Morning rumors about MSC's takeover of EasyJet are increasing volatility in the company's shares.

Morning rumors about MSC's takeover of EasyJet are increasing volatility in the company's shares.

Shares of EasyJet (EZJ.UK) rose as much as 11.5% today following Italian media reports of potential takeover interest from shipping company MSC. However, as Tuesday's session progressed, these gains weakened, and the gain is now "only" 2%. This is because a spokesperson for Mediterranean Shipping Company stated in an emailed statement to Reuters that "MSC denies any involvement in this matter," which seems to dispel the validity of the gains observed this morning. Importantly, however, the airline itself has not communicated the media reports on this matter.

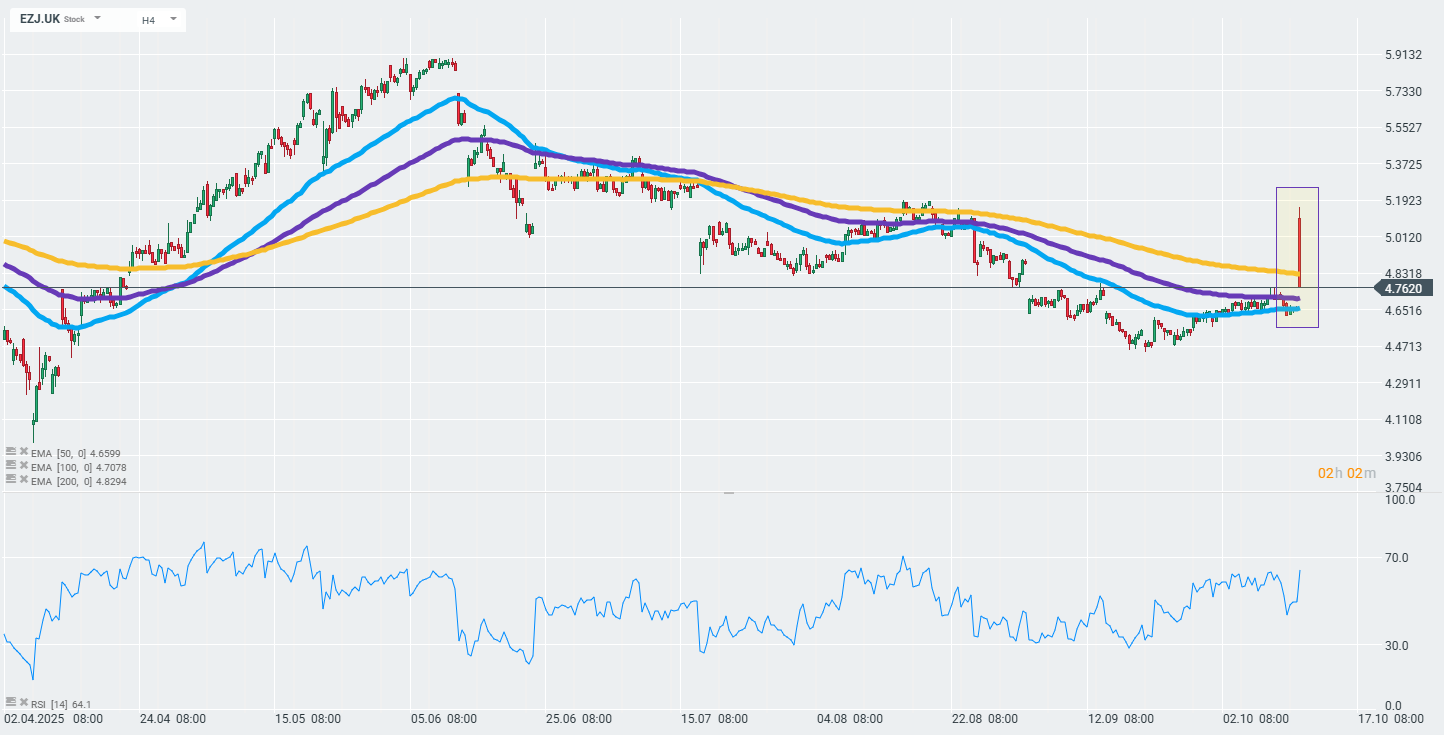

EasyJet (EZJ.UK) shares, after initially gaining as much as 10%, have retraced almost 80% of their gains and are currently falling below the 200-period exponential moving average (golden line on the chart), which has been a key resistance point on the chart since August. Source: xStation

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood