European Union governments will implement a $60 a barrel price cap on Russian seaborne oil with an adjustment mechanism to keep the cap at 5% below market prices after Poland formally agreed to this idea. Earlier Poland and the Baltic countries opted for a more severe limit, even$30 per barrel, while Greece, Cyprus and Malta, whose domestic shipping industries play a key role in the international transport of Russian oil, wanted $70 cap, diplomats with knowledge of the situation told Euronews. The rest of the G7 (and Australia) are expected to approve this mechanism shortly. It's set to go into effect on December 5, which is the day after the OPEC+ meeting. Therefore oil traders may expect elevated volatility after the weekend.

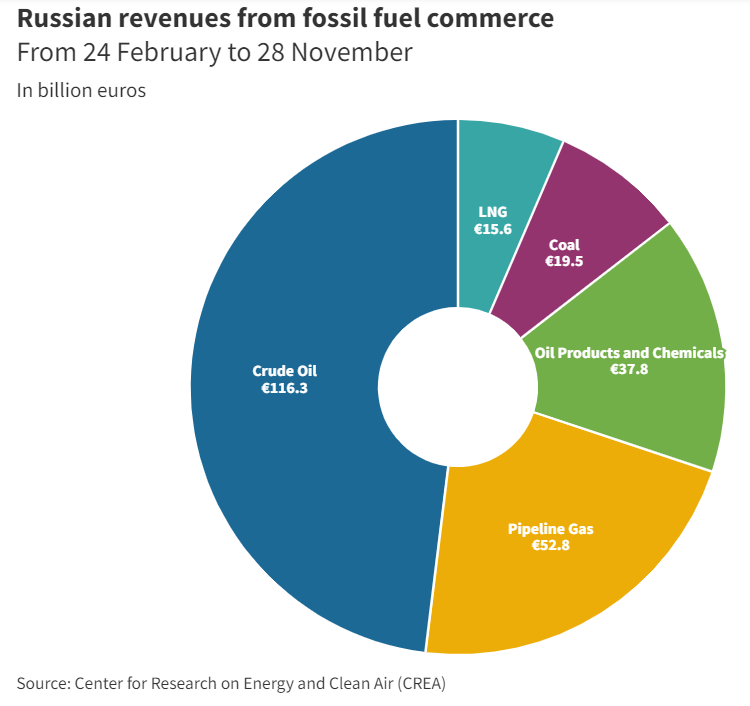

Price cap aims to further cripple the Kremlin's finances and ability to fund war on Ukraine. Since the beginning of the conflict on 24 February to 28 November, Russia recorded crude oil sales of €116 billion and €38 billion from oil products and chemicals, according to data from Center for Research on Energy and Clean (CREA), a Helsinki-based organization. The EU was the top buyer during this period. Source: Center for Research on Energy and Clean (CREA) via Euronews.

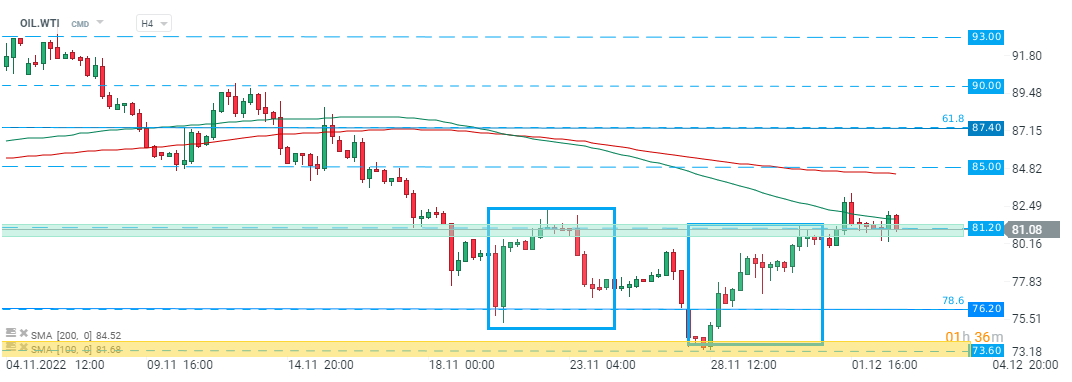

OIL.WTI saw relatively small reaction to today's EU decision and continues to trade around major support at $81.20 per barrel. Source: xStation5

Daily summary: The market looks for direction, oil and metals under pressure

Gold loses 2.5% amid US - Iran trade negotiations and dollar strength 📉ANZ lifts outlook

Oil drops over 2% on possible Iran Deal 🛢️🔥

BHP Results, the Copper Market, and the KGHM Correction. What You Need to Know