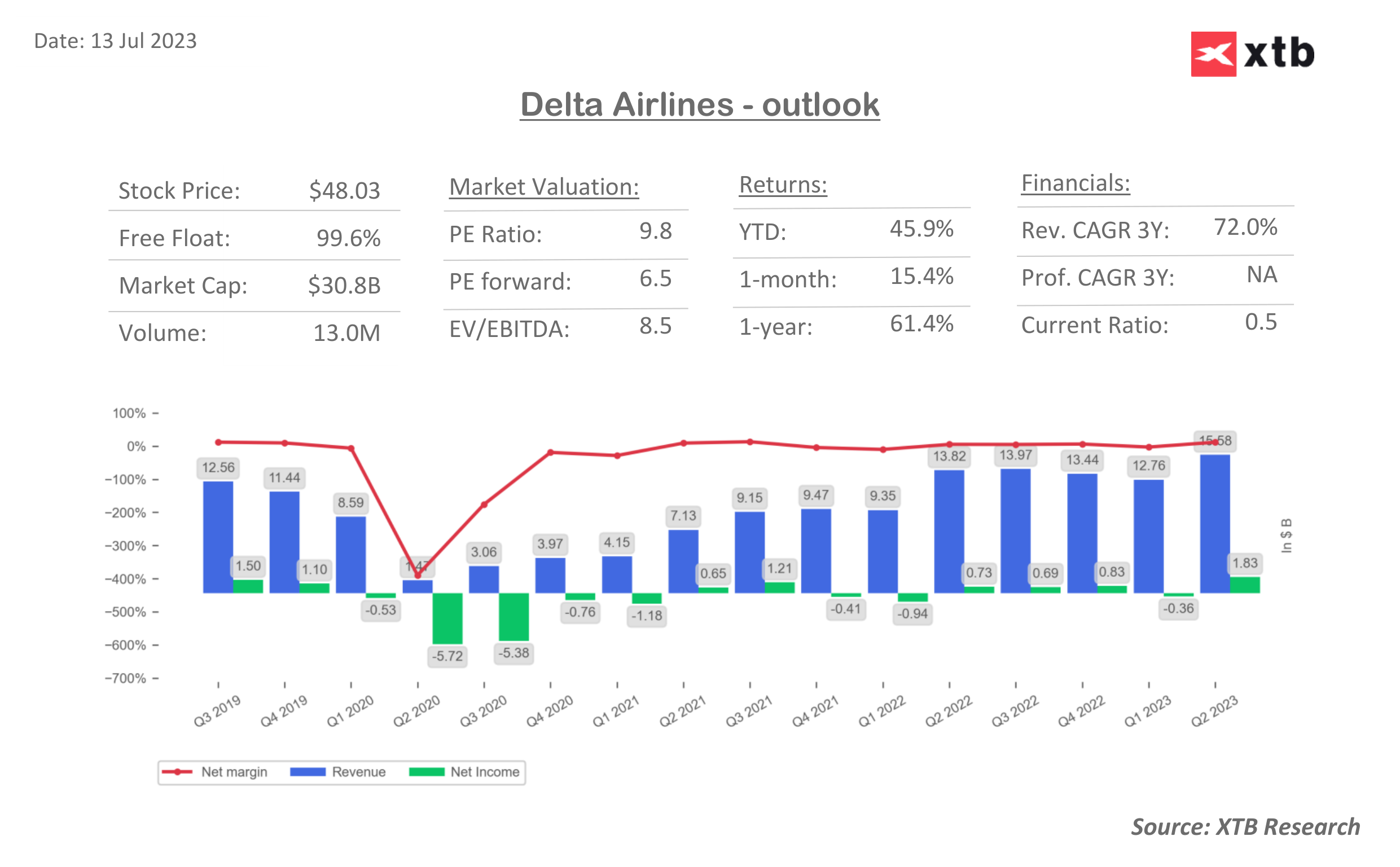

Delta Air Lines shares are gaining 3.55% in the pre-market trading after the company reported its financial results for the Q2 2023, revealing the highest quarterly revenue and profitability in the company's history. The strong operating cash flow in the June quarter has enabled accelerated debt reduction. The company expects record revenue for the next quarter, with a mid-teens operating margin and earnings per share (EPS) ranging from $2.20 to $2.50. The full-year EPS outlook has been raised to $6 - $7, with the free cash flow guide of $3 billion being the same.

Key Takeaways:

- Delta Air Lines reported record operating revenue of $15.6 billion and record operating income of $2.5 billion in the June quarter of 2023.

- The company's pre-tax income was $2.3 billion, with a pre-tax margin of 14.9 %.

- The earnings per share for the June quarter was $2.84.

- Delta's operating cash flow was $2.6 billion, with payments on debt and finance lease obligations amounting to $1.8 billion.

- The total debt and finance lease obligations at the end of the quarter were $20.2 billion.

Selected Financials:

- operating revenue of $14.6 billion vs $14.49 billion expected, which was 19% higher than the same quarter in 2022;

- EPS for the June quarter of 2023 was $2.68, higher than the previous year and $2.40 expected;

- operating cash flow remained at $2.6 billion, with free cash flow of $1.1 billion.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records