pharmaceutical companies have proposed supplies/discounts for the American healthcare system in exchange for tariff exemptions. Shareholders are mixed in their reactions. AstraZeneca (AZN.UK) is down about 1%. Sanofi (SNF.FR) is up about 0.5%, Novo Nordisk (NOVOB.DK) is down 2%.

PSI Software (PSAN.DE) - The software producer for energy manufacturers is up 34%, driven by the planned acquisition of the company by a private fund. This is a continuation of last week's movement, in which the company already rose by about 38%.

Despite few fundamental bases, automotive companies in Europe are experiencing a broad rebound. BMW(.DE) is up 1.7%, Stellantis (STLAM.IT) is up 2.3%.

Theon International (THEON.NL) - The Greek night vision manufacturing company announced the acquisition of shares in one of its French partners, with the stock price rising by over 8%.

Daily Summary: "Sell America" pushes US assets off the cliff (20.01.2026)

Banks fear Trump📉Central planning in the USA?

💡Geopolitics and Tariffs Under the Spotlight: Precious Metals Hit Records (Commodity Wrap, 20.01.2026)

Daily summary: Its fear, but not panic yet. Trump has shaken the markets again.