Market moods shifted in the afternoon following a set of mixed macroeconomic data from the US. Downward pressure is additionally fueled by Ethereum, which, despite the successful Merge and the transition to the Proof of Stake protocol, was sold out in accordance with the unwritten principle among investors called "sell the news". Alsoy comments from the Ukrainian government weighed on market sentiment. Officials stated that the continuation of the swift counter-offensive might be difficult due to the fortification of the Russian forces in the eastern part of the country.

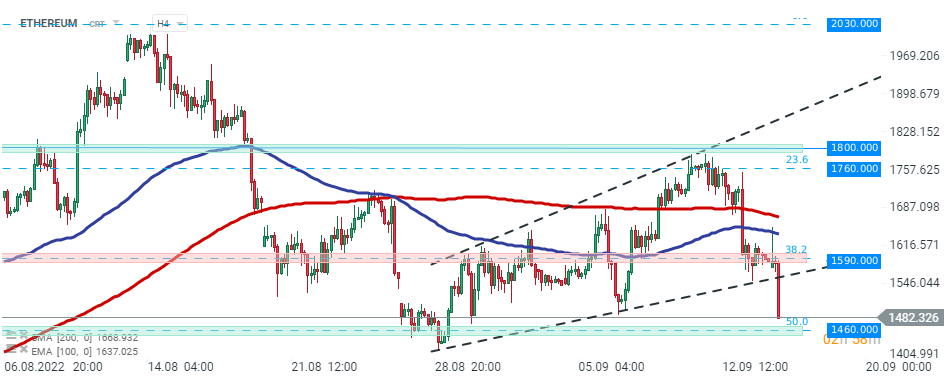

ETHEREUM price broke below major support zone around $1590, which coincides with 38.2% Fibonacci retracement of the upward correction launched in June and lower limit of the ascending broadening wedge formation. Currently the price is approaching August lows at $1460, which is also marked by 50.0% retracement. Should break lower occur, declines may deepen towards support at $1360, where lows from July are located. Source: xStation5

ETHEREUM price broke below major support zone around $1590, which coincides with 38.2% Fibonacci retracement of the upward correction launched in June and lower limit of the ascending broadening wedge formation. Currently the price is approaching August lows at $1460, which is also marked by 50.0% retracement. Should break lower occur, declines may deepen towards support at $1360, where lows from July are located. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?