Geopolitical tensions and earnings season are commanding nearly all investor attention, yet macroeconomic data will still be plentiful during Thursday’s session.

UK GDP came in above expectations, but the significant impact of a strong car production at Jaguar Land Rover suggests the improvement may be largely on paper. The absence of more structural signals of a recovery in the UK’s economic potential translated into a muted reaction in the pound (GBPUSD: -0.05%).

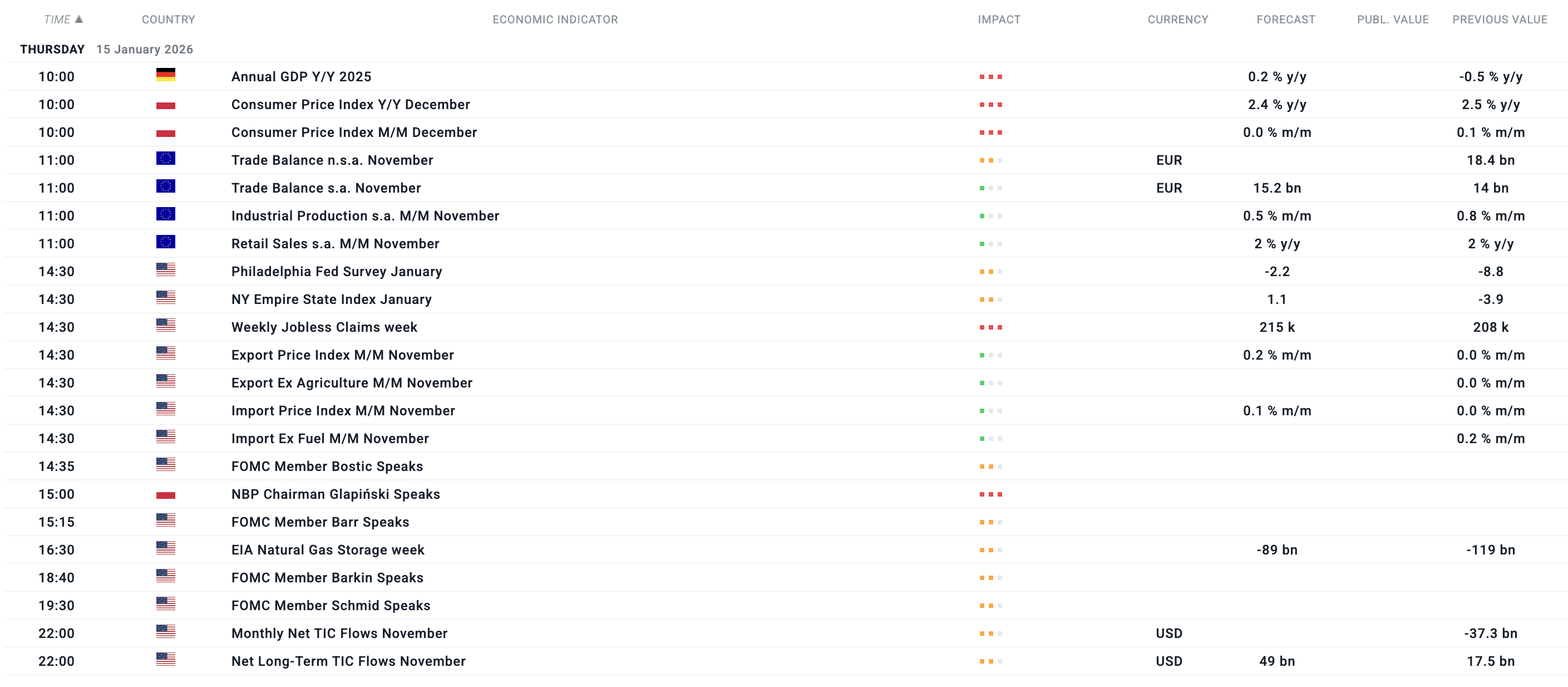

Alongside UK data and several Eurozone inflation readings, the highlight in Europe will be Germany’s GDP estimate for 2025, which has hovered dangerously close to zero quarter-on-quarter in recent quarters.

In Poland, the most important release will be the final December inflation reading, which, together with the National Bank of Poland governor’s conference, is expected to increase volatility in the PLN.

EURUSD may also react to Eurozone trade and industrial production data, potentially providing investors with fresh reference points for the ECB’s recently neutral stance.

In the U.S., trade data, initial jobless claims, and multiple FOMC member speeches are scheduled.

Earnings releases today includeL Goldman Sachs, Morgan Stanley, and BlackRock.

All times CET. Source: xStation5

All times CET. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment