-

Around 140 companies from S&P 500 reported earnings

-

Positive earnings surprises, mixed sales surprise

-

Results much lower on year-over-year basis

-

Major tech companies to reported Q3 results on Thursday

While global stock markets are taking a dive on the back of a rapidly deteriorating pandemic situation, traders should not forget about the ongoing earnings season. Around 140 companies from the S&P 500 index have already reported results for the third quarter of 2020 and those turned out to be better than expected. Investors brace for a Super Thursday this week, when 4 major tech companies will release their Q3 results.

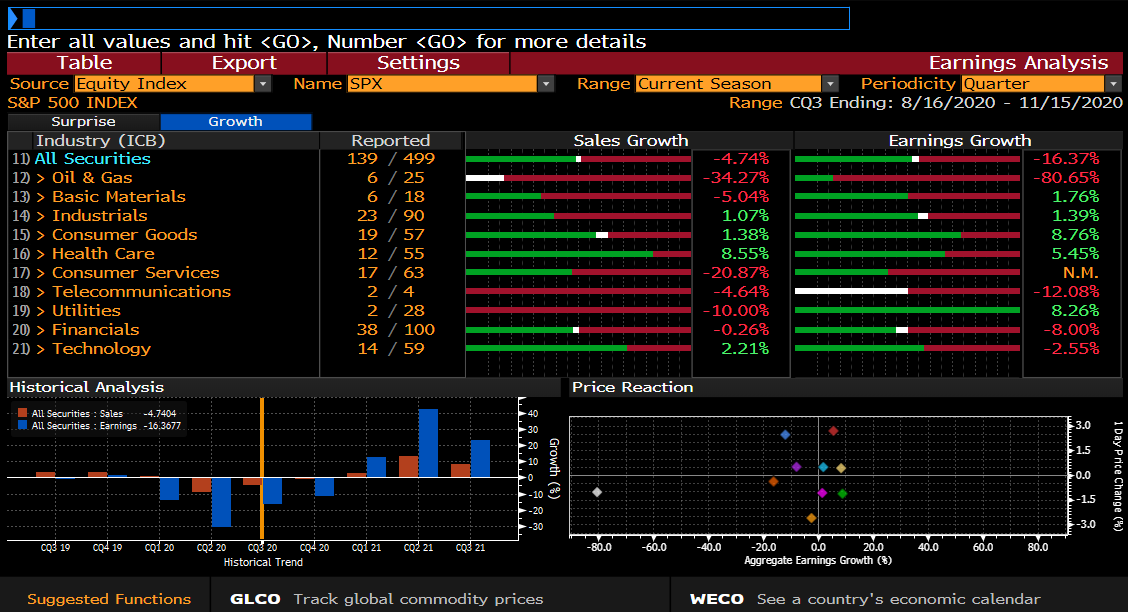

Every major sector in the S&P 500 index has presented better than expected Q3 earnings. Situation looks less rosy when it comes to sales surprise. Source: Bloomberg

Every major sector in the S&P 500 index has presented better than expected Q3 earnings. Situation looks less rosy when it comes to sales surprise. Source: Bloomberg

Companies surprise with earnings...

So far, around 140 companies from the S&P 500 index have reported Q3 results. As one can see on the chart above, both sales and earnings turned out to be higher than expected at the index level. Oil companies, miners and financial stocks provided the biggest positive earnings surprises as commodity prices rebounded and Wall Street trading bonanza continued. Situation is a bit mixed when it comes to sales data - most sectors delivered better expected results but utilities missed expectations. Nevertheless, one should keep in mind that analysts' tend to underestimate earnings of US companies therefore one should not give too much weight to the fact that reports are better than expected.

In spite of positive earnings surprises, most sectors reported massive declines in earnings and sales on the year-over-year basis. Source: xStation5

In spite of positive earnings surprises, most sectors reported massive declines in earnings and sales on the year-over-year basis. Source: xStation5

… but results still look grim on year-over-year basis

However, focusing on consensus estimates often masks a real picture. Taking a look on the chart above, one can see that in spite of most sectors reporting better than expected results, earnings turned out to be much lower year-over-year. Oil&Gas sector is a perfect example as earnings of 6 companies that have already reported turned out to be 80% above consensus while at the same time they were 80% lower than a year ago. A point to note when it comes to future quarters is that many US banks as well as other institutions do not think that the next round of government stimulus will arrive before year's end. This points to more struggles down the road with small businesses being the most vulnerable.

