- Political turmoil hangs over the valuations

- The European military industry continues to move the markets

- British economy slows down, rate cuts expected

- European inflation in line with expectations

- Political turmoil hangs over the valuations

- The European military industry continues to move the markets

- British economy slows down, rate cuts expected

- European inflation in line with expectations

The European session is proceeding in a calm mood, with a predominance of moderate optimism. Most indices remain around the opening levels, but with slight increases. The growth leader is FTSE1000, whose contracts are rising by over 1.4% on the wave of new expectations regarding the interest rate path. ITA40 and NED25 contracts are up by 0.4%. DAX remains around the opening price of the quotations. Declines can be observed in French and Swiss indices, but they are limited to 0.3%.

Investors on the European market have a long series of political information and macroeconomic data to discount.

- Donald Trump threatens retaliation against European technology companies in response to fines against American corporations. The US president also threatens invasion of Venezuela again. This may generate additional volatility during the session or in the coming days.

- Germany is introducing a series of significant decisions that the market may interpret as growth-oriented. Firstly, the EU coalition voted for significant concessions in the law banning the sale of combustion vehicles. At the same time, Germany is withdrawing from a series of restrictions on electricity consumption by enterprises.

- KNDS — The German tank manufacturer is preparing IPO plans, and the company's management is expected to present a preliminary schedule for entering the public market by the end of this week.

Macroeconomic data:

- Inflation in the UK: The CPI reading turned out to be below expectations, reaching 3.2% year-on-year compared to the expected 3.4%. On a monthly basis, deflation was recorded at 0.2%. This provides more room for rate cuts by the BoE.

- The IFO index from Germany is below expectations, remaining in contraction territory at 87.6.

- Eurozone HCPI inflation was in line with market expectations, at 2.4% annually and -0.5% MoM.

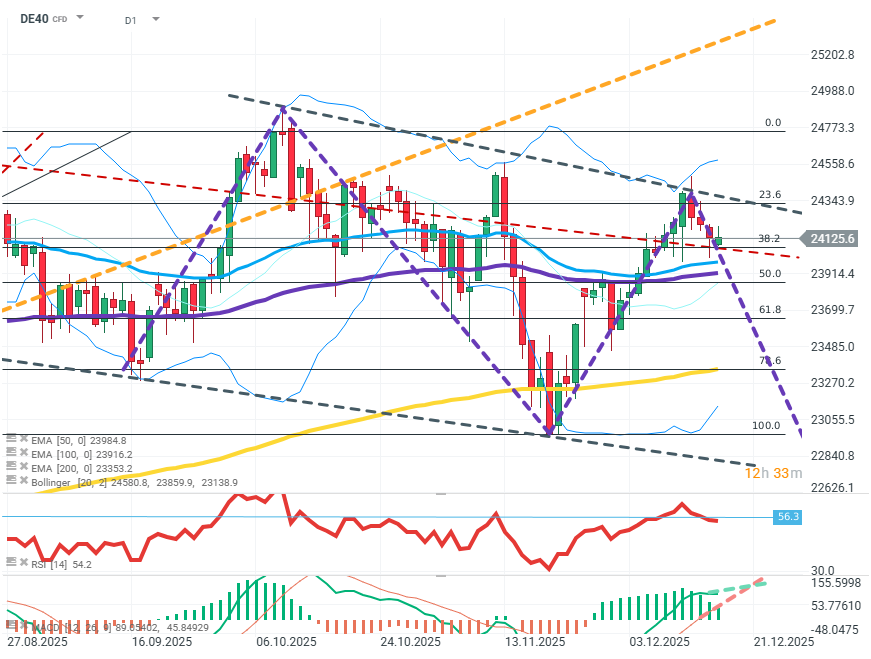

DE40 (D1)

Source: xStation5

The chart shows the continuation of the formation of a broad downward pattern with a low trend slope. The EMA average and MACD show a decreasing spread, indicating growing weakness among buyers, who need to break the FIBO 23.6 level to prevent further declines. If sellers want to maintain the initiative, it is crucial to quickly overcome the EMA 50 and 100 averages and then FIBO 50.

Company news:

- RENK (R3NK.DE), Rheinmetall (RHM.DE) - German defense companies are correcting part of the recent declines. This is a result of further failures in peace negotiations, NATO countries' purchases, and information about alleged, unannounced Russian military gatherings and exercises in Belarus. Valuations are rising by about 1.5-2.5%.

- Siemens Healthineers (SHL.DE) - The company announces that one of its owned startups is reporting progress in ongoing projects.

- Suedzucker (SZU.DE) - The food producer published a disappointing revenue growth forecast. The company is losing over 3%.

- Thyssenkrupp Nucera (NCH2.DE) - The company specializing in energy equipment published results above expectations and with good forecasts for the future. Shares are up by over 2%.

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

US OPEN: War in Iran hits the markets

EU Suspends Landmark Trade Deal. Gold is up 2%

⛔ Trump’s tariffs ruled illegal: will companies receive billions of dollars in refunds?