Didi Global (DIDI.US) stock managed to erase premarket losses and is trading more than 6% higher despite the fact that China based ride-hailing company posted a 1.7% decline in third-quarter revenue and a loss of $4.7 billion, caused by the regulatory crackdown. After the company debuted on NYSE in June, the Chinese government ordered it to remove its app from mobile app stores, while the Cyberspace Administration of China took into scrutiny how the company was handling clients' data. Due to the ongoing pressure from Chinese regulators, Didi decided to delist from the New York Stock Exchange and pursue a Hong Kong listing. Also increasing competition from other ride-hailing services like automakers Geely Holding Group and SAIC Motor Corp Ltd weighed on the company's results.

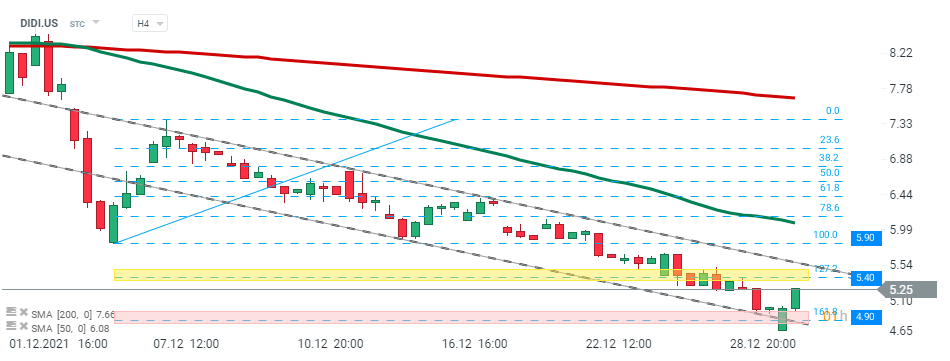

Didi Global (DIDI.US) stock launched today's session lower around the major support at $4.90 which is strengthened by 161.8% external Fibonacci retracement of the last upward wave, however it seems that investors ignored recent news and bought the dip. Currently the price is approaching the upper limit of the descending channel around $5.40. Should a break higher occur, upward move may accelerate towards resistance at $5.90 which is marked with previous price reactions. Source: xStation5

Didi Global (DIDI.US) stock launched today's session lower around the major support at $4.90 which is strengthened by 161.8% external Fibonacci retracement of the last upward wave, however it seems that investors ignored recent news and bought the dip. Currently the price is approaching the upper limit of the descending channel around $5.40. Should a break higher occur, upward move may accelerate towards resistance at $5.90 which is marked with previous price reactions. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records