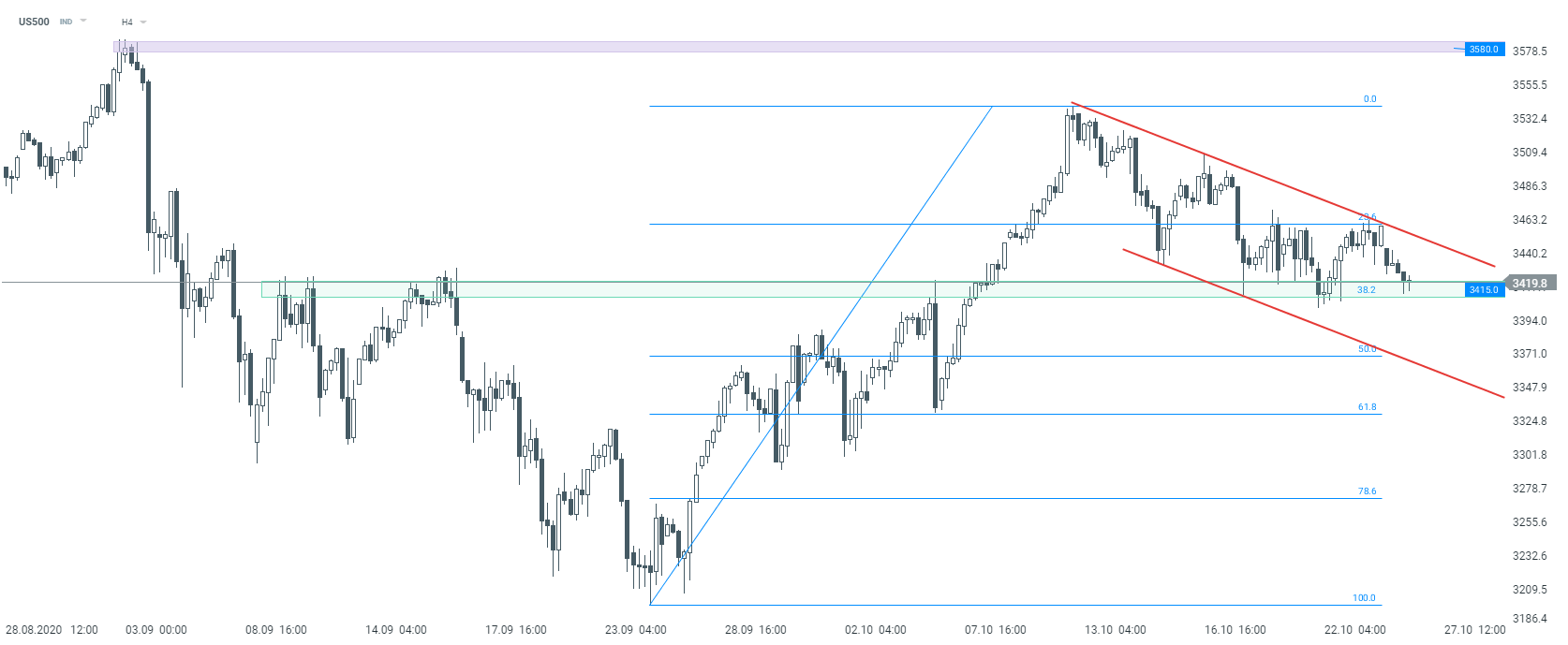

US500 topped in mid-October and started to move lower within a downward channel. Index pulled back from the topside of the channel and is now testing support at the 3,415 pts, that also coincides with the 38.2% retracement of the recent upward move. Breaking below it would pave the way towards the lower limit of the channel near 50% retracement. However, the upcoming US GDP report and earnings of Big Tech have a scope to turn the tide. Will they manage to do it? We shall know this Thursday! Source: xStation5

US500 topped in mid-October and started to move lower within a downward channel. Index pulled back from the topside of the channel and is now testing support at the 3,415 pts, that also coincides with the 38.2% retracement of the recent upward move. Breaking below it would pave the way towards the lower limit of the channel near 50% retracement. However, the upcoming US GDP report and earnings of Big Tech have a scope to turn the tide. Will they manage to do it? We shall know this Thursday! Source: xStation5

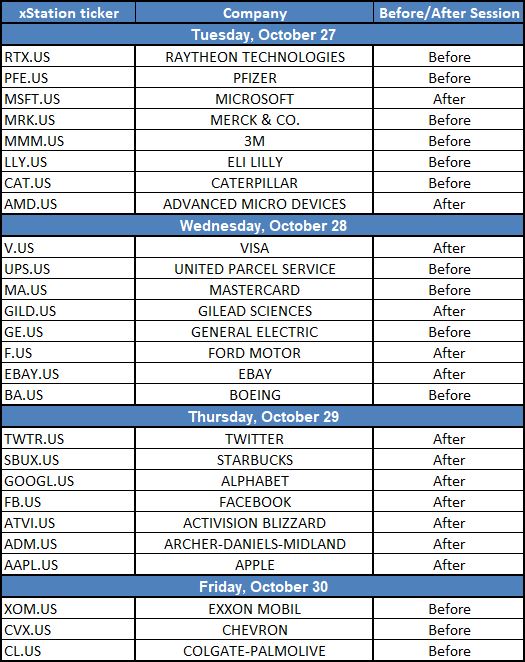

Super Thursday approaches

Thursday is unquestionably the most interesting day this week for investors following US earnings season. This is because investors will be served earnings reports from 4 major tech companies - Alphabet (GOOGL.US), Amazon (AMZN.US), Apple (AAPL.US) and Facebook (FB.US). Adding Microsoft (MSFT.US) to this mix, which is expected to report on Tuesday, we get over 20% of S&P 500 weight! Stock rally of the US tech sector has eased somewhat recently as a new antitrust case against social media giants has been launched recently. However, earnings reports may hint at a continuation of solid performance and provide fresh fuel for gains. Investors should also keep in mind that Thursday will see the release of the US Q3 GDP report that is expected to show record rebound after Q2 plunge. Busy earnings calendar combined with a key GDP release is likely to keep stock markets moving in the second half of the week.

Key US earnings releases this week. Source: Bloomberg, XTB

Key US earnings releases this week. Source: Bloomberg, XTB

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