- Futures point to a mixed opening for the cash session in Europe.

- The focus is on technology companies, defense contractors, and the real estate market.

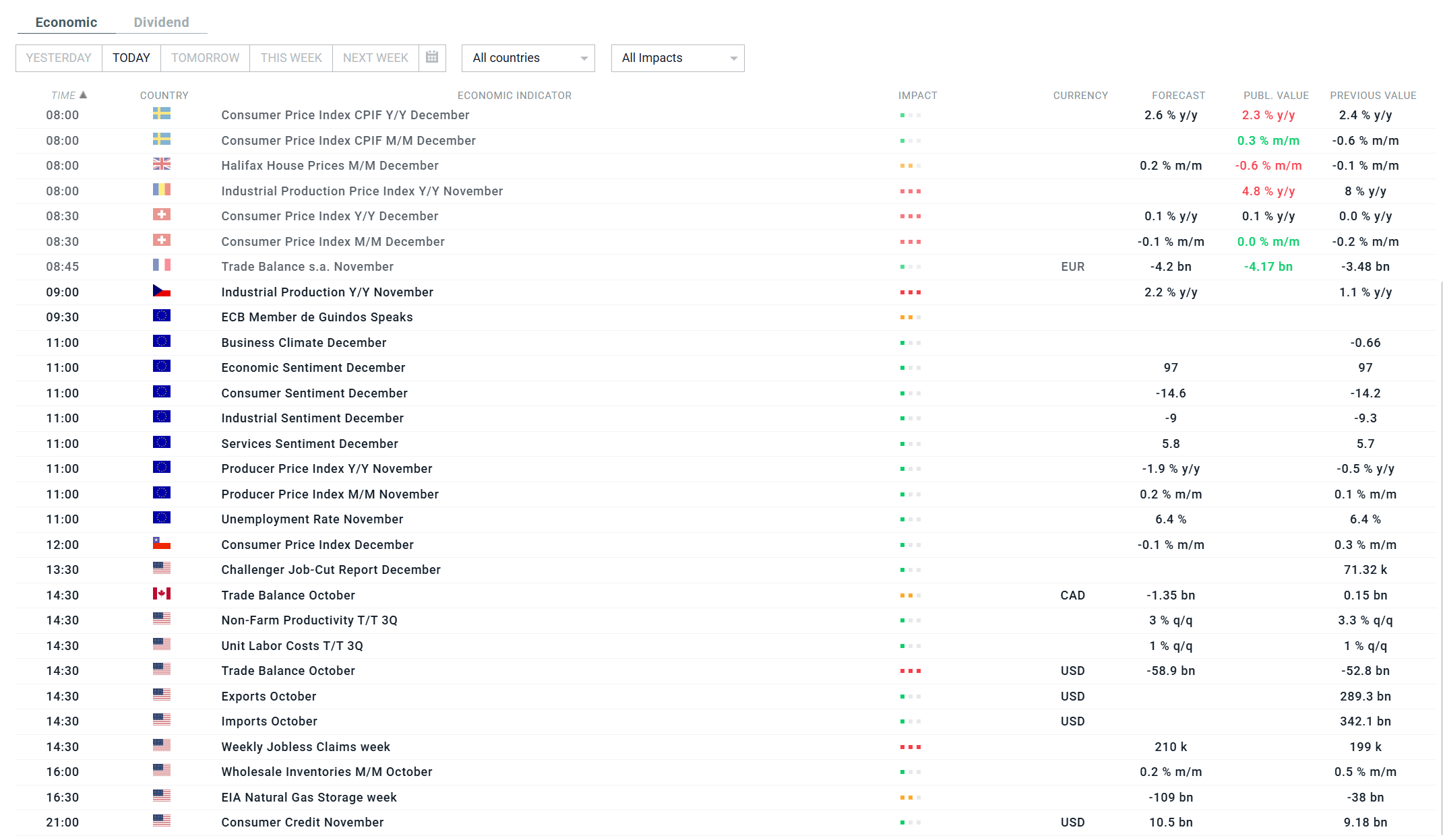

- The calendar includes, among other things: the US trade balance, jobless claims data, and the Challenger report on the labor market.

- Futures point to a mixed opening for the cash session in Europe.

- The focus is on technology companies, defense contractors, and the real estate market.

- The calendar includes, among other things: the US trade balance, jobless claims data, and the Challenger report on the labor market.

Fifteen minutes before the opening of the cash session in Europe, futures contracts point to a mixed picture for today's session, with a slight bias towards declines. The DE40 is currently down 0.1%, while the VSTOXX contract, which reflects volatility on the European trading floor, is up 0.63%. Markets are retreating after yesterday's comments by Trump, which hit real estate and defense companies, causing significant sell-offs in their shares. However, tech companies centered around Nvidia may be a light at the end of the tunnel after the Chinese establishment announced a moment ago that China will once again approve certain purchases of Nvidia H200 processors this quarter, mainly for purely commercial purposes. Beijing is expected to continue to ban the use of H200 processors in government agencies and critical infrastructure. This news may provide some enthusiasm as trading begins in the US, unless the markets take a different direction.

Detailed macro calendar for the day (CET time):

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment